Entergy 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LIQUIDITY AND CAPITAL RESOURCES

This section discusses Entergy’s capital structure, capital

spending plans and other uses of capital, sources of capital,

and the cash flow activity presented in the cash flow statement.

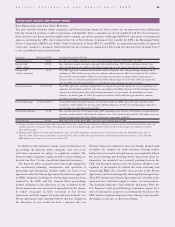

CAPITAL STRUCTURE

Entergy’s capitalization is balanced between equity and debt, as

shown in the following table. The reduction in the percentage

for 2002 is primarily the result of the sale of Damhead Creek in

December 2002. Debt outstanding on the Damhead Creek

facility was $458 million as of December 31, 2001.

2002 2001 2000

Net debt to net capital at the end of the year 46.3% 49.7% 49.8%

Net debt consists of gross debt less cash and cash equivalents.

Gross debt consists of notes payable, capital lease obligations,

and long-term debt, including the currently maturing portion.

Net capital consists of net debt, common shareholders’ equity,

and preferred stock and securities.

Long-term debt, including the currently maturing portion,

makes up over 90% of Entergy’s total debt outstanding.

Following are Entergy’s long-term debt principal maturities as

of December 31, 2002, by operating segment (in millions):

2006– After

Long-term Debt Maturities 2003 2004 2005 2007 2007

U.S. Utility $1,111 $855 $470 $466 $3,751

Non-Utility Nuclear $ 87 $ 91 $ 95 $205 $ 205

Energy Commodity Services $ 79 – – – –

Parent and Other – $595 – – $ 267

These figures include principal payments on the Entergy

Louisiana and System Energy sale-leaseback transactions,

which are included in long-term debt on the balance sheet.

In the fourth quarter of 2002, the U.S. Utility issued

$640 million of debt with maturities ranging from 2007 to 2032.

Approximately $71 million of the proceeds of the debt issued in

the fourth quarter were used to retire, in 2002, debt that was

scheduled to mature in 2003, and the remainder will be used to

meet certain 2003 maturities as they occur. Entergy Mississippi

issued an additional $100 million of debt in January 2003 that

matures in 2013. The proceeds will be used to repay, prior to

maturity, debt of Entergy Mississippi that is scheduled to mature

in 2003 and 2004. Note 7 to the consolidated financial state-

ments provides more detail concerning long-term debt.

The Energy Commodity Services debt was paid at maturity

in January 2003 using money drawn on Entergy Corporation’s

364-day credit facility.

Capital lease obligations, including nuclear fuel leases, are a

minimal part of Entergy’s overall capital structure, and are

discussed further in Note 10 to the consolidated financial

statements. Following are Entergy’s payment obligations

under those leases (in millions):

2006– After

2003 2004 2005 2007 2007

Capital lease payments,

including nuclear fuel leases $160 $137 $10 $9 $5

Notes payable, which include borrowings outstanding on

credit facilities with original maturities of less than one year,

were less than $1 million as of December 31, 2002. Entergy

Corporation, Entergy Arkansas, Entergy Louisiana, and

Entergy Mississippi each have 364-day credit facilities available

as follows (in millions):

Expiration Amount of Amount Drawn as

Company Date Facility of Dec. 31, 2002

Entergy Corporation May 2003 $1,450 $535

Entergy Arkansas May 2003 $ 63 –

Entergy Louisiana May 2003 $ 15 –

Entergy Mississippi May 2003 $ 25 –

Although the Entergy Corporation credit line expires in May

2003, Entergy has the discretionary option to extend the period

to repay the amount then outstanding for an additional 364-day

term. Because of this option, which Entergy intends to exercise

if it does not renew the credit line or obtain an alternative

source of financing, the debt outstanding under the credit line

is reflected in long-term debt on the balance sheet. The credit

line is reflected as notes payable at December 31, 2001.

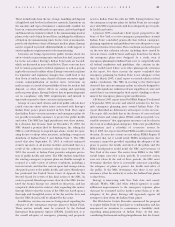

Operating Lease Obligations and Guarantees

of Unconsolidated Obligations

In addition to the obligations listed above that are reflected on

the balance sheet, Entergy has a minimal amount of operating

leases and guarantees in support of unconsolidated obliga-

tions that are not reflected as liabilities on the balance sheet.

These items are not on the balance sheet in accordance with

generally accepted accounting principles.

Following are Entergy’s payment obligations on noncance-

lable operating leases with a term over one year as of

December 31, 2002 (in millions):

2006– After

2003 2004 2005 2007 2007

Operating lease payments $98 $91 $73 $98 $140

The operating leases are discussed more thoroughly in Note 10

to the consolidated financial statements.

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS continued

28