Entergy 2002 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

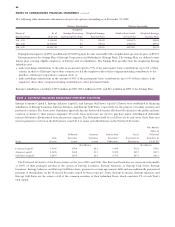

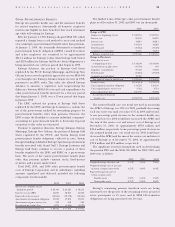

The planned construction and capital investments do not

include potential investments in new businesses or assets.

Entergy will also require $2.6 billion during the period 2003-

2005 to meet long-term debt and preferred stock maturities

and cash sinking fund requirements. Entergy plans to meet

these requirements primarily with internally generated funds

and cash on hand, supplemented by proceeds from the

issuance of debt and outstanding credit facilities. In the fourth

quarter of 2002, the U.S. Utility issued $640 million of debt

with maturities ranging from 2007 to 2032. Approximately

$71 million of the proceeds of the debt issued in the fourth

quarter were used to retire, in 2002, debt that was scheduled

to mature in 2003, and the remainder will be used to meet

certain 2003 maturities as they occur. Entergy Mississippi

issued an additional $100 million of debt in January 2003 that

matures in 2013. The proceeds will be used to repay, prior

to maturity, debt of Entergy Mississippi that is scheduled to

mature in 2003 and 2004. Certain domestic utility companies

may also continue the reacquisition or refinancing of all or a

portion of certain outstanding series of preferred stock and

long-term debt.

SALES WARRANTIES AND INDEMNITIES

In the CitiPower sales transaction, Entergy or its subsidiaries

made certain warranties to the purchaser. These warranties

include representations regarding litigation, accuracy of

financial accounts, and the adequacy of existing tax provisions.

The purchasers of CitiPower have asserted notice of claims

against Entergy under the terms of the Tax Warranty Deed

dated November 23, 1998 between them and Entergy. The Tax

Warranty Deed includes a reservation of rights relating to a

potential liability in the event of an adverse tax ruling. In

November 2002, the Australian Taxation Office assessed

CitiPower for taxes for the years 1997 through 1999.

Management believes it has adequately provided for the

ultimate resolution of this matter.

In the Saltend sales transaction, Entergy or its subsidiaries

made certain warranties to the purchasers relating primarily to

the performance of certain remedial work on the facility and the

assumption of responsibility for certain contingent liabilities.

Entergy believes that it has provided adequately for the warranties

as of December 31, 2002.

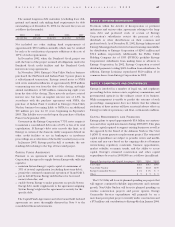

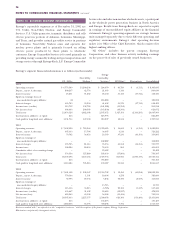

POWER PURCHASE AGREEMENTS

Entergy Louisiana has an agreement extending through the

year 2031 to purchase energy generated by a hydroelectric

facility known as the Vidalia project. Entergy Louisiana made

payments under the contract of approximately $104.2 million

in 2002, $86.0 million in 2001, and $58.6 million in 2000. If the

maximum percentage (94%) of the energy is made available to

Entergy Louisiana, current production projections would

require estimated payments of approximately $79.5 million in

2003, and a total of $2.7 billion for the years 2004 through

2031. Entergy Louisiana currently recovers the costs of the

purchased energy through its fuel adjustment clause. In an

LPSC-approved settlement related to tax benefits from the

treatment of the Vidalia contract, Entergy Louisiana agreed to

credit monthly rates by $11 million each year for up to ten

years, beginning in October 2002.

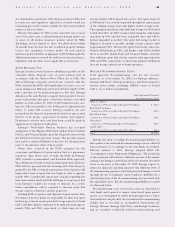

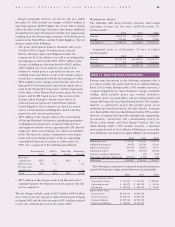

NUCLEAR INSURANCE

The Price-Anderson Act limits public liability of a nuclear

plant owner for a single nuclear incident to approximately

$9.5 billion. Protection for this liability is provided through a

combination of private insurance underwritten by American

Nuclear Insurers (ANI) (currently $300 million for each

reactor) and an industry assessment program. In addition,

liability arising out of terrorist acts will be covered by ANI sub-

ject to one industry aggregate limit of $300 million, with a

conditional option for one shared industry aggregate limit

reinstatement of $300 million. (There are no terrorism

limitations under the Price-Anderson Secondary Financial

Protection program, which responds upon the exhaustion of

ANI coverage). Under the assessment program, the maximum

payment requirement for each nuclear incident would be

$88.1 million per reactor, payable at a rate of $10 million per

licensed reactor per incident per year. Entergy has ten

licensed reactors, with five each in the U.S. Utility segment

and the Non-Utility Nuclear segment. As a co-licensee of

Grand Gulf 1 with System Energy, South Mississippi Electric

Power Agency (SMEPA) would share in 10% of this obligation.

In addition, each owner/licensee of Entergy’s ten nuclear

units participates in a private insurance program that provides

coverage for worker tort claims filed for bodily injury caused

by radiation exposure. The program provides for a maximum

assessment of approximately $3 million for each licensed reactor

in the event that losses exceed accumulated reserve funds.

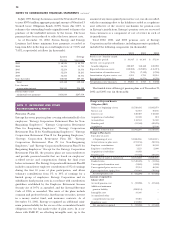

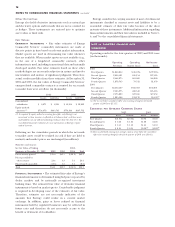

Entergy’s nuclear owner/licensee subsidiaries are also

members of certain insurance programs that provide coverage

for property damage, including decontamination and prema-

ture decommissioning expense, to members’ nuclear generating

plants. These programs are underwritten by Nuclear Electric

Insurance, Limited (NEIL). As of December 31, 2002, Entergy

was insured against such losses up to $2.3 billion for each of its

nuclear units, except for Pilgrim and Vermont Yankee which are

insured for $1.115 billion in property damages. In addition,

Entergy’s nuclear owner/licensee subsidiaries are members of

the NEIL insurance program that covers certain replacement

power and business interruption costs incurred due to

prolonged nuclear unit outages. Under the property damage

and replacement power/business interruption insurance pro-

grams, these Entergy subsidiaries could be subject to assess-

ments if losses exceed the accumulated funds available to the

insurers. As of December 31, 2002, the maximum amounts of

such possible assessments were $81.4 million for the U.S. Utility

segment and $68.9 million for the Non-Utility Nuclear segment.

Entergy maintains property insurance for each of its nuclear

units in excess of the Nuclear Regulatory Commission’s (NRC)

minimum requirement for nuclear power plant licensees

of $1.06 billion per site. NRC regulations provide that

the proceeds of this insurance must be used, first, to

render the reactor safe and stable, and second, to complete

68

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued