Entergy 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

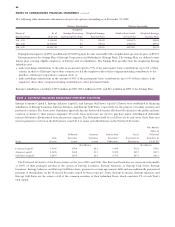

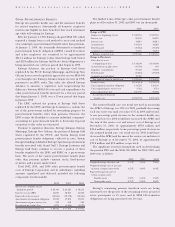

The annual long-term debt maturities (excluding lease obli-

gations) and annual cash sinking fund requirements for debt

outstanding as of December 31, 2002, for the next five years are

as follows (in thousands):

2003 2004 2005 2006 2007

$1,150,786 $925,005 $540,372 $139,952 $475,288

Not included are other sinking fund requirements of

approximately $30.2 million annually, which may be satisfied

by cash or by certification of property additions at the rate of

167% of such requirements.

In December 2002, when the Damhead Creek project was

sold, the buyer of the project assumed all obligations under the

Damhead Creek credit facilities and the Damhead Creek

interest rate swap agreements.

In November 2000, Entergy’s Non-Utility Nuclear business

purchased the FitzPatrick and Indian Point 3 power plants in

a seller-financed transaction. Entergy issued notes to NYPA

with seven annual installments of approximately $108 million

commencing one year from the date of the closing, and eight

annual installments of $20 million commencing eight years

from the date of the closing. These notes do not have a stated

interest rate, but have an implicit interest rate of 4.8%. In

accordance with the purchase agreement with NYPA, the

purchase of Indian Point 2 resulted in Entergy’s Non-Utility

Nuclear business becoming liable to NYPA for an additional

$10 million per year for 10 years, beginning in September

2003. This liability was recorded upon the purchase of Indian

Point 2 in September 2001.

Covenants in the Entergy Corporation 7.75% notes require it

to maintain a consolidated debt ratio of 65% or less of its total

capitalization. If Entergy’s debt ratio exceeds this limit, or if

Entergy or certain of the domestic utility companies default on

other credit facilities or are in bankruptcy or insolvency

proceedings, an acceleration of the facility’s maturity may occur.

In January 2003, Entergy paid in full, at maturity, the out-

standing debt relating to the Top of Iowa wind project.

CAPITAL FUNDS AGREEMENT

Pursuant to an agreement with certain creditors, Entergy

Corporation has agreed to supply System Energy with sufficient

capital to:

maintain System Energy’s equity capital at a minimum of

35% of its total capitalization (excluding short-term debt);

permit the continued commercial operation of Grand Gulf 1;

pay in full all System Energy indebtedness for borrowed

money when due; and

enable System Energy to make payments on specific System

Energy debt, under supplements to the agreement assigning

System Energy’s rights in the agreement as security for the

specific debt.

The Capital Funds Agreement and other Grand Gulf 1-related

agreements are more thoroughly discussed in Note 9 to the

consolidated financial statements.

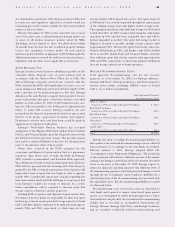

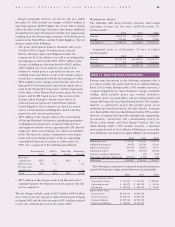

NOTE 8. DIVIDEND RESTRICTIONS

Provisions within the Articles of Incorporation or pertinent

indentures and various other agreements relating to the long-

term debt and preferred stock of certain of Entergy

Corporation’s subsidiaries restrict the payment of cash

dividends or other distributions on their common and

preferred stock. As of December 31, 2002, Entergy Arkansas and

Entergy Mississippi had restricted retained earnings unavailable

for distribution to Entergy Corporation of $296.1 million and

$36.2 million, respectively. Additionally, the Public Utility

Holding Company Act of 1935 (PUHCA) prohibits Entergy

Corporation’s subsidiaries from making loans or advances to

Entergy Corporation. In 2002, Entergy Corporation received

dividend payments totaling $618.4 million from subsidiaries. In

addition, Entergy Louisiana repurchased $120 million of its

common shares from Entergy Corporation in 2002.

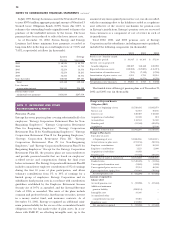

NOTE 9. COMMITMENTS AND CONTINGENCIES

Entergy is involved in a number of legal, tax, and regulatory

proceedings before various courts, regulatory commissions, and

governmental agencies in the ordinary course of its business.

While management is unable to predict the outcome of such

proceedings, management does not believe that the ultimate

resolution of these matters will have a material adverse effect on

Entergy’s results of operations, cash flows, or financial condition.

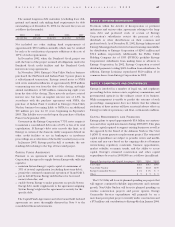

CAPITAL REQUIREMENTS AND FINANCING

Entergy plans to spend approximately $3.4 billion on construc-

tion and other capital investments during 2003-2005. This plan

reflects capital required to support existing businesses as well as

the approval by the Board of the Arkansas Nuclear One Unit

1(ANO 1) steam generator replacement project. The estimated

capital expenditures are subject to periodic review and modifi-

cation and may vary based on the ongoing effects of business

restructuring, regulatory constraints, business opportunities,

market volatility, economic trends, and the ability to access

capital. Entergy’s estimated construction and other capital

expenditures by year for 2003-2005 are as follows (in millions):

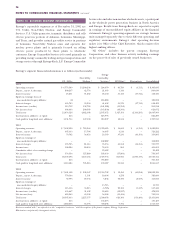

Planned Construction and Capital Investment 2003 2004 2005

U.S. Utility $924 $915 $965

Non-Utility Nuclear $201 $142 $109

Energy Commodity Services $ 24 $ 76 $ 3

Other $ 7 $ 7 $ 9

The U.S. Utility will focus its planned spending on projects that

will support continued reliability improvements and customer

growth. Non-Utility Nuclear will focus its planned spending on

routine construction projects and power uprates. Energy

Commodity Services expenditures will primarily be on a

merchant power plant project currently under construction and

a $73 million cash contribution to Entergy-Koch in January 2004.

ENTERGY CORPORATION AND SUBSIDIARIES 2002 67