Entergy 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation is an investor-owned public utility holding

company that operates primarily through three business segments.

U.S. UTILITY generates, transmits, distributes, and

sells electric power, with a small amount of natural

gas distribution.

NON-UTILITY NUCLEAR owns and operates five nuclear

power plants and is primarily focused on selling electric

power produced by those plants to wholesale customers.

ENERGY COMMODITY SERVICES is focused almost exclusively

on providing energy commodity trading and gas trans-

portation and storage services through Entergy-Koch, LP.

Energy Commodity Services also includes Entergy’s non-

nuclear wholesale assets business.

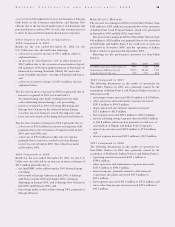

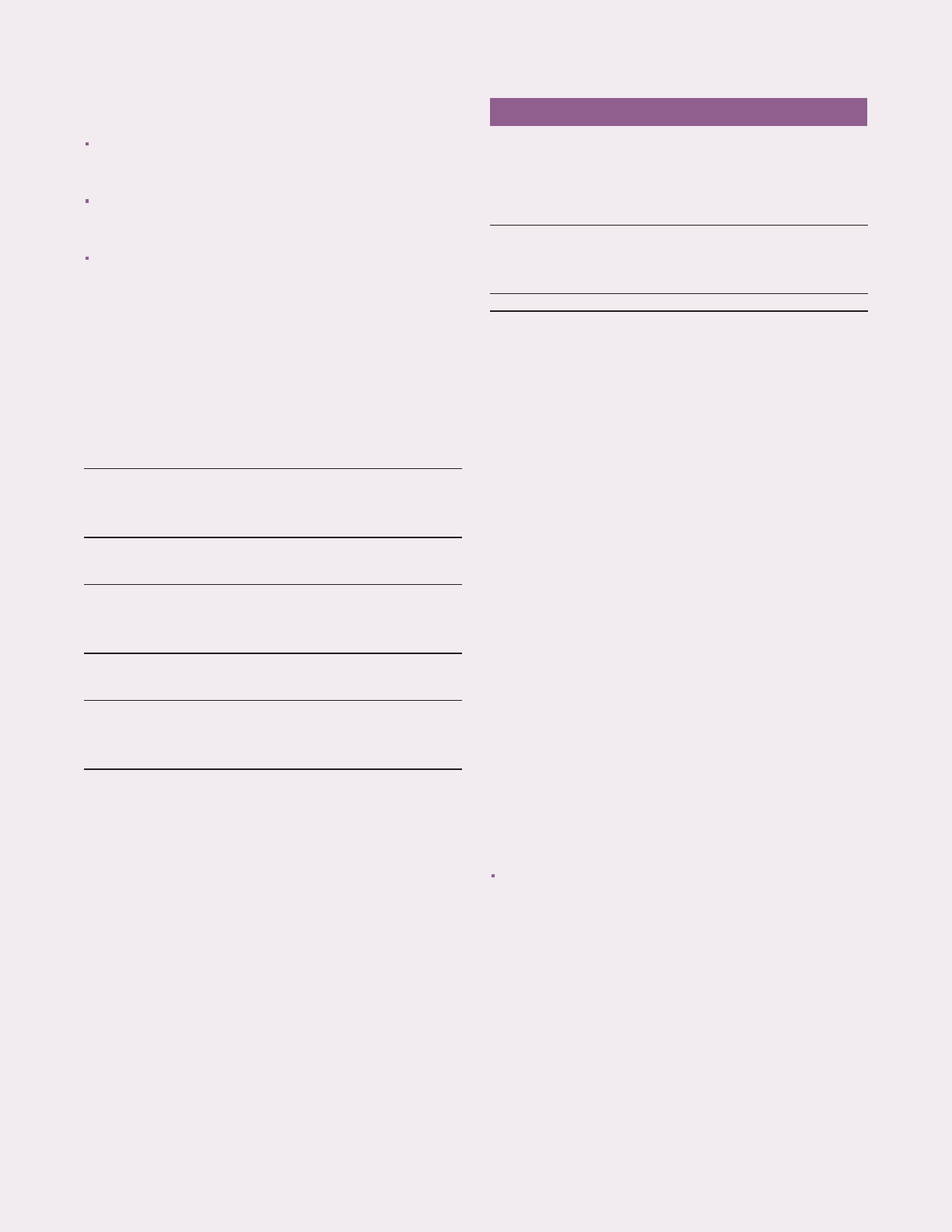

Following are the percentages of Entergy’s consolidated

revenues and net income generated by these segments and the

percentage of total assets held by them:

% of Revenue

Segment 2002 2001 2000

U.S. Utility 82 77 74

Non-Utility Nuclear 14 8 3

Energy Commodity Services 4 14 23

Parent & Other – 1 –

% of Net Income

Segment 2002(1) 2001 2000

U.S. Utility 97 77 87

Non-Utility Nuclear 32 17 7

Energy Commodity Services (23) 14 8

Parent & Other (6) (8) (2)

% of Total Assets

Segment 2002 2001 2000

U.S. Utility 78 78 81

Non-Utility Nuclear 17 13 9

Energy Commodity Services 8 9 10

Parent & Other (3) – –

(1) The net income figures in 2002 include a $238 million net of tax charge in

the Energy Commodity Services segment. If this charge were excluded, the

percentages would be 70% for U.S. Utility, 23% for Non-Utility Nuclear,

11% for Energy Commodity Services, and (4%) for Parent & Other.

RESULTS OF OPERATIONS

Earnings applicable to common stock for the years ended

December 31, 2002, 2001, and 2000 by operating segment are

as follows (in thousands):

Operating Segment 2002 2001 2000

U.S. Utility $ 583,251 $ 550,243 $ 586,642

Non-Utility Nuclear 200,505 127,880 49,158

Energy Commodity Services (145,830) 105,939 54,908

Parent & Other (38,566) (57,866) (11,414)

Total $ 599,360 $ 726,196 $ 679,294

Results for 2002 were negatively affected by net charges

($238.3 million after-tax) reflecting the effect of Entergy’s

decision to discontinue additional greenfield power plant

development and asset impairments resulting from the deteri-

orating economics of wholesale power markets principally in

the United States and the United Kingdom. The net charges

are discussed more fully below in the Energy Commodity

Services discussion.

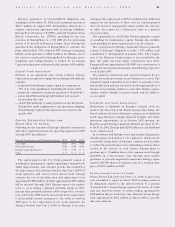

Entergy’s income before taxes is discussed according to the

business segments listed above. See Note 12 to the consolidated

financial statements for further discussion of Entergy’s business

segments and their financial results in 2002, 2001, and 2000.

U.S. UTILITY

The increase in earnings for the U.S. Utility in 2002 from

$550 million to $583 million was primarily due to a decrease

in interest charges combined with an increase in other

income, partially offset by decreases in operating income and

interest income.

The decrease in earnings for the U.S. Utility in 2001 from

$587 million to $550 million was primarily due to a decrease in

operating income and increased interest charges, partially

offset by an increase in interest income.

Operating Income

2002 Compared to 2001

Operating income decreased by $43.6 million in 2002 primarily

due to:

an increase in other operation and maintenance expenses

of $273.2 million. $159.9 million of this increase is offset

in other regulatory credits and relates to a March 2002

settlement agreement and 2001 earnings review that

became final in the second quarter of 2002, allowing

Entergy Arkansas to recover a large majority of 2000

and 2001 ice storm repair expenses through previously-

collected transition cost account (TCA) amounts (the

remaining increase in other operation and maintenance

expenses is explained below); and

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS

ENTERGY CORPORATION AND SUBSIDIARIES 2002 23