Entergy 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

Energy

Non-Utility Commodity

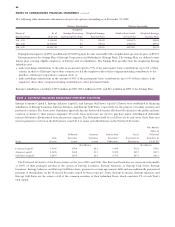

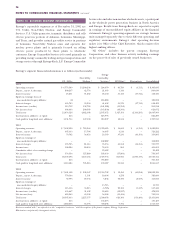

U.S. Utility Nuclear*Services*All Other*Eliminations Consolidated

2002

Operating revenues $ 6,773,509 $1,200,238 $ 294,670 $ 40,729 $ (4,111) $ 8,305,035

Deprec., amort. & decomm. 800,257 42,774 21,465 5,143 – 869,639

Interest income 23,231 71,262 26,140 35,433 (37,741) 118,325

Equity in earnings (loss) of

unconsolidated equity affiliates (2) – 183,880 – – 183,878

Interest charges 465,703 93,250 61,632 35,579 (37,741) 618,423

Income taxes (credits) 313,752 132,726 (141,288) (11,252) – 293,938

Net income (loss) 606,963 200,505 (145,830) (38,566) – 623,072

Total assets 21,074,126 4,482,308 2,167,472 1,327,354 (2,103,291) 26,947,969

Investments in affiliates - at equity 214 – 823,995 – – 824,209

Cash paid for long-lived asset additions 1,131,734 347,390 210,297 18,514 – 1,707,935

2001

Operating revenues $ 7,432,920 $ 789,244 $1,370,485 $ 34,603 $ (6,353) $ 9,620,899

Deprec., amort. & decomm. 667,333 17,706 34,667 4,516 – 724,222

Interest income 79,702 54,053 23,169 37,235 (34,354) 159,805

Equity in earnings of

unconsolidated equity affiliates – – 162,882 – – 162,882

Interest charges 576,705 81,114 74,953 41,558 (34,353) 739,977

Income taxes 300,284 80,053 74,493 863 – 455,693

Cumulative effect of accounting change – – 23,482 – – 23,482

Net income (loss) 574,554 127,880 105,939 (57,866) – 750,507

Total assets 20,309,695 3,449,156 2,377,733 863,906 (1,090,179) 25,910,311

Investments in affiliates - at equity 214 – 765,889 – – 766,103

Cash paid for long-lived asset additions 1,110,484 705,216 199,387 21,550 – 2,036,637

2000

Operating revenues $ 7,401,598 $ 298,147 $2,353,792 $ 32,450 $ (63,858) $10,022,129

Deprec., amort. & decomm. 770,144 1,191 10,996 3,278 – 785,609

Interest income 57,795 29,534 5,838 78,390 (8,507) 163,050

Equity in earnings of

unconsolidated equity affiliates – – 13,715 – – 13,715

Interest charges 515,156 33,213 (3,725) 22,103 (9,317) 557,430

Income taxes (credits) 435,667 31,492 24,689 (12,927) – 478,921

Net income (loss) 618,263 49,158 54,908 (11,414) – 710,915

Total assets 20,567,433 2,227,177 2,590,678 620,104 (553,496) 25,451,896

Investments in affiliates - at equity 214 – 136,273 – – 136,487

Cash paid for long-lived asset additions 1,080,055 63,593 390,298 9,771 – 1,543,717

Businesses marked with * are referred to as the “competitive businesses,” with the exception of the parent company, Entergy Corporation.

Eliminations are primarily intersegment activity.

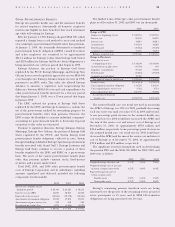

Entergy’s segment financial information is as follows (in thousands):

NOTE 12. BUSINESS SEGMENT INFORMATION

Entergy’s reportable segments as of December 31, 2002 are

U.S. Utility, Non-Utility Nuclear, and Energy Commodity

Services. U.S. Utility generates, transmits, distributes, and sells

electric power in portions of Arkansas, Louisiana, Mississippi,

and Texas, and provides natural gas utility service in portions

of Louisiana. Non-Utility Nuclear owns and operates five

nuclear power plants and is primarily focused on selling

electric power produced by those plants to wholesale

customers. Energy Commodity Services is focused primarily on

providing energy commodity trading and gas transportation and

storage services through Entergy-Koch, L.P. Energy Commodity

Services also includes non-nuclear wholesale assets, a participant

in the wholesale power generation business in North America

and Europe. Results from Entergy-Koch are reported as equity

in earnings of unconsolidated equity affiliates in the financial

statements. Entergy’s operating segments are strategic business

units managed separately due to their different operating and

regulatory environments. Entergy’s chief operating decision

maker is its Office of the Chief Executive, which consists of its

highest-ranking officers.

“All Other” includes the parent company, Entergy

Corporation, and other business activity, including earnings

on the proceeds of sales of previously owned businesses.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued