Entergy 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

issues in which they allege that Entergy New Orleans ratepayers

may have been overcharged by more than $32 million, the vast

majority of which is reflected in the plaintiffs’ claim. However, it

is not clear precisely what periods and damages are being

alleged in the proceeding. Entergy intends to defend this

matter vigorously, both in court and before the City Council.

Hearings were held in February and March 2002. The parties

have submitted post-hearing briefs and the matter has been

submitted to the City Council for a decision. In October 2002,

the plaintiffs filed a motion to re-open the evidentiary record, or

in the alternative, a motion for a new trial seeking to re-open the

record to accept certain testimony filed by the City Council

advisors in a separate proceeding at the FERC. The ultimate

outcome of the lawsuit and the City Council proceeding cannot

be predicted at this time.

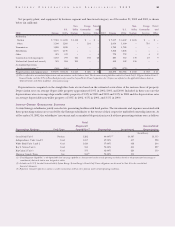

SYSTEM ENERGY’S1995 RATE PROCEEDING

System Energy applied to FERC in May 1995 for a rate increase,

and implemented the increase in December 1995. The request

sought changes to System Energy’s rate schedule, including

increases in the revenue requirement associated with decom-

missioning costs, the depreciation rate, and the rate of

return on common equity. The request proposed a 13% return

on common equity. In July 2000, FERC approved a rate of

return of 10.58% for the period December 1995 to the date

of FERC’s decision, and prospectively adjusted the rate of return

to 10.94% from the date of FERC’s decision. FERC’s decision

also changed other aspects of System Energy’s proposed rate

schedule, including the depreciation rate and decommissioning

costs and their methodology. FERC accepted System Energy’s

compliance tariff in November 2001. System Energy made

refunds to the domestic utility companies in December 2001.

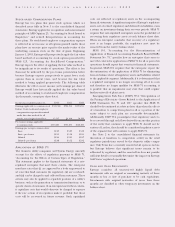

In accordance with regulatory accounting principles, during

the pendency of the case, System Energy recorded reserves for

potential refunds against its revenues. Upon the order

becoming final, Entergy Arkansas, Entergy Louisiana, Entergy

Mississippi, Entergy New Orleans, and System Energy recorded

entries to spread the impacts of FERC’s order to the various

revenue, expense, asset, and liability accounts affected, as if the

order had been in place since commencement of the case in

1995. System Energy also recorded an additional reserve

amount against its revenue, to adjust its estimate of the impact

of the order, and recorded additional interest expense on that

reserve. System Energy also recorded reductions in its deprecia-

tion and its decommissioning expenses to reflect the lower

levels in FERC’s order, and reduced tax expense affected by

the order.

Entergy Arkansas refunded $54.3 million, including interest,

through the issuance of refund checks in March 2002 as

approved by the APSC.

Entergy Louisiana refunded $4.9 million, including interest,

to its customers through a credit on the September 2002 bills as

approved by the LPSC.

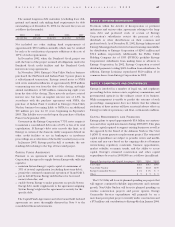

Entergy Mississippi’s allocation of the proposed System

Energy wholesale rate increase was $21.6 million annually. In

July 1995, Entergy Mississippi filed a schedule with the MPSC

that deferred the retail recovery of the System Energy rate

increase. The deferral plan, which was approved by the MPSC,

began in December 1995, the effective date of the System

Energy rate increase, and was effective until the issuance of the

final order by FERC. Entergy Mississippi revised the deferral

plan two times during the pendency of the System Energy

proceeding. As a result of the final resolution of the FERC order

and in accordance with Entergy Mississippi’s second revised

deferral plan, refunds to Entergy Mississippi from System

Energy, including interest, have been credited against deferral

balances and a refund of the remaining $14.8 million in excess

of the deferral balances was included as credits to the amounts

billed to Entergy Mississippi’s customers in October 2001

through September 2002 under its Grand Gulf Riders.

Entergy New Orleans’ allocation of the proposed System

Energy wholesale rate increase was $11.1 million annually. In

February 1996, Entergy New Orleans filed a plan with the

Council to defer 50% of the amount of the System Energy rate

increase. In December 2001, the Council approved a refund to

customers. The total amount of the refund to Entergy New

Orleans’ customers was $43 million. In anticipation of the

FERC order, Entergy New Orleans advanced the refunding of

$10 million in February 2001 to customers to assist with unex-

pected high energy bills. The total refund was also reduced by

an additional $6 million which was used for the establishment

of a public benefits and payments assistance program. The

remaining $27 million was refunded through the issuance of

refund checks during the first quarter of 2002.

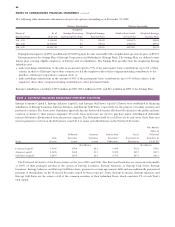

FERC SETTLEMENT

In November 1994, FERC approved an agreement settling a

long-standing dispute involving income tax allocation proce-

dures of System Energy. In accordance with the agreement,

System Energy has been refunding a total of approximately

$62 million, plus interest, to Entergy Arkansas, Entergy

Louisiana, Entergy Mississippi, and Entergy New Orleans

through June 2004. System Energy also reclassified from utility

plant to other deferred debits approximately $81 million of

other Grand Gulf 1 costs. Although such costs are excluded

from rate base, System Energy is amortizing and recovering

these costs over a 10-year period. Interest on the $62 million

refund and the loss of the return on the $81 million of other

Grand Gulf 1 costs is reducing Entergy’s and System Energy’s

net income by approximately $10 million annually.

60

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued