Entergy 2002 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2002 19

its position as competitors left the market.

Trading across all products – including gas,

power, and weather – contributed to increased

EKT earnings in 2002. EKT continued to rank

among the top trading companies in gas, power,

and weather derivatives trading – based on

the votes of banks, brokers, end-users, and

traders worldwide.

EKT expanded its customer business into the

Western United States, signing an agreement

with a major natural gas local distribution

company. By managing gas and power positions

for its customers, EKT increases its earnings in

a low-risk business.

Gulf South Pipeline contributes stable

revenues in a regulated pipeline business. Gulf

South also benefits from a diverse customer

base and diverse supply sources. Gulf South’s

approximately 8,000-mile system has

connections to nearly 100 other pipelines.

Growth on a solid foundation

Entergy is committed to the energy trading

business. We see it as a necessary component

of our overall strategy, and we’re confident

that there will continue to be a robust energy

trading business in the future. The fact is,

gas and power are volatile commodities, and

companies will continue to need trading

services to manage commodity risks.

Trading is a good business for Entergy-Koch.

EKT has upside opportunities in both trading

and its customer businesses as competitors exit.

Entergy-Koch holds credit ratings of “A3”

from Moody’s and “A” from Standard & Poor’s

– the only ratings at this level issued to a trading

company without a guarantee from a parent

company. The strength of Entergy-Koch’s

ratings reflects a conservative balance sheet, a

disciplined trading approach, and superior risk

management practices. Strong credit ratings are

especially important to potential customers and

counterparties in the current market.

To maintain its strong credit as the trading

operation grows, Entergy-Koch must expand its

balance sheet. That means investing in assets that

earn more than the cost of capital, such as gas

pipelines and storage.

Investments through Entergy-Koch are a

key growth opportunity for Entergy. First, they

provide the return on the investment itself.

Second, by expanding the Entergy-Koch

balance sheet, they leverage expansion of its

profitable trading operation.

Gulf South plans to drive growth through

improved productivity and investments in

expanded pipeline and storage facilities with an

attractive rate of return.

In 2002, Gulf South announced development

of the Magnolia Gas Storage facility in Louisiana.

Salt dome storage capacity of 4.1 Bcf is expected

to be in service in early 2004, with expansion up

to 6.5 Bcf by 2007. Magnolia will complement

Gulf South’s existing storage capacity of 68.5 Bcf

at Bistineau and Jackson.

How Entergy-Koch is different

With all the problems that have hit energy

trading businesses, the exit of several of our

competitors, and the announcements of poor

results, how is Entergy-Koch different?

First, some trading companies engaged in

long-dated contracts with weak counterparties.

In contrast, EKT has maintained a trading

book of relatively short duration, and the

great majority of its trading partners have

investment grade credit ratings.

Second, well over half of Entergy-Koch

earnings are generated by more predictable

revenues: from the Gulf South Pipeline – an

asset-based, regulated business – and from

EKT’s customer businesses.

Third, EKT’s trading results are not based on

big bets and pure speculation. Its trades are

based on fundamental analytics supported by

information from its depth of market knowledge.

Entergy-Koch has not engaged in market

manipulation or simultaneous trading activities

designed to inflate volumes and revenues – and

is one of the only large trading companies to

have such an unblemished record.

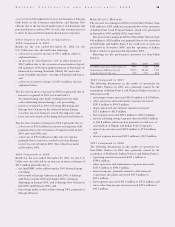

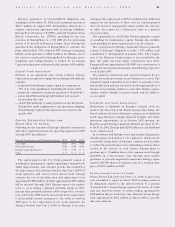

Entergy-Koch Trading’s

discipline is reflected in

consistent results. Between

2000 and 2002, EKT

recorded gains on a

significant majority of

trading days. Most trading

days resulted in gains of

less than $5 million. EKT

didn’t have to count on big

wins to make money.

RECOGNITION

Leadership in

Energy Trading

Entergy-Koch Trading was

recognized for Corporate

Leadership of the Year in

the 2003

Energy and

Power Risk Management

Magazine

Awards.

The award noted that

EKT's "commercial success

over the past 12 months

has been impressive" and

that it "has grown from

a niche player into a

market leader."

80

60

40

20

0

EKT Trading Days

2000-2002

(number of days by

daily gain or loss)

loss days gain days