Entergy 2002 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

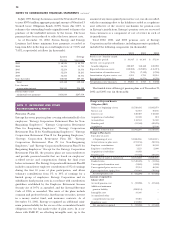

OTHER POSTRETIREMENT BENEFITS

Entergy also provides health care and life insurance benefits

for retired employees. Substantially all domestic employees

may become eligible for these benefits if they reach retirement

age while still working for Entergy.

Effective January 1, 1993, Entergy adopted SFAS 106, which

required a change from a cash method to an accrual method

of accounting for postretirement benefits other than pensions.

At January 1, 1993, the actuarially determined accumulated

postretirement benefit obligation (APBO) earned by retirees

and active employees was estimated to be approximately

$241.4 million for Entergy (other than Entergy Gulf States)

and $128 million for Entergy Gulf States. Such obligations are

being amortized over a 20-year period that began in 1993.

Entergy Arkansas, the portion of Entergy Gulf States

regulated by the PUCT, Entergy Mississippi, and Entergy New

Orleans have received regulatory approval to recover SFAS 106

costs through rates. Entergy Arkansas began recovery in 1998,

pursuant to an APSC order. This order also allowed Entergy

Arkansas to amortize a regulatory asset (representing the

difference between SFAS 106 costs and cash expenditures for

other postretirement benefits incurred for a five-year period

that began January 1, 1993) over a 15-year period that began

in January 1998.

The LPSC ordered the portion of Entergy Gulf States

regulated by the LPSC and Entergy Louisiana to continue the

use of the pay-as-you-go method for ratemaking purposes for

postretirement benefits other than pensions. However, the

LPSC retains the flexibility to examine individual companies’

accounting for postretirement benefits to determine if special

exceptions to this order are warranted.

Pursuant to regulatory directives, Entergy Arkansas, Entergy

Mississippi, Entergy New Orleans, the portion of Entergy Gulf

States regulated by the PUCT, and System Energy fund

postretirement benefit obligations collected in rates. System

Energy is funding on behalf of Entergy Operations postretirement

benefits associated with Grand Gulf 1. Entergy Louisiana and

Entergy Gulf States continue to recover a portion of these

benefits regulated by the LPSC and FERC on a pay-as-you-go

basis. The assets of the various postretirement benefit plans

other than pensions include common stocks, fixed-income

securities, and a money market fund.

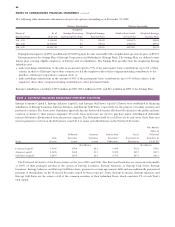

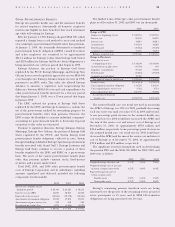

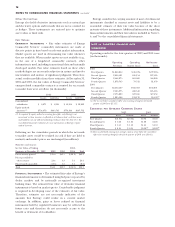

Total 2002, 2001, and 2000 other postretirement benefit

costs of Entergy Corporation and its subsidiaries, including

amounts capitalized and deferred, included the following

components (in thousands):

2002 2001 2000

Service cost - benefits earned

during the period $ 29,199 $ 24,225 $ 18,252

Interest cost on APBO 44,819 38,811 34,022

Expected return on assets (14,066) (12,578) (10,566)

Amortization of transition obligation 17,874 17,874 17,874

Amortization of prior service cost 992 992 520

Recognized net (gain)/loss 1,874 (1,506) (3,070)

Net postretirement benefit cost $ 80,692 $ 67,818 $ 57,032

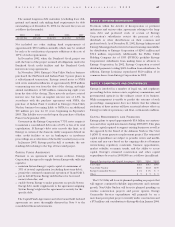

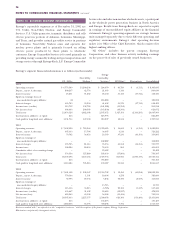

The funded status of Entergy’s other postretirement benefit

plans as of December 31, 2002 and 2001 was (in thousands):

2002 2001

Change in APBO

Balance at beginning of year $ 590,731 $ 507,756

Service cost 29,199 24,225

Interest cost 44,819 38,811

Actuarial loss 159,143 44,289

Benefits paid (35,861) (37,403)

Acquisition of subsidiary 11,475 13,053

Balance at end of year $ 799,506 $ 590,731

Change in Plan Assets

Fair value of assets

at beginning of year $ 158,190 $ 143,038

Actual return on plan assets (11,559) 663

Employer contributions 59,542 51,892

Benefits paid (35,861) (37,403)

Acquisition of subsidiary 12,380 –

Fair value of assets at end of year $ 182,692 $ 158,190

Funded status $(616,814) $(432,541)

Unrecognized transition obligation 114,724 126,196

Unrecognized prior service cost 3,522 4,514

Unrecognized net loss 245,795 70,208

Accrued postretirement

benefit cost $(252,773) $(231,623)

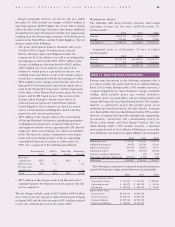

The assumed health care cost trend rate used in measuring

the APBO of Entergy was 10% for 2003, gradually decreasing

each successive year until it reaches 4.5% in 2009 and beyond.

A one percentage point increase in the assumed health care

cost trend rate for 2002 would have increased the APBO and

the sum of the service cost and interest cost of Entergy as of

December 31, 2002, by approximately $87.8 million and

$10.6 million, respectively. A one percentage point decrease in

the assumed health care cost trend rate for 2002 would have

decreased the APBO and the sum of the service cost and interest

cost of Entergy as of December 31, 2002, by approximately

$79.8 million and $9.4 million, respectively.

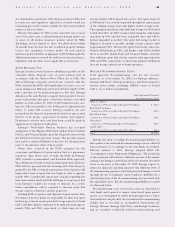

The significant actuarial assumptions used in determining

the pension PBO and the SFAS 106 APBO for 2002, 2001, and

2000 were as follows:

2002 2001 2000

Weighted-average discount rate 6.75% 7.50% 7.50%

Weighted-average rate of increase

in future compensation levels 3.25% 4.60% 4.60%

Expected long-term rate of

return on plan assets:

Taxable assets 5.50% 5.50% 5.50%

Non-taxable assets 8.75% 9.00% 9.00%

Entergy’s remaining pension transition assets are being

amortized over the greater of the remaining service period of

active participants or 15 years, and its SFAS 106 transition

obligations are being amortized over 20 years.

ENTERGY CORPORATION AND SUBSIDIARIES 2002 73