Entergy 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGY COMMODITY SERVICES

The decrease in earnings for Energy Commodity Services in

2002 from $106 million to a $146 million loss was primarily due

to the impairment charges that are discussed below.

The increase in earnings for Energy Commodity Services in

2001 from $55 million to $106 million was primarily due to the

strong performance of the trading and gas pipeline businesses

of Entergy-Koch.

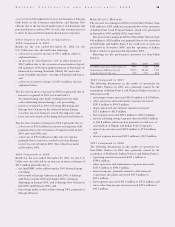

2002 Compared to 2001

The decrease in earnings for Energy Commodity Services in

2002 was primarily due to the charges to reflect the effect of

Entergy’s decision to discontinue additional greenfield power

plant development and to reflect asset impairments resulting

from the deteriorating economics of wholesale power markets

principally in the United States and the United Kingdom.

Entergy recorded net charges of $428.5 million ($238.3 million

net of tax) to operating expenses. The net charges consist of

the following:

The power development business obtained contracts in

October 1999 to acquire 36 turbines from General Electric.

Entergy’s rights and obligations under the contracts for 22

of the turbines were sold to an independent special-purpose

entity in May 2001. $178.0 million of the charges, including

an offsetting net of tax benefit of $18.5 million related to

the subsequent sale of four turbines to a third party, is a

provision for the net costs resulting from cancellation or

sale of the turbines subject to purchase commitments with

the special-purpose entity.

$204.4 million of the charges results from the write-off of

Entergy Power Development Corporation’s equity invest-

ment in the Damhead Creek project and the impairment

of the values of its Warren Power power plant and its Crete

and RS Cogen projects. This portion of the charges

reflects Entergy’s estimate of the effects of reduced spark

spreads in the United States and the United Kingdom.

Damhead Creek was sold in December 2002, resulting in

an after-tax gain of $31.4 million.

$39.1 million of the charges relates to the restructuring of

the non-nuclear wholesale assets business, and is comprised

of $22.5 million of impairments of administrative fixed

assets, $10.7 million of estimated sublease losses, and

$5.9 million of employee-related costs.

$32.7 million of the charges results from the write-off of

capitalized project development costs for projects that will

not be completed.

A gain of $25.7 million ($15.9 million net of tax) was

realized on the sale in August 2002 of an interest in

projects under development in Spain.

Also, in the first quarter of 2002, Energy Commodity

Services sold its interests in projects in Argentina, Chile, and

Peru for net proceeds of $135.5 million. After impairment

provisions recorded for these Latin American interests in

2001, the net loss realized on the sale in 2002 is insignificant.

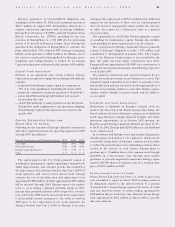

Revenues and fuel and purchased power expenses

decreased for Energy Commodity Services by $1,075.8 million

and $876.9 million, respectively, in 2002 primarily due to:

a decrease of $542.9 million in revenues and $539.6 million

in fuel and purchased power expenses resulting from the

sale of Highland Energy in the fourth quarter of 2001;

a decrease of $161.7 million in revenues resulting from the

sale of the Saltend plant in August 2001; and

a decrease of $139.1 million in revenues and $133.5 million

in purchased power expenses due to the contribution of

substantially all of Entergy’s power marketing and trading

business to Entergy-Koch in February 2001. Earnings from

Entergy-Koch are reported as equity in earnings of uncon-

solidated equity affiliates in the financial statements. The

net income effect of the lower revenues was more than

offset by the income from Entergy’s investment in Entergy-

Koch. The income from Entergy’s investment in Entergy-

Koch was $31.9 million higher in 2002 primarily as a result

of earnings at Entergy-Koch Trading (EKT) and higher

earnings at Gulf South Pipeline due to more favorable

transportation contract pricing. Although the gain/loss

days ratio reported below declined in 2002, EKT made

relatively more money on the gain days than the loss days,

and thus had an increase in earnings for the year.

Following are key performance measures for Entergy-

Koch’s operations for 2002 and 2001:

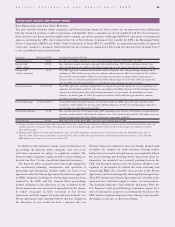

2002 2001

Entergy-Koch Trading

Gas volatility 61% 72%

Electricity volatility 48% 78%

Gas marketed (BCF/D)(1) 5.8 3.0

Electricity marketed (GWh)(1) 408,038 180,893

Gain/loss days 1.8 2.8

Gulf South Pipeline

Throughput (BCF/D) 2.40 2.45

Production cost ($/MMBtu) $0.094 $0.093

(1) Previously reported volumes, which included only U.S. trading, have been

adjusted to reflect both U.S. and Europe volumes traded.

Entergy accounts for its 50% share in Entergy-Koch under the

equity method of accounting. Certain terms of the partnership

arrangement allocate income from various sources, and the

taxes on that income, on a significantly disproportionate basis

through 2003. Losses and distributions from operations are

allocated to the partners equally. Substantially all of Entergy-

Koch’s profits were allocated to Entergy in 2002. Effective

January 1, 2004, a revaluation of Entergy-Koch’s assets for legal

capital account purposes will occur, and future profit allocations

will change after the revaluation. The profit allocations other

than for weather trading and international trading are expected

to become equal, unless special allocations are necessary to

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS continued

26