Entergy 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TRANSITION TO COMPETITION LIABILITIES

In conjunction with electric utility industry restructuring

activity in Texas, regulatory mechanisms were established to

mitigate potential stranded costs. Texas restructuring legislation

allows depreciation on transmission and distribution assets

to be directed toward generation assets. The liability recorded

as a result of this mechanism is classified as “transition to

competition” deferred credits.

REACQUIRED DEBT

The premiums and costs associated with reacquired debt of the

domestic utility companies and System Energy (except that

portion allocable to the deregulated operations of Entergy Gulf

States) are being amortized over the life of the related new

issuances, in accordance with ratemaking treatment.

FOREIGN CURRENCY TRANSLATION

All assets and liabilities of Entergy’s foreign subsidiaries are

translated into U.S. dollars at the exchange rate in effect at the

end of the period. Revenues and expenses are translated at

average exchange rates prevailing during the period. The

resulting translation adjustments are reflected in a separate

component of shareholders’ equity. Current exchange rates

are used for U.S. dollar disclosures of future obligations

denominated in foreign currencies.

NEW ACCOUNTING PRONOUNCEMENT

SFAS 143, which was implemented in the first quarter of 2003,

requires the recording of liabilities for all legal obligations asso-

ciated with the retirement of long-lived assets that result from

the normal operation of those assets. These liabilities will be

recorded at their fair values (which are likely to be the present

values of the estimated future cash outflows) in the period in

which they are incurred, with an accompanying addition to

the recorded cost of the long-lived asset. The asset retirement

obligation will be accreted each year through a charge to

expense, to reflect the time value of money for this present

value obligation. The amounts added to the carrying amounts

of the long-lived assets will be depreciated over the useful lives

of the assets. The net effect of implementing this standard for

Entergy’s regulated utilities will be recorded as a regulatory

asset or liability, with no resulting impact on Entergy’s net

income. The implementation of SFAS 143 for the portion of

River Bend not subject to cost-based ratemaking is expected

to decrease earnings by approximately $25 million as a result of

a one-time cumulative effect of accounting change. For the

Non-Utility Nuclear business, the implementation of SFAS 143

is expected to result in a decrease in liabilities of approximately

$520 million as a result of the discounting methodology

required by SFAS 143. Assets are expected to decrease in 2003

by approximately $360 million, and earnings are expected to

increase by approximately $160 million as a result of a one-time

cumulative effect of accounting change.

NOTE 2. RATE AND REGULATORY MATTERS

ELECTRIC INDUSTRY RESTRUCTURING AND THE

CONTINUED APPLICATION OF SFAS 71

Although Arkansas and Texas enacted retail open access laws,

the retail open access law in Arkansas has now been repealed.

Retail open access in Entergy Gulf States’ service territory

in Texas has been delayed. Entergy believes that significant

issues remain to be addressed by regulators, and the enacted

law in Texas does not provide sufficient detail to allow

Entergy Gulf States to reasonably determine the impact on

Entergy Gulf States’ regulated operations. Entergy therefore

continues to apply regulatory accounting principles to the

retail operations of all of the domestic utility companies.

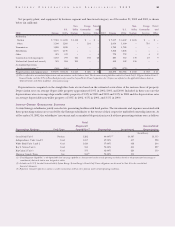

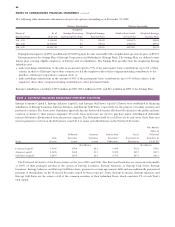

Following is a summary of the status of retail open access in

the domestic utility companies’ retail service territories.

% of Entergy’s

2002 Revenues Derived

from Retail Electric Utility

Status of Retail Operations in

Jurisdiction Open Access the Jurisdiction

Arkansas Retail open access legislation

was repealed in February 2003. 14.5%

Texas Implementation was delayed in Entergy

Gulf States’ service area in a settlement

approved by the Public Utility Commission

of Texas (PUCT). Retail open access is not

likely before the first quarter of 2004.

Status is discussed further below. 10.4%

Louisiana The LPSC has deferred pursuing retail

open access, pending developments at

the federal level and in other states. 33.5%

Mississippi The Mississippi Public Service Corporation

(MPSC) has recommended not pursuing

open access at this time. 10.6%

New Orleans The Council of the City of New Orleans,

Louisiana (Council or City Council) has

taken no action on Entergy New Orleans’

proposal filed in 1997. 5.0%

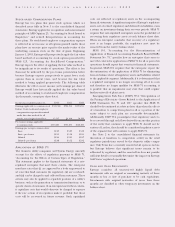

Retail open access commenced in portions of Texas on

January 1, 2002. The staff of the PUCT filed a petition to delay

retail open access in Entergy Gulf States’ service area, and

Entergy Gulf States reached a settlement agreement with the

PUCT to delay retail open access until at least September 15,

2002. In September 2002, the PUCT ordered Entergy Gulf

States to file on January 24, 2003 a proposal for an interim

solution – retail open access without a FERC-approved

regional transmission organization (RTO) – if it appears by

January 15, 2003 that a FERC-approved RTO will not be func-

tional by January 1, 2004. On January 24, 2003, Entergy Gulf

States filed its proposal, which among other elements,

includes:

the recommendation that retail open access in Entergy

Gulf States’ Texas service territory, including corporate

unbundling, occur by January 1, 2004, or else be delayed

until at least January 1, 2007 (If retail open access is

ENTERGY CORPORATION AND SUBSIDIARIES 2002 55