Entergy 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

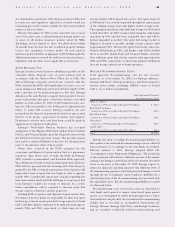

NOTE 3. INCOME TAXES

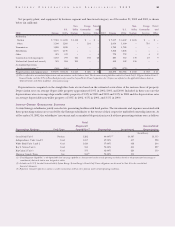

Income tax expenses for 2002, 2001, and 2000 consist of the

following (in thousands):

For the years ended December 31, 2002 2001 2000

Current:

Federal(a) $510,109 $321,085 $291,616

Foreign (3,295) 3,355 11,555

State(a) 43,788 53,565 51,293

Total(a) 550,602 378,005 354,464

Deferred – net (233,532) 110,944 150,018

Investment tax credit

adjustments – net (23,132) (23,192) (25,561)

Recorded income tax expense $293,938 $465,757 $478,921

(a) The actual cash taxes paid/(received) were $57,856 in 2002, ($113,466) in

2001, and $345,361 in 2000. Entergy Louisiana’s mark-to-market tax

accounting election has significantly reduced taxes paid in 2001 and 2002.

For a more detailed discussion of the tax accounting election, see the discussion

of Entergy Louisiana Tax Accounting Election in Management’s Financial

Discussion and Analysis section.

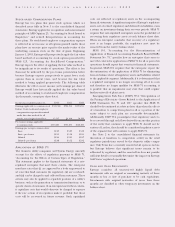

Total income taxes differ from the amounts computed by

applying the statutory income tax rate to income before taxes.

The reasons for the differences for the years 2002, 2001, and

2000 are (in thousands):

For the years ended December 31, 2002 2001 2000

Computed at statutory rate (35%) $320,954 $425,692 $416,443

Increases (reductions) in tax

resulting from:

State income taxes net of

federal income tax effect 44,835 45,124 47,504

Depreciation 29,774 11,890 49,741

Amortization of investment

tax credits (22,294) (22,488) (23,783)

Flow-through/permanent

differences (38,197) (20,698) (18,495)

U.S. tax on foreign income (28,416) 21,422 1,472

Other – net (12,718) 4,815 6,039

Total income taxes $293,938 $465,757 $478,921

Effective income tax rate 32.1% 38.3% 40.3%

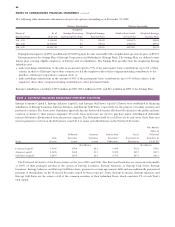

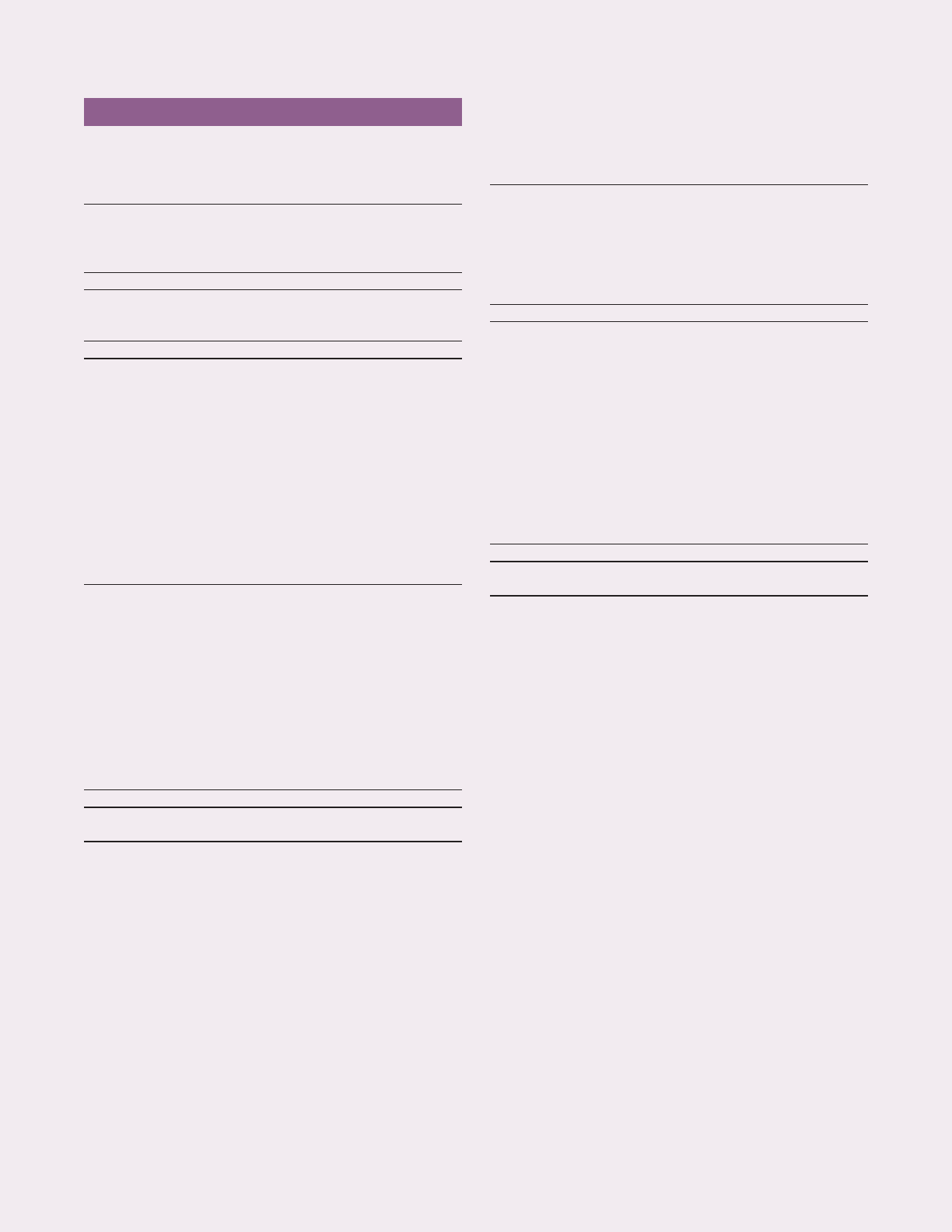

Significant components of net deferred and noncurrent

accrued tax liabilities as of December 31, 2002 and 2001 are as

follows (in thousands):

For the years ended December 31, 2002 2001

Deferred and Noncurrent

Accrued Tax Liabilities

Net regulatory assets/(liabilities) $(1,085,287) $(1,195,100)

Plant-related basis differences (3,064,130) (3,107,827)

Power purchase agreements (866,976) (400,000)

Nuclear decommissioning (237,944) (163,869)

Other (406,703) (174,219)

Total (5,661,040) (5,041,015)

Deferred Tax Assets

Accumulated deferred investment

tax credit 151,930 160,003

Capital loss carryforwards 68,378 55,845

Foreign tax credits 3,355 73,741

Sale and leaseback 232,228 230,157

Unbilled/deferred revenues 309,346 64,178

Pension-related items 139,058 117,675

Reserve for regulatory adjustments 103,843 109,370

Customer deposits 58,165 77,321

Nuclear decommissioning 104,555 15,599

Other 240,266 266,961

Valuation allowance (27,352) (98,011)

Total 1,383,772 1,072,839

Net deferred and noncurrent

accrued tax liability $(4,277,268) $(3,968,176)

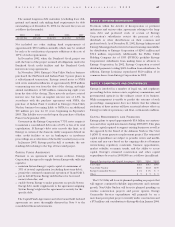

The 2002 valuation allowance is provided against United

Kingdom (UK) capital loss and UK net operating loss carry-

forwards, which can be utilized against future UK taxable

income. For UK tax purposes, these carryforwards do not expire.

The 2001 valuation allowance is provided primarily against

foreign tax credit carryforwards, which can be utilized against

future United States taxes on foreign source income. If these

carryforwards are not utilized, they will expire between 2002

and 2006.

At December 31, 2002, Entergy had $11.2 million of

indefinitely reinvested undistributed earnings from subsidiary

companies outside the U.S. Upon distribution of these earnings

in the form of dividends or otherwise, Entergy could be subject

to U.S. income taxes (subject to foreign tax credits) and

withholding taxes payable to various foreign countries.

ENTERGY CORPORATION AND SUBSIDIARIES 2002 61