Entergy 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

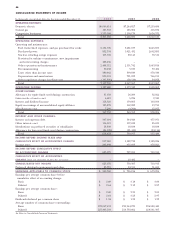

EKT seeks to limit the daily value-at-risk on any given day to

a certain dollar amount approved by the trading committee.

EKT’s value-at-risk measures, which it calls Daily Earnings

at Risk (DE@R), for its trading portfolio were as follows

(in millions):

2002 2001

DE@R at end of period $15.2 $5.5

Average DE@R for the period $10.8 $6.4

EKT’s DE@R increased in 2002 compared to 2001 as a result of

an increase in the size of the position held and an increase in

the volatility of natural gas prices in the latter part of the year.

For all derivative and contractual transactions, EKT is

exposed to losses in the event of nonperformance by counter-

parties to these transactions. Relevant considerations when

assessing EKT’s credit risk exposure include:

EKT’s operations are primarily concentrated in the

energy industry.

EKT’s trade receivables and other financial instruments

are predominantly with energy, utility, and financial

services related companies, as well as other trading

companies in the U.S., United Kingdom (UK), and

Western Europe.

EKT maintains credit policies, which its management

believes minimize overall credit risk.

Prospective and existing customers are reviewed for credit-

worthiness based upon pre-established standards, with

customers not meeting minimum standards providing

various secured payment terms, including the posting

of cash collateral.

EKT also has master netting agreements in place. These

agreements allow EKT to offset cash and non-cash gains

and losses arising from derivative instruments with the

same counterparty. EKT’s policy is to have such master

netting agreements in place with significant counterparties.

Based on EKT’s policies, risk exposures, and valuation adjust-

ments related to credit, EKT does not anticipate a material

adverse effect on its financial position as a result of counterparty

nonperformance. As of December 31, 2002 approximately 86%

of EKT’s counterparty credit exposure is associated with compa-

nies that have at least investment grade credit ratings.

Following are EKT’s mark-to-market assets (liabilities) and

the period within which the assets (liabilities) would be

realized (paid) in cash if they are held to maturity and market

prices are unchanged (in millions):

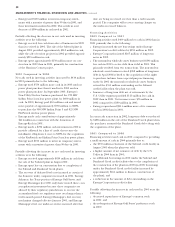

Maturities and Sources for Fair

Value of Trading Contracts at

December 31, 2002 2003 2004 2005-2006 Total

Prices actively quoted $45.0 $45.1 $(20.2) $69.9

Prices provided by

other sources 24.4 3.3 1.9 29.6

Prices based on models (13.3) 1.3 3.4 (8.6)

Total $56.1 $49.7 $(14.9) $90.9

Following is a roll-forward of the change in the fair value of

EKT’s mark-to-market contracts during 2002 (in millions):

2002

Fair value of contracts at December 31, 2001 $106

Fair value of contracts settled during the year (347)

Initial recorded value of new contracts

entered into during the year 7

Net option premiums received during the year (78)

Change in fair value of contracts attributable to

market movements during the year 403

Net change in contracts outstanding during the year (15)

Fair value of contracts at December 31, 2002 $ 91

Foreign Currency Exchange Rate Risk

Entergy Gulf States, System Fuels, and Entergy’s Non-Utility

Nuclear business entered into foreign currency forward

contracts to hedge the Euro-denominated payments due under

certain purchase contracts. The notional amounts of the

foreign currency forward contracts are 249.5 million Euro and

the forward currency rates range from .8624 to .9664. The

maturities of these forward contracts depend on the purchase

contract payment dates and range in time from January 2003 to

January 2007. The mark-to-market valuation of the forward

contracts at December 31, 2002 was a net asset of $38.9 million.

The counterparty banks obligated on 233.0 million Euro of the

notional amount of these agreements are rated by Standard &

Poor’s Rating Services at AA on their senior debt obligations

as of December 31, 2002. The counterparty bank obligated on

16.5 million Euro of the notional amount of these agreements

is rated by Standard & Poor’s Rating Services at A+ on its senior

debt obligations as of December 31, 2002.

Interest Rate and Equity Price Risk –

Decommissioning Trust Funds

Entergy’s nuclear decommissioning trust funds are exposed

to fluctuations in equity prices and interest rates. The Nuclear

Regulatory Commission (NRC) requires Entergy to maintain

trusts to fund the costs of decommissioning ANO 1, ANO 2,

River Bend, Waterford 3, Grand Gulf 1, Pilgrim, Indian Point 1 and 2,

and Vermont Yankee (NYPA currently retains the decommis-

sioning trusts and liabilities for Indian Point 3 and FitzPatrick).

The funds are invested primarily in equity securities; fixed-rate,

fixed-income securities; and cash and cash equivalents.

Management believes that exposure of the various funds to

market fluctuations will not affect the financial results of opera-

tions for the ANO, River Bend, Grand Gulf 1, and Waterford 3

trust funds because of the application of regulatory accounting

principles. The Pilgrim, Indian Point 1 and 2, and Vermont

Yankee trust funds collectively hold approximately $841 million

of fixed-rate, fixed-income securities as of December 31, 2002.

These securities have an average coupon rate of approximately

6.0%, an average duration of approximately 5.2 years, and an

average maturity of approximately 8.3 years. The Pilgrim,

Indian Point 1 and 2, and Vermont Yankee trust funds also

collectively hold equity securities worth approximately $358 million

as of December 31, 2002. These securities are generally held in

ENTERGY CORPORATION AND SUBSIDIARIES 2002 35