Entergy 2002 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2002 77

used to determine the original net present value. Entergy

records the monthly accretion as interest income.

The acquisition was accounted for using the purchase

method. The results of operations of Indian Point 3 and

FitzPatrick subsequent to the purchase date have been included

in Entergy’s consolidated statements of income. The purchase

price has been allocated to the acquired assets, including

identifiable intangible assets, and liabilities assumed based on

their estimated fair values on the purchase date. Intangible

assets are being amortized straight-line over the remaining lives

of the plants.

ASSET DISPOSITIONS

In the first quarter of 2002, Entergy sold its interests in

projects in Argentina, Chile, and Peru for net proceeds of

$135.5 million. After impairment provisions recorded for

these Latin American interests in 2001, the net loss realized on

the sale in 2002 is insignificant.

In August 2002, Entergy sold its interest in projects under

development in Spain for a realized gain on the sale of

$25.7 million. In December 2002, Entergy sold its 800 MW

Damhead Creek power plant for an after-tax gain on the sale

of $31.4 million. The Damhead Creek buyer assumed all

market and regulatory risks associated with the facility.

In August 2001, Entergy sold the Saltend plant for a cash

payment of approximately $800 million. Entergy’s gain on the

sale was approximately $88.1 million ($57.2 million after tax).

In the sales transaction, Entergy or its subsidiaries made

certain warranties to the purchasers relating primarily to the

performance of certain remedial work on the facility and the

assumption of responsibility for certain contingent liabilities.

Entergy believes that it has provided adequate reserves for the

warranties as of December 31, 2002.

NOTE 15. RISK MANAGEMENT AND FAIR VALUES

MARKET AND COMMODITY RISKS

In the normal course of business, Entergy is exposed to a

number of market and commodity risks. Market risk is the

potential loss that Entergy may incur as a result of changes in

the market or fair value of a particular instrument or

commodity. All financial and commodity-related instruments,

including derivatives, are subject to market risk. Entergy is

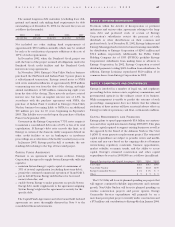

subject to a number of commodity and market risks, including:

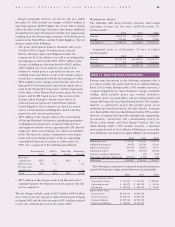

Type of Risk Primary Affected Segments

Power price risk All reportable segments

Fuel price risk All reportable segments

Foreign currency exchange rate risk All reportable segments

Equity price and

interest rate risk - investments U.S. Utility, Non-Utility Nuclear

Entergy manages these risks through both contractual

arrangements and derivatives. Contractual risk management

tools include long-term power and fuel purchase agreements,

capacity contracts, and tolling agreements. Entergy also uses a

variety of commodity and financial derivatives, including

natural gas and electricity futures, forwards, swaps, and

options, foreign currency forwards, and interest rate swaps as

a part of its overall risk management strategy. Except for the

energy trading activities conducted by the Energy Commodity

Services segment, Entergy enters into derivatives only to

manage natural risks inherent in its physical or financial assets

or liabilities.

Entergy’s exposure to market risk is determined by a

number of factors, including the size, term, composition, and

diversification of positions held, as well as market volatility and

liquidity. For instruments such as options, the time period

during which the option may be exercised and the relation-

ship between the current market price of the underlying

instrument and the option’s contractual strike or exercise

price also affects the level of market risk. A significant factor

influencing the overall level of market risk to which Entergy is

exposed is its use of hedging techniques to mitigate such risk.

Entergy manages market risk by actively monitoring

compliance with stated risk management policies as well as

monitoring the effectiveness of its hedging policies and

strategies. Entergy’s risk management policies limit the

amount of total net exposure and rolling net exposure during

the stated periods. These policies, including related risk limits,

are regularly assessed to ensure their appropriateness given

Entergy’s objectives.

Hedging Derivatives

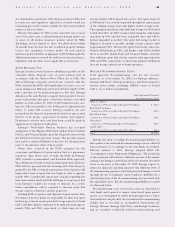

Entergy classifies substantially all of the following types of

derivative instruments held by its consolidated businesses as

cash flow hedges:

Instrument Business Segment

Natural gas and electricity

futures and forwards Energy Commodity Services

Foreign currency forwards U.S. Utility, Non-Utility Nuclear

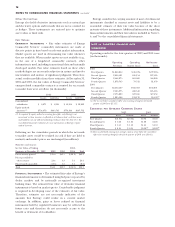

Cash flow hedges with unrealized gains of approximately

$21 million at December 31, 2002 are scheduled to mature

during 2003. Gains totaling approximately $4.3 million were

realized during 2002 on the maturity of cash flow hedges. A sub-

stantial majority of these unrealized and realized gains resulted

from foreign currency hedges related to Euro-denominated

nuclear fuel acquisition contracts, and related gains or losses,

when realized, are included in the capitalized cost of nuclear

fuel. The maximum length of time over which Entergy is

currently hedging the variability in future cash flows for fore-

casted transactions at December 31, 2002 is approximately five

years. The ineffective portion of the change in the value of

Entergy’s cash flow hedges during 2002 was insignificant.