Entergy 2002 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

decontamination operations. Only after proceeds are dedicated

for such use and regulatory approval is secured would any

remaining proceeds be made available for the benefit of plant

owners or their creditors.

Effective November 15, 2001, in the event that one or more

acts of terrorism cause accidental property damage under one

or more of all nuclear insurance policies issued by NEIL

(including, but not limited to, those described above) within

12 months from the date the first accidental property damage

occurs, the maximum recovery under all such nuclear

insurance policies shall be an aggregate of $3.24 billion plus the

additional amounts recovered for such losses from reinsurance,

indemnity, and any other source applicable to such losses.

SPENT NUCLEAR FUEL

Entergy’s nuclear owner/licensee subsidiaries provide for the

estimated future disposal costs of spent nuclear fuel in

accordance with the Nuclear Waste Policy Act of 1982. The

affected Entergy companies entered into contracts with the

DOE, whereby the DOE will furnish disposal service at a cost

of one mill per net kWh generated and sold after April 7, 1983,

plus a one-time fee for generation prior to that date. Entergy

Arkansas is the only Entergy company that generated electric

power with nuclear fuel prior to that date and has a recorded

liability as of December 31, 2002 of $153 million for the one-

time fee. The fees payable to the DOE may be adjusted in the

future to assure full recovery. Entergy considers all costs

incurred for the disposal of spent nuclear fuel, except accrued

interest, to be proper components of nuclear fuel expense.

Provisions to recover such costs have been or will be made in

applications to regulatory authorities.

Entergy’s Non-Utility Nuclear business has accepted

assignment of the Pilgrim, FitzPatrick, Indian Point 3, Indian

Point 2, and Vermont Yankee spent fuel disposal contracts with

the DOE held by their previous owners. The previous owners

have paid or retained liability for the fees for all generation

prior to the purchase dates of those plants.

Delays have occurred in the DOE’s program for the

acceptance and disposal of spent nuclear fuel at a permanent

repository. After twenty years of study, the DOE, in February

2002, formally recommended, and President Bush approved,

Yucca Mountain, Nevada as the permanent spent fuel repository.

DOE will now proceed with the licensing and, if the license is

granted by the NRC, eventual construction of the repository will

begin and receipt of spent fuel may begin as early as approxi-

mately 2010. Considerable uncertainty remains regarding the

time frame under which the DOE will begin to accept spent fuel

from Entergy’s facilities for storage or disposal. As a result,

future expenditures will be required to increase spent fuel

storage capacity at Entergy’s nuclear plant sites.

Pending DOE acceptance and disposal of spent nuclear fuel,

the owners of nuclear plants are responsible for their own spent

fuel storage. Current on-site spent fuel storage capacity at Grand

Gulf 1 and River Bend is estimated to be sufficient until approx-

imately 2006 and 2004, respectively, at which time dry cask

storage facilities will be placed into service. The spent fuel pool

at Waterford 3 was recently expanded through the replacement

of the existing storage racks with higher density storage racks.

This expansion should provide sufficient storage for Waterford

3 until after 2010. An ANO storage facility using dry casks began

operation in 1996 and has been expanded since and will be

further expanded as needed. The spent fuel storage facility at

Pilgrim is licensed to provide enough storage capacity until

approximately 2012. The first dry spent fuel storage casks were

loaded at FitzPatrick in 2002, and further casks will be loaded

there as needed. Indian Point and Vermont Yankee currently

have sufficient spent fuel storage capacity until approximately

2004 and 2006, respectively, at which time planned additional

dry cask storage capacity are to begin operation.

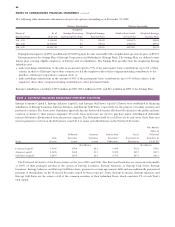

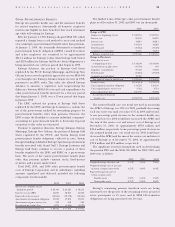

NUCLEAR DECOMMISSIONING COSTS

Total approved decommissioning costs for rate recovery

purposes as of December 31, 2002, for Entergy Arkansas’,

Entergy Gulf States’, Entergy Louisiana’s, and System Energy’s

nuclear power plants, excluding SMEPA’s share of Grand

Gulf 1, are as follows (in millions):

Total Approved Estimated

Decommissioning Costs

ANO 1 & ANO 2

(based on a 1998 cost study reflecting 1997 dollars) $ 813.1

River Bend- Louisiana

(based on a 1996 cost study reflecting 1996 dollars) 419.0

River Bend- Texas

(based on a 1996 cost study reflecting 1996 dollars) 385.2

Waterford 3

(based on a 1994 updated study in 1993 dollars) 320.1

Grand Gulf 1

(based on a 1994 cost study using 1993 dollars) 341.1

Total $2,278.5

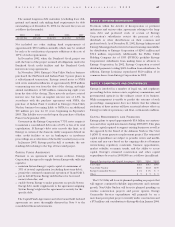

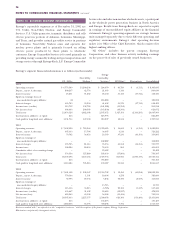

Entergy has been recording decommissioning liabilities for

these plants as the estimated decommissioning costs are collected

from customers or as earnings on the trust funds are realized.

Effective January 1, 2003, Entergy adopted SFAS 143,

“Accounting for Asset Retirement Obligations.” The provisions

of this statement will result in a different amount of decommis-

sioning costs being recorded than under the method described

above in use prior to December 31, 2002. Entergy expects to

adjust for financial reporting purposes this different level of

decommissioning expense to the level previously being recorded

through the use of regulatory assets/regulatory liabilities for a

substantial portion of the decommissioning costs associated with

the units listed above. The decommissioning liabilities recorded

are discussed below.

Decommissioning costs recovered in rates are deposited in

trust funds and reported at market value based upon market

quotes or as determined by widely used pricing services. These

trust fund assets largely offset the accumulated decommissioning

liability that is recorded as accumulated depreciation for

Entergy Arkansas, Entergy Gulf States, and Entergy Louisiana,

and are recorded as deferred credits for System Energy and

ENTERGY CORPORATION AND SUBSIDIARIES 2002 69