Entergy 2002 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

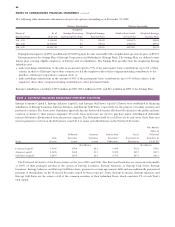

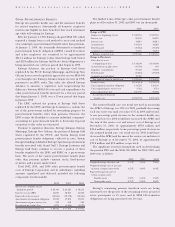

Governmental Bonds(a) – continued: Maturity Date 2002 2001

7.7% Series West Feliciana Parish- Louisiana 2014 94,000 94,000

5.8% Series West Feliciana Parish- Louisiana 2015 28,400 28,400

7.0% Series West Feliciana Parish- Louisiana 2015 39,000 39,000

7.5% Series West Feliciana Parish- Louisiana 2015 41,600 41,600

9.0% Series West Feliciana Parish- Louisiana 2015 45,000 45,000

5.8% Series West Feliciana Parish- Louisiana 2016 20,000 20,000

6.3% Series Pope County- Arkansas 2016 19,500 19,500

5.6% Series Jefferson County- Arkansas 2017 45,500 45,500

6.3% Series Jefferson County- Arkansas 2018 9,200 9,200

6.3% Series Pope County- Arkansas 2020 120,000 120,000

8.0% Series Pope County- Arkansas 2020 – 20,000

6.25% Series Independence County- Arkansas 2021 45,000 45,000

7.5% Series St. Charles Parish- Louisiana 2021 50,000 50,000

8.0% Series Pope County- Arkansas 2021 – 27,000

5.875% Series Mississippi Business Finance Corp. 2022 216,000 216,000

5.9% Series Mississippi Business Finance Corp. 2022 102,975 102,975

7.0% Series Warren County- Mississippi 2022 8,095 8,095

7.0% Series Washington County- Mississippi 2022 7,935 7,935

7.0% Series St. Charles Parish- Louisiana 2022 24,000 24,000

7.05% Series St. Charles Parish- Louisiana 2022 20,000 20,000

Auction Rate Independence City- Mississippi 2022 30,000 30,000

5.95% Series St. Charles Parish- Louisiana 2023 25,000 25,000

6.2% Series St. Charles Parish- Louisiana 2023 33,000 33,000

6.875% Series St. Charles Parish- Louisiana 2024 20,400 20,400

6.375% Series St. Charles Parish- Louisiana 2025 16,770 16,770

7.3% Series Claiborne County- Mississippi 2025 7,625 7,625

6.2% Series Claiborne County- Mississippi 2026 90,000 90,000

5.05% Series Pope County- Arkansas(b) 2028 47,000 47,000

5.65% Series West Feliciana Parish- Louisiana(c) 2028 62,000 62,000

6.6% Series West Feliciana Parish- Louisiana 2028 40,000 40,000

5.35% Series St. Charles Parish- Louisiana(d) 2029 110,950 110,950

Auction Rate St. Charles Parish- Louisiana 2030 60,000 60,000

4.85% Series St. Charles Parish- Louisiana(e) 2030 – 55,000

4.9% Series St. Charles Parish- Louisiana(e)(f) 2030 55,000 –

Total governmental bonds $1,643,380 $ 1,690,380

66

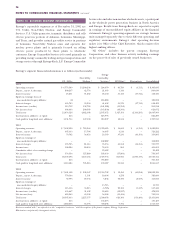

Other Long-Term Debt: 2002 2001

Damhead Creek Project Credit Facilities, avg rate 6.52% $ – $ 458,385

Note Payable to NYPA, non-interest bearing, 4.8% implicit rate 683,640 756,914

Bank Credit Facility (Entergy Corporation and Subsidiaries, Note 4) 535,000 –

7.75% Notes due December 2009, Entergy Corporation 267,000 –

Long-term DOE Obligation (Entergy Corporation and Subsidiaries, Note 9) 152,804 150,217

Waterford 3 Lease Obligation 7.45%(Entergy Corporation and Subsidiaries, Note 10) 297,950 313,918

Grand Gulf Lease Obligation 7.02% (Entergy Corporation and Subsidiaries, Note 10) 414,843 445,734

Unamortized Premium and Discount- Net (13,741) (15,133)

Top of Iowa wind project debt, avg rate 3.15% due 2003 79,029 78,527

Other 70,464 128,328

Total Long-Term Debt $8,278,319 $ 8,003,799

Less Amount Due Within One Year 1,191,320 682,771

Long-Term Debt Excluding Amount Due Within One Year $ 7,086,999 $7,321,028

Fair Value of Long-Term Debt(g) $7,270,696 $ 6,764,419

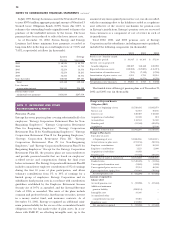

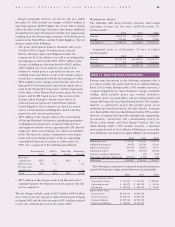

(a) Consists of pollution control revenue bonds and environmental revenue bonds, certain series of which are secured by non-interest bearing first mortgage bonds.

(b) The bonds are subject to mandatory tender for purchase from the holders at 100% of the principal amount outstanding on September 1, 2005 and will then be remarketed.

(c) The bonds are subject to mandatory tender for purchase from the holders at 100% of the principal amount outstanding on September 1, 2004 and will then be remarketed.

(d) The bonds are subject to mandatory tender for purchase from the holders at 100% of the principal amount outstanding on October 1, 2003 and will then be remarketed.

(e) On June 1, 2002, Entergy Louisiana remarketed $55 million St. Charles Parish Pollution Control Revenue Refunding Bonds due 2030, resetting the interest rate

to 4.9% through May 2005.

(f) The bonds are subject to mandatory tender for purchase from the holders at 100% of the principal amount outstanding on June 1, 2005 and will then be remarketed.

(g) The fair value excludes lease obligations, long-term DOE obligations, and other long-term debt and includes debt due within one year. It is determined using bid price

reported by dealer markets and by nationally recognized investment banking firms.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued