Entergy 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy’s guarantees of unconsolidated obligations out-

standing as of December 31, 2002 total a maximum amount of

$267.5 million. In August 2001, EntergyShaw entered into a

turnkey construction agreement with an Entergy subsidiary,

Entergy Power Ventures, L.P. (EPV), and with Northeast Texas

Electric Cooperative, Inc. (NTEC), providing for the con-

struction by EntergyShaw of a 550 MW electric generating

station to be located in Harrison County, Texas. Entergy has

guaranteed the obligations of EntergyShaw to construct the

plant, which will be 70% owned by EPV. Entergy’s maximum

liability on the guarantee is $232.5 million. In addition, one of

the contracts transferred to Entergy-Koch by Entergy’s power

marketing and trading business is backed by an Entergy

Corporation guarantee authorized in the amount of $35 million.

Capital Funds Agreement

Pursuant to an agreement with certain creditors, Entergy

Corporation has agreed to supply System Energy with sufficient

capital to:

maintain System Energy’s equity capital at a minimum of

35% of its total capitalization (excluding short-term debt);

permit the continued commercial operation of Grand Gulf 1;

pay in full all System Energy indebtedness for borrowed

money when due; and

enable System Energy to make payments on specific System

Energy debt, under supplements to the agreement assigning

System Energy’s rights in the agreement as security for the

specific debt.

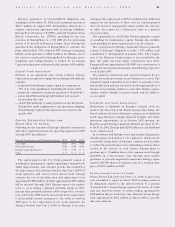

CAPITAL EXPENDITURE PLANS AND

OTHER USES OF CAPITAL

Following are the amounts of Entergy’s planned construction

and other capital investments by operating segment for 2003

through 2005 (in millions):

Planned Construction and Capital Investment 2003 2004 2005

U.S. Utility $924 $915 $965

Non-Utility Nuclear $201 $142 $109

Energy Commodity Services $ 24 $ 76 $ 3

Other $ 7 $ 7 $ 9

The capital plan for the U.S. Utility primarily consists of

spending for maintenance capital, supporting continued reli-

ability improvements, and customer growth. Also included is

the replacement of the Arkansas Nuclear One Unit 1 (ANO 1)

steam generator and reactor vessel closure head. Entergy

estimates the cost of the fabrication and replacement to be

approximately $235 million, of which approximately $135 million

will be incurred through 2004. Entergy expects the replace-

ment to occur during a planned refueling outage in 2005.

Entergy Arkansas filed in January 2003 a request for a declara-

tory order by the APSC that the investment in the replacement

is in the public interest analogous to the order received in

1998 prior to the replacement of the steam generator for

Arkansas Nuclear One Unit 2 (ANO 2). Receipt of an order

relating to the replacement at ANO 1 would provide additional

support for the inclusion of these costs in a future general

rate case; however, management cannot predict the outcome

of either the request for a declaratory order or a general

rate proceeding.

The capital plan for Non-Utility Nuclear primarily consists

of spending for maintenance capital. Entergy also includes

some spending for power uprate projects in the estimate.

The capital plan for Energy Commodity Services primarily

consists of Entergy’s obligation to make a $73 million cash

contribution to Entergy-Koch in January 2004. The comple-

tion of the Harrison County project is also included in the

plan. The plant has been under construction since 2001.

Entergy will own approximately 385 MW once construction is

completed and operation has begun, which Entergy expects to

occur in June 2003.

The planned construction and capital investments do not

include potential investments in new businesses or assets. The

estimated capital expenditures are subject to periodic review

and modification and may vary based on the ongoing effects of

business restructuring, regulatory constraints, business oppor-

tunities, market volatility, economic trends, and the ability to

access capital.

Dividends and Stock Repurchases

Declarations of dividends on Entergy’s common stock are

made at the discretion of the Board. Among other things, the

Board evaluates the level of Entergy’s common stock dividends

based upon Entergy’s earnings, financial strength, and future

investment opportunities. At its October 2002 meeting, the

Board increased Entergy’s quarterly dividend per share by 6%,

to $0.35. In 2002, Entergy paid $299 million in cash dividends

on its common stock.

In accordance with Entergy’s stock option plans, Entergy peri-

odically grants stock options to its employees, which may be

exercised to obtain shares of Entergy’s common stock. In order

to reduce the potential increase in outstanding common shares

created by the exercise of stock options, Entergy plans to

purchase up to 10 million shares of its common stock through

mid-2004 on a discretionary basis through open market

purchases or privately negotiated transactions. Entergy repur-

chased 2,885,000 shares of common stock for a total purchase

price of $118.5 million in 2002.

System Energy Letters of Credit

System Energy had three-year letters of credit in place that

were scheduled to expire in March 2003 securing certain of

its obligations related to the sales/leaseback of a portion

of Grand Gulf 1. System Energy replaced the letters of credit

with new three-year letters of credit totaling approximately

$192 million that are backed by cash collateral. System Energy

used approximately $192 million in March 2003 to provide

this cash collateral.

ENTERGY CORPORATION AND SUBSIDIARIES 2002 29