Entergy 2002 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 4. LINES OF CREDIT AND RELATED

SHORT-TERM BORROWINGS

Entergy Corporation has in place a 364-day bank credit

facility with a borrowing capacity of $1.450 billion, of which

$535 million was outstanding as of December 31, 2002. The

weighted-average interest rate on Entergy’s outstanding bor-

rowings under this facility as of December 31, 2002 and 2001

was 2.5% and 3.2%, respectively. The commitment fee for this

facility is currently 0.20% of the line amount. Commitment

fees and interest rates on loans under the credit facility can

fluctuate depending on the senior debt ratings of the domestic

utility companies.

Although the Entergy Corporation credit facility expires in

May 2003, Entergy has the discretionary option to extend the

period to repay the amount then outstanding for an additional

364-day term. Because of this option, which Entergy intends to

exercise if it does not renew the credit line or obtain an alter-

native source of financing, the debt outstanding under the

credit line is reflected in long-term debt on the balance sheet.

The credit line is reflected as notes payable at December 31,

2001. Entergy Corporation’s facility requires it to maintain a

consolidated debt ratio of 65% or less of its total capitalization.

If Entergy’s debt ratio exceeds this limit, or if Entergy or the

domestic utility companies default on other credit facilities or

are in bankruptcy or insolvency proceedings, an acceleration

of the facility’s maturity may occur.

The short-term borrowings of Entergy’s subsidiaries are

limited to amounts authorized by the SEC. The current limits

authorized are effective through November 30, 2004. In

addition to borrowing from commercial banks, Entergy’s

subsidiaries are authorized to borrow from the Entergy System

Money Pool (money pool). The money pool is an inter-company

borrowing arrangement designed to reduce Entergy’s

subsidiaries’ dependence on external short-term borrowings.

Borrowings from the money pool and external borrowings com-

bined may not exceed the SEC authorized limits. As of

December 31, 2002, Entergy’s subsidiaries’ authorized limit was

$1.6 billion and the outstanding borrowing from the money

pool was $61.5 million. There were no borrowings outstanding

from external sources.

Entergy Arkansas, Entergy Louisiana, and Entergy Mississippi

each have 364-day credit facilities available as follows (in millions):

Expiration Amount of Amount Drawn as

Company Date Facility of Dec. 31, 2002

Entergy Arkansas May 2003 $63 –

Entergy Louisiana May 2003 $15 –

Entergy Mississippi May 2003 $25 –

The facilities have variable interest rates and the average

commitment fee is 0.13%.

62

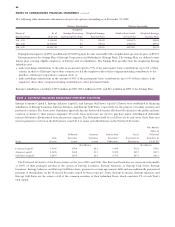

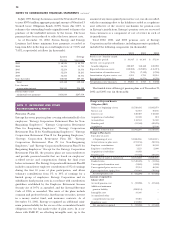

NOTE 5. PREFERRED AND COMMON STOCK

PREFERRED STOCK

The number of shares authorized and outstanding and dollar value of preferred stock for Entergy Corporation subsidiaries as of

December 31, 2002 and 2001, are presented below (dollars in thousands). Only the Entergy Gulf States series “with sinking fund”

contains mandatory redemption requirements. All other series are redeemable at Entergy’s option.

Shares Authorized Total

and Outstanding Dollar Value

2002 2001 2002 2001

Entergy Corporation

U.S. Utility Preferred Stock:

Without sinking fund:

Entergy Arkansas, 4.32% – 7.88% Series 1,613,500 1,613,500 $116,350 $116,350

Entergy Gulf States, 4.20% – 7.56% Series 473,268 473,268 47,327 47,327

Entergy Louisiana, 4.16% – 8.00% Series 2,115,000 2,115,000 100,500 100,500

Entergy Mississippi, 4.36% – 8.36% Series 503,807 503,807 50,381 50,381

Entergy New Orleans, 4.36% – 5.56% Series 197,798 197,798 19,780 19,780

Total without sinking fund 4,903,373 4,903,373 $334,337 $334,337

With sinking fund:

Entergy Gulf States, Adjustable Rate 7.0%(a) 243,269 261,848 $ 24,327 $ 26,185

Total with sinking fund 243,269 261,848 $ 24,327 $ 26,185

Fair Value of Preferred Stock with sinking fund(b) $20,792 $ 26,160

All outstanding preferred stock is cumulative. Entergy Gulf States has annual sinking fund requirements of $3.45 million through 2007 for its preferred stock outstanding.

Totals may not foot due to rounding.

(a) Represents weighted-average annualized rates for 2002.

(b) Fair values were determined using bid prices reported by dealer markets and by nationally recognized investment banking firms. There is additional disclosure of fair

value of financial instruments in Note 15 to the consolidated financial statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued