Entergy 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

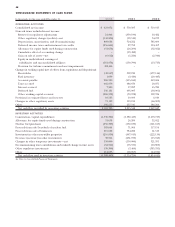

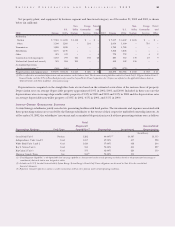

CONSOLIDATED STATEMENTS OF CASH FLOWS

In thousands, for the years ended December 31, 2002 2001 2000

FINANCING ACTIVITIES:

Proceeds from the issuance of:

Long-term debt 1,197,330 682,402 904,522

Common stock 130,061 64,345 41,908

Retirement of:

Long-term debt (1,341,274) (962,112) (181,329)

Repurchase of common stock (118,499) (36,895) (550,206)

Redemption of preferred stock (1,858) (39,574) (157,658)

Changes in short-term borrowings—net 244,333 (37,004) 267,000

Dividends paid:

Common stock (298,991) (269,122) (271,019)

Preferred stock (23,712) (24,044) (32,400)

Net cash flow provided by (used in) financing activities (212,610) (622,004) 20,818

Effect of exchange rates on cash and cash equivalents 3,125 325 (5,948)

Net increase (decrease) in cash and cash equivalents 583,755 (630,851) 168,705

Cash and cash equivalents at beginning of period 751,573 1,382,424 1,213,719

Cash and cash equivalents at end of period $ 1,335,328 $ 751,573 $ 1,382,424

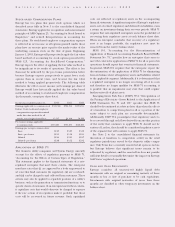

SUPPLEMENTAL DISCLOSURE OF

CASH FLOW INFORMATION:

Cash paid (received) during the period for:

Interest—net of amount capitalized $ 633,931 $ 708,748 $ 505,414

Income taxes $57,856 $ (113,466) $ 345,361

Noncash investing and financing activities:

Debt assumed by the Damhead Creek purchaser $ 488,432 – –

Decommissioning trust funds acquired

in nuclear power plant acquisitions $ 310,000 $ 430,000 –

Change in unrealized depreciation of

decommissioning trust assets $(72,982) $ (34,517) $ (11,577)

Long-term debt refunded with proceeds from

long-term debt issued in prior period $ (47,000) – –

Proceeds from long-term debt issued for the purpose

of refunding prior long-term debt –$47,000 –

Acquisition of Indian Point 3 and FitzPatrick:

Fair value of assets acquired ––$917,667

Initial cash paid at closing ––$50,000

Liabilities assumed and notes issued to seller ––$867,667

See Notes to Consolidated Financial Statements.

ENTERGY CORPORATION AND SUBSIDIARIES 2002 49