Entergy 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MARKET AND CREDIT RISKS

Market risk is the risk of changes in the value of commodity and

financial instruments, or in future operating results or cash

flows, in response to changing market conditions. Entergy is

exposed to the following significant market risks:

the commodity price risk associated with Entergy’s Non-

Utility Nuclear and Energy Commodity Services segments;

the foreign currency exchange rate risk associated with

certain of Entergy’s contractual obligations; and

the interest rate and equity price risk associated with

Entergy’s investments in decommissioning trust funds.

Entergy is also exposed to credit risk. Credit risk is the risk of

loss from nonperformance by suppliers, customers, or financial

counterparties to a contract or agreement. Where it is a signifi-

cant consideration, counterparty credit risk is addressed in the

discussions that follow.

Commodity Price Risk

POWER GENERATION

The sale of electricity from the power generation plants owned

by Entergy’s Non-Utility Nuclear business and Energy Com-

modity Services, unless otherwise contracted, is subject to the

fluctuation of market power prices. Entergy’s Non-Utility

Nuclear business has entered into power purchase agreements

(PPAs) and other contracts to sell the power produced by its

power plants at prices established in the PPAs. Entergy continues

to pursue opportunities to extend the existing PPAs and to enter

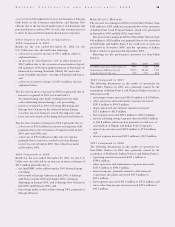

into new PPAs with other parties. Following is a summary of the

amount of Entergy’s Non-Utility Nuclear business’ and Energy

Commodity Services’ output that is currently sold forward under

physical or financial contracts at fixed prices:

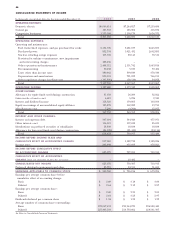

2003 2004 2005 2006 2007

Non-Utility Nuclear:

% of planned generation

sold forward 100% 92% 25% 11% 9%

Planned generation (GWh) 33,317 33,361 34,006 34,613 34,300

Average price per MWh $37.06 $38.36 $35.94 $31.97 $31.42

Energy Commodity Services:

% of planned generation

sold forward 38% 18% 22% 19% 21%

Planned generation (GWh) 3,124 3,249 3,820 3,494 3,618

Contracted spark spread

per MWh $11.70 $10.63 $10.62 $ 9.69 $ 9.68

The Vermont Yankee acquisition included a 10-year PPA

under which the former owners will buy the power produced

by the plant through the expiration of the current operating

license for the plant. The PPA includes an adjustment clause

under which the prices specified in the PPA will be adjusted

downward annually, beginning in 2006, if power market prices

drop below the PPA prices. Accordingly, because the price is

not fixed, the table above does not report power from that

plant as sold forward after 2005.

Under the PPAs with NYPA for the output of power from

Indian Point 3 and FitzPatrick, the Non-Utility Nuclear business

is obligated to produce at an average capacity factor of 85% with

a financial true-up payment to NYPA should NYPA's cost to

purchase power due to an output shortfall be higher than

the PPAs' price. The calculation of any true-up payments is

based on two two--year periods. For the first period, which ran

through November 20, 2002, Indian Point 3 and FitzPatrick

operated at 95% and 97%, respectively, under the true-up

formula. Credits of up to 5% reflecting period one generation

above 85% can be used to offset any output shortfalls in the

second period, which runs through the end of the PPAs on

December 31, 2004.

Entergy continually monitors industry trends in order to

determine whether asset impairments or other losses could

result from a decline in value, or cancellation, of merchant

power projects, and records provisions for impairments and

losses accordingly.

MARKETING AND TRADING

The earnings of Entergy’s Energy Commodity Services segment

are exposed to commodity price market risks primarily through

Entergy’s 50%-owned, unconsolidated investment in Entergy-

Koch. Entergy-Koch Trading uses value-at-risk models as one

measure of the market risk of a loss in fair value for EKT’s

natural gas and power trading portfolio. Actual future gains and

losses in portfolios will differ from those estimated based upon

actual fluctuations in market rates, operating exposures, and

the timing thereof, and changes in the portfolio of derivative

financial instruments during the year.

To manage its portfolio, EKT enters into various derivative

and contractual transactions in accordance with the policy

approved by the trading committee of the governing board of

Entergy-Koch. The trading portfolio consists of physical and

financial natural gas and power as well as other energy and

weather-related contracts. These contracts take many forms,

including futures, forwards, swaps, and options.

Characteristics of EKT’s value-at-risk method and the use of

that method are as follows:

Value-at-risk is used in conjunction with stress testing,

position reporting, and profit and loss reporting in order

to measure and control the risk inherent in the trading

and mark-to-market portfolios.

EKT estimates its value-at-risk using a model based on

J.P. Morgan’s Risk Metrics methodology combined with

a Monte Carlo simulation approach.

EKT estimates its daily value-at-risk for natural gas and

power using a 97.5% confidence level. EKT’s daily value- at-

risk is a measure that indicates that, if prices moved against

the positions, the loss in neutralizing the portfolio would

not be expected to exceed the calculated value-at-risk.

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS continued

34

Entergy’s Non-Utility Nuclear business has entered

into power purchase agreements and other contracts to sell

the power produced by its power plants at prices

established in the PPAs.