Entergy 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30% share of River Bend formerly owned by Cajun Electric

Power Cooperative, Inc., Entergy Gulf States obtained decom-

missioning trust funds of $132 million, which have since grown

to almost $150 million. Entergy Gulf States believes that these

funds will be sufficient to cover the costs of decommissioning

this portion of River Bend, and no further collections or

deposits are being made for these costs. Additionally, under the

Deregulated Asset Plan in the Louisiana jurisdiction of Entergy

Gulf States, a portion of River Bend (approximately 16% of its

total capacity) is excluded from rate base, and no amounts

have been or are being collected for decommissioning for this

portion of the plant.

In the U.S. Utility business unit, the obligations recorded by

Entergy for decommissioning are classified either as a compo-

nent of accumulated depreciation (ANO 1 and 2, Waterford 3,

and the regulated portion of River Bend) or as a deferred

credit (System Energy and the nonregulated portion of River

Bend) in the line item entitled “Decommissioning.” The

amounts recorded for these obligations are comprised of col-

lections from customers and earnings on the trust funds. The

classification and recording of these obligations will change

with the implementation of SFAS 143, which is discussed in

more detail below.

Non-Utility Nuclear

In conjunction with the purchase of Entergy’s Non-Utility

Nuclear facilities, Entergy assumed the decommissioning

obligations and received the related decommissioning trust

funds (except for the NYPA acquisition, in which NYPA retained

the decommissioning obligations for the Indian Point 3 and

FitzPatrick units). Based on decommissioning cost studies

and expected plant operation lives, Entergy believes that the

amounts in the trust funds will be sufficient to fund future decom-

missioning costs without additional deposits from Entergy.

As Entergy has assumed these decommissioning obligations

without any further external source of funding, changes in

estimates of decommissioning costs for these units will have a

direct impact on Entergy’s financial position and results of

operations. Upon purchase of the plants, Entergy recorded

obligations that were equivalent to the amounts initially

received in the decommissioning trust funds. These obliga-

tions are recorded as deferred credits in the line item entitled

“Decommissioning.” These obligations are accreted at implicit

discount rates that are determined based upon the estimated

costs of decommissioning. The accounting for these obligations

will change with the implementation of SFAS 143, which is

discussed in more detail below.

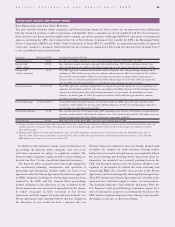

SFAS 143

Entergy implemented SFAS 143, “Accounting for Asset

Retirement Obligations,” effective January 1, 2003. Nuclear

decommissioning costs comprise substantially all of Entergy’s

asset retirement obligations, and the measurement and

recording of Entergy’s decommissioning obligations outlined

above will change significantly with the implementation of

SFAS 143. The most significant differences in the measure-

ment of these obligations are outlined below:

RECORDING OF FULL OBLIGATION –SFAS 143 requires that

the fair value of an asset retirement obligation be recorded

when it is incurred. This will cause the recorded decommis-

sioning obligation in Entergy’s U.S. Utility business to

increase significantly, as Entergy had previously only

recorded this obligation as the related costs were collected

from customers, and as earnings were recorded on the

related trust funds.

FAIR VALUE APPROACH –SFAS 143 requires that these

obligations be measured using a fair value approach.

Among other things, this entails the assumption that the

costs will be incurred by a third party and will therefore

include appropriate profit margins and risk premiums.

Entergy’s decommissioning studies to date have been based

on Entergy performing the work, and have not included

any such margins or premiums. Inclusion of these items

increases cost estimates.

DISCOUNT RATE –SFAS 143 requires that these obligations

be discounted using a credit-adjusted, risk-free rate. This

will result in significant decreases in Entergy’s decommis-

sioning obligations in the Non-Utility Nuclear business, as

this discount rate is higher than the implicit rates utilized

by Entergy in accounting for these obligations through

December 31, 2002.

The net effect of implementing this standard, to the extent that

it was not recorded as regulatory assets or liabilities, will be

recognized as a cumulative effect of an accounting change in

Entergy’s 2003 statement of income. Implementation will have

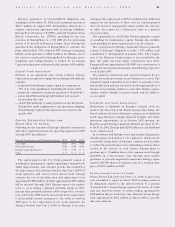

the following effect on Entergy’s financial statements:

The net effect of implementing this standard for the

rate-regulated business of the domestic utility companies

and System Energy will be recorded as regulatory assets

or liabilities, with no resulting impact on Entergy’s net

income. Assets and liabilities are expected to increase by

approximately $1.1 billion in 2003 for the domestic utility

companies and System Energy as a result of recording the

asset retirement obligations at their fair values as determined

under SFAS 143 and recording the related regulatory

assets and liabilities. The implementation of SFAS 143 for

the portion of River Bend not subject to cost-based rate-

making is expected to decrease earnings by approximately

$25 million as a result of a one-time cumulative effect of

accounting change.

For the Non-Utility Nuclear business, the implementation

of SFAS 143 is expected to result in a decrease in liabilities

ENTERGY CORPORATION AND SUBSIDIARIES 2002 39

Federal regulations require the Department of Energy

to provide a permanent repository for the storage of

spent nuclear fuel, and recent legislation has been

passed by Congress to develop this repository at

Yucca Mountain, Nevada.