Entergy 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

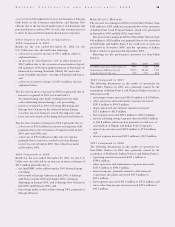

an increase in depreciation and amortization expenses of

$105.7 million primarily due to the effects in 2001 of the

final Federal Energy Regulatory Commission (FERC)

order addressing the System Energy Resources, Inc.

(System Energy) 1995 rate filing.

Partially offsetting these decreases in operating income were

the following:

increased revenues of $155.7 million due to increased

electricity usage in the service territories;

an increase in revenue of $94.3 million due to an increase

in the price applied to unbilled sales; and

an increase in other regulatory credits of $121.3 million

primarily due to a March 2002 settlement agreement

allowing Entergy Arkansas to recover a large majority of

2000 and 2001 ice storm repair expenses through the

previously-collected TCA amounts. This increase is offset

in other operation and maintenance expenses.

In addition to the effect of the March 2002 settlement agree-

ment, the increase in other operation and maintenance

expenses was primarily due to:

an increase of $51.2 million in benefit costs;

increased expenses of $24.5 million at Entergy Arkansas

due to the reversal in 2001 of ice storm costs previously

charged to expense in December 2000;

an increase of $14.6 million in fossil plant expenses due to

maintenance outages and turbine inspection costs at vari-

ous plants;

an increase of $10.9 million to reflect the current estimate

of the liability for the future disposal of low-level radioac-

tive waste materials; and

lower nuclear insurance refunds of $6.7 million.

Fuel recovery mechanisms at the domestic utility companies

(Entergy Arkansas, Entergy Gulf States, Entergy Louisiana,

Entergy Mississippi, and Entergy New Orleans, collectively)

generally provide for the deferral of fuel and purchased power

costs above the amounts included in existing rates. Operating

revenues include a decrease in fuel cost recovery revenue of

$897.4 million and $60.5 million related to electric sales and

gas sales, respectively, primarily due to lower fuel recovery

factors resulting from decreases in the market prices of natural

gas and purchased power in 2002. As such, this revenue

decrease is offset by decreased fuel and purchased power

expenses. Also contributing to the decrease in fuel cost

recovery revenue was a lower fuel recovery surcharge in 2002

in the Texas jurisdiction of Entergy Gulf States.

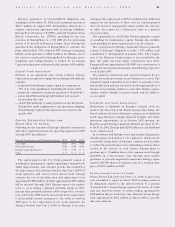

2001 Compared to 2000

Operating income decreased $125.6 million in 2001 primarily

due to:

decreased revenues of $161.9 million due to decreased

electricity usage in the service territories;

a decrease in revenue of $161.7 million due to a decrease

in the price applied to unbilled sales; and

the accrual of $26.8 million in the TCA at Entergy Arkansas.

Partially offsetting these decreases in operating income were

the following:

a decrease in other operation and maintenance expenses

of $95.6 million, which is explained below;

a decrease in depreciation and amortization expense at

System Energy of $74.5 million primarily resulting from

the final resolution of its 1995 rate filing; and

a decrease in decommissioning expense at System Energy

of $32.4 million resulting from the final resolution of the

FERC order addressing the 1995 rate increase filing.

The decrease in other operation and maintenance expenses in

2001 was primarily due to:

a decrease in property damage expenses of $49.7 million

primarily due to a reversal of $24.5 million in June 2001,

upon recommendation from the Arkansas Public Service

Commission (APSC), of ice storm costs previously charged

to expense in December 2000 (the effect of the reversal of

the ice storm costs on net income was largely offset by the

adjustment to the TCA as a result of the 2000 earnings

review in 2001);

decreases in expenses of $9.3 million at Entergy Arkansas

due to decreased transition to competition support costs

and $11.0 million at Entergy Louisiana due to decreased

legal fees; and

decreases of $10.7 million and $14.6 million at Entergy

Louisiana and Entergy Mississippi, respectively, because of

maintenance and planned maintenance outages at certain

fossil plants in 2000.

Operating revenues include an increase in fuel cost recovery

revenue of $462.7 million related to electric sales, primarily

due to increased fuel recovery factors at Entergy Arkansas,

Entergy Gulf States in the Texas jurisdiction, and Entergy

Mississippi, combined with higher fuel and purchased power

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS continued

24

The increase in earnings in 2002 for Non-Utility Nuclear

from $128 million to $201 million was primarily due

to the operation of Indian Point 2 and Vermont Yankee,

which were purchased in September 2001 and

July 2002, respectively.