Entergy 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

delayed past January 1, 2004, Entergy Gulf States seeks

authorization to separate into two bundled utilities, one

subject to the retail jurisdiction of the PUCT and

one subject to the retail jurisdiction of the LPSC.);

the recommendation that Entergy’s transmission organiza-

tion, possibly with the oversight of another entity, will

continue to serve as the transmission authority for purposes

of retail open access in Entergy Gulf States’ service territory;

the recommendation that decision points be identified

that would require, prior to January 1, 2004, the PUCT’s

determination, based upon objective criteria, whether to

proceed with further efforts toward retail open access in

Entergy Gulf States’ Texas service territory.

The PUCT is expected to consider this proposal on March 21,

2003. This proposal takes into account that other regulatory

approvals, including that of the LPSC and the SEC, are necessary

prior to January 1, 2004.

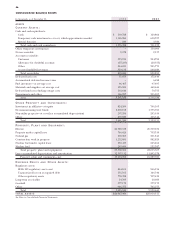

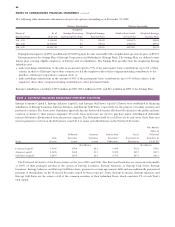

REGULATORY ASSETS

Other Regulatory Assets

The domestic utility companies and System Energy are subject

to the provisions of SFAS 71, “Accounting for the Effects of

Certain Types of Regulation.” Regulatory assets represent

probable future revenues associated with certain costs that are

expected to be recovered from customers through the

ratemaking process. In addition to the regulatory assets that

are specifically disclosed on the face of the balance sheets, the

table below provides detail of “Other regulatory assets” that

are included on the balance sheets as of December 31, 2002

and 2001 (in millions).

2002 2001

Department of Energy (DOE) fees (Note 9) $ 40.3 $ 47.5

Provisions for storm damages 93.9 214.0

Imputed capacity charges (Note 2) 17.3 41.7

Postretirement benefits 23.9 26.3

Pension costs 157.8 –

Depreciation re-direct (Note 1) 79.1 79.1

River Bend AFUDC (Note 1) 41.3 43.2

Spindletop gas storage lease 35.0 32.2

Low-level radwaste 19.4 –

1994 FERC settlement (Note 2) 12.1 20.2

Sale-leaseback deferral (Note 10) 123.9 128.3

Other 94.3 74.9

Total $738.3 $707.4

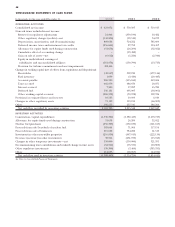

Deferred Fuel Costs

The domestic utility companies are allowed to recover certain

fuel and purchased power costs through fuel mechanisms

included in electric rates that are recorded as fuel cost

recovery revenues. The difference between revenues collected

and the current fuel and purchased power costs is recorded as

“Deferred fuel costs” on the domestic utility companies’

financial statements. The table below shows the amount of

deferred fuel costs as of December 31, 2002 and 2001 that has

been or will be recovered or (refunded) through the fuel

mechanisms of the domestic utility companies (in millions).

2002 2001

Entergy Arkansas $(42.6) $ 17.2

Entergy Gulf States $100.6 $126.7

Entergy Louisiana $(25.6) $(67.5)

Entergy Mississippi $ 38.2 $106.2

Entergy New Orleans $(14.9) $(10.2)

ENTERGY ARKANSAS – Entergy Arkansas’ rate schedules include

an energy cost recovery rider to recover fuel and purchased

energy costs in monthly bills. The rider utilizes prior year energy

costs and projected energy sales for the twelve month period

commencing on April 1 of each year to develop an annual

energy cost rate. The energy cost rate includes a true-up adjust-

ment reflecting the over-recovery or under-recovery, including

carrying charges, of the energy cost for the prior calendar year.

As a result of reduced fuel and purchased power costs in

2001 and the accumulated over-recovery of 2001 energy costs,

Entergy Arkansas decreased the energy cost rate effective April

2002. In September 2002, Entergy Arkansas filed and the

Arkansas Public Service Commission (APSC) approved an

interim revision to the energy cost rate effective October 2002

through March 2003. Entergy Arkansas reduced the energy

cost rate to offset the accumulated over-recovery of energy

costs through June 2002 and the projected over-recovery

through December 2002. The revised energy cost rate will be

effective through March 2003 when the annual energy cost

rate redetermination will be filed for the period April 2003

through March 2004.

ENTERGY GULF STATES – In the Texas jurisdiction, Entergy Gulf

States’ rate schedules include a fixed fuel factor to recover fuel

and purchased power costs, including carrying charges, not

recovered in base rates. Under current methodology, semi-

annual revisions of the fixed fuel factor are made in March

and September based on the market price of natural gas.

Entergy Gulf States will likely continue to use this methodology

until the start of retail open access. The amounts collected

under Entergy Gulf States’ fixed fuel factor and any interim

surcharge implemented until the date retail open access com-

mences are subject to fuel reconciliation proceedings before

the PUCT. In the Texas jurisdiction, Entergy Gulf States’

deferred electric fuel costs are $91.8 million as of December

31, 2002, which includes the following (in millions):

Interim surcharge $53.9

Items to be addressed as part of unbundling $29.0

Imputed capacity charges $8.6

Other $0.3

The PUCT has ordered that the imputed capacity charges

be excluded from fuel rates and therefore recovered through

base rates. It is uncertain, however, when or if a base rate

proceeding before the PUCT will be initiated. The current

56

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued