Entergy 2002 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy’s Non-Utility Nuclear business. The liability associated

with the trust funds received from Cajun with the transfer of

Cajun’s 30% share of River Bend is also recorded as a deferred

credit by Entergy Gulf States. The actual decommissioning

costs may vary from the estimates because of regulatory

requirements, changes in technology, and increased costs of

labor, materials, and equipment.

Entergy periodically reviews and updates estimated decom-

missioning costs. Entergy is presently under-recovering

decommissioning costs for ANO 1, Arkansas Nuclear One Unit

2 (ANO 2), Grand Gulf 1, Waterford 3, and the Louisiana-

regulated share of River Bend. Under-recovery for Grand Gulf 1

and Waterford 3 is based on the existence of more recent

estimates reflecting higher costs. Under-recovery of ANO 1,

ANO 2, and River Bend is based on suspension of decommis-

sioning collections under the assumption that the lives of those

plants have been or will be extended.

In June 2001, Entergy Arkansas received notification from the

NRC of approval for a renewed operating license authorizing

operations at ANO 1 through May 2034. In October 2000, the

APSC ordered Entergy Arkansas to reflect 20-year license

extensions in its determination of the ANO 1 and ANO 2

decommissioning revenue requirements for rates to be effective

January 1, 2001. Entergy Arkansas will not make additional

contributions to the trust funds in 2003 for ANO 1 and ANO 2

based on the extension of the ANO 1 license, the assumption

that the ANO 2 license will be extended, and that the existing

decommissioning trust funds, together with their expected

future earnings, will meet the estimated decommissioning costs.

An updated decommissioning cost study for ANO 1 and 2 will

be filed with the APSC in March 2003.

In December 2002, Entergy Gulf States and the LPSC

reached a settlement of the fourth through eighth post-merger

earnings reviews. Among other things, the settlement includes

suspension of collections for decommissioning the Louisiana-

regulated portion of River Bend beginning January 1, 2003

based upon an assumption that the operating license and the

useful life of River Bend will be extended. According to the

settlement agreement, in the event that the NRC formally

notifies Entergy that the decommissioning funding for River

Bend is or would become inadequate, Entergy Gulf States would

be permitted recognition in rates of decommissioning expense

at a level sufficient to address reasonably the NRC’s concern as

expressed in the notification. The decommissioning liability

for the 30% share of River Bend formerly owned by Cajun

was fully funded by a transfer of $132 million to the River

Bend Decommissioning Trust at the completion of Cajun’s

bankruptcy proceedings.

Entergy Louisiana prepared a decommissioning cost

update for Waterford 3 in 1999 and produced a revised

decommissioning cost update of $481.5 million. This cost

update was filed with the LPSC in the third quarter of 2000.

System Energy included updated decommissioning costs

(based on the updated 1994 study) in its 1995 rate increase

filing with FERC. Rates requested in this proceeding were

placed into effect in December 1995, subject to refund. In

July 2000, FERC issued an order approving a lower decommis-

sioning cost than what was requested by System Energy in the

1995 filing. System Energy adjusted its collection to the FERC-

approved level of $341 million in the third quarter of 2001. A

1999 decommissioning cost update of $540.8 million for

System Energy’s 90% share of Grand Gulf 1 has not yet been

filed with FERC.

As part of the Pilgrim, Indian Point 1 and 2, and Vermont

Yankee purchases, the previous owners transferred decommis-

sioning trust funds, along with the liability to decommission the

plants, to Entergy. Entergy believes that the decommissioning

trust funds will be adequate to cover future decommis-

sioning costs for these plants without any additional deposits to

the trusts.

For the Indian Point 3 and FitzPatrick plants purchased in

2000, NYPA retained the decommissioning trusts and the

decommissioning liability. NYPA and Entergy executed decom-

missioning agreements, which specify their decommissioning

obligations. NYPA has the right to require Entergy to assume

the decommissioning liability provided that it assigns the

corresponding decommissioning trust, up to a specified level,

to Entergy. If the decommissioning liability is retained by

NYPA, Entergy will perform the decommissioning of the plants

at a price equal to the lesser of a pre-specified level or the

amount in the decommissioning trusts. Entergy believes that

the amounts available to it under either scenario are sufficient

to cover the future decommissioning costs without any addi-

tional contributions to the trusts.

The provisions of SFAS 143 will also be applicable to the

non-regulated nuclear units beginning in 2003. Refer to Note 1

to the consolidated financial statements for a discussion of the

effect of SFAS 143 on Entergy.

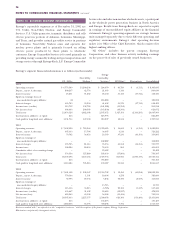

The cumulative liabilities and decommissioning expenses

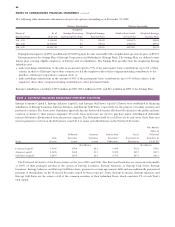

recorded in 2002 by Entergy were as follows (in millions):

Liabilities 2002 2002 Liabilities

as of Trust Decommissioning as of

Dec. 31, 2001 Earnings Expenses(a) Dec. 31, 2002

ANO 1 & ANO 2 $ 292.8 $17.9 $ – $ 310.7

River Bend 226.8 6.2 4.0 237.0

Waterford 3 111.5 3.4 10.4 125.3

Grand Gulf 1 134.3 4.4 16.1 154.8

Pilgrim 474.1 –(b) 16.1 490.2

Indian Point 1 & 2 435.3 –(b) 21.6 456.9

Vermont Yankee 310.7(c) –(b) 6.0 316.7

Total $1,985.5 $31.9 $74.2 $2,091.6

(a) Includes decommissioning expenses and interest from accretion of the obligations.

(b) Trust earnings on the decommissioning trust funds for Pilgrim, Indian Point

1 & 2, and Vermont Yankee are recorded as income and do not increase the

decommissioning liability.

(c) Added in third quarter of 2002, when the unit was acquired.

In 2000, ANO’s decommissioning expense was $3.8 million.

River Bend’s decommissioning expense was $6.2 million in

both 2001 and 2000, and Waterford 3’s decommissioning

expense was $10.4 million for both years. Grand Gulf 1’s

2001 decommissioning expense, which included the effect

of the FERC-ordered refund, was ($23.8 million); its 2000

70

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued