Entergy 2002 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2002 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Arkansas filed its final storm damage cost determina-

tion, which reflected costs of approximately $195 million. In the

March 2002 settlement, the parties agreed that $153 million of

the ice storm costs would be classified as incremental ice storm

expenses that can be offset against the TCA, and any excess of

ice storm costs over the amount available in the TCA would be

deferred and amortized over 30 years, although such excess

costs were not allowed to be included as a separate component

of rate base. The allocated ice storm expenses exceeded the

available TCA funds by $15.8 million and this was recorded as a

regulatory asset in June 2002. Of the remaining ice storm costs,

$32.2 million will be addressed through established ratemaking

procedures, including $22.2 million classified as capital addi-

tions. $3.8 million of the ice storm costs will not be recovered

through rates.

Filings with the PUCT and Texas Cities

RETAIL RATES – Entergy Gulf States is operating in Texas under

the terms of a June 1999 settlement agreement. The settlement

provided for a base rate freeze that has remained in effect

during the delay in implementation of retail open access in

Entergy Gulf States’ Texas service territory.

RECOVERY OF RIVER BEND COSTS –In March 1998, the PUCT

disallowed recovery of $1.4 billion of company-wide abeyed

River Bend plant costs, which have been held in abeyance since

1988. Entergy Gulf States appealed the PUCT’s decision on this

matter to the Travis County District Court in Texas. A 1999

settlement agreement limits potential recovery of the remaining

plant asset to $115 million as of January 1, 2002, less deprecia-

tion after that date. Entergy Gulf States accordingly reduced the

value of the plant asset in 1999. Entergy Gulf States has also

agreed in a subsequent settlement that it will not seek recovery

of the abeyed plant costs through any additional charge to Texas

ratepayers. In an interim order approving this agreement, how-

ever, the PUCT recognized that any additional River Bend

investment found prudent, subject to the $115 million cap,

could be used as an offset against stranded benefits, should leg-

islation be passed requiring Entergy Gulf States to return strand-

ed benefits to retail customers.

In April 2002, the Travis County District Court issued an order

affirming the PUCT’s order on remand disallowing recovery of

the abeyed plant costs. Entergy Gulf States has appealed this

ruling to the Third District Court of Appeals. The Court of

Appeals heard oral argument in November 2002 but has not yet

issued a final decision. The financial statement impact of the

retail rate settlement agreement on the remaining abeyed plant

costs will ultimately depend on several factors, including the

possible discontinuance of SFAS 71 accounting treatment for

the Texas generation business, the determination of the market

value of generation assets, and any future legislation in Texas

addressing the pass-through or sharing of any stranded benefits

with Texas ratepayers. While Entergy Gulf States expects to

prevail in its lawsuit, no assurance can be given that additional

reserves or write-offs will not be required in the future.

Filings with the LPSC

ANNUAL EARNINGS REVIEWS (ENTERGY GULF STATES) – In

December 2002, the LPSC approved a settlement between

Entergy Gulf States and the LPSC staff pursuant to which

Entergy Gulf States agreed to make a base rate refund of

$16.3 million, including interest, and to implement a $22.1 million

prospective base rate reduction effective January 2003. The

settlement discharged any potential liability relating to remaining

issues that arose in Entergy Gulf States’ fourth, fifth, sixth,

seventh, and eighth post-merger earnings reviews. Entergy Gulf

States made the refund in February 2003. In addition to resolving

and discharging all liability associated with the fourth through

eighth earnings reviews, the settlement provides that Entergy

Gulf States shall be authorized to continue to reflect in rates a

ROE of 11.1% until a different ROE is authorized by a final

resolution disposing of all issues in the proceeding that was

commenced with Entergy Gulf States’ May 2002 filing.

In May 2002, Entergy Gulf States filed its ninth and last

required post-merger analysis with the LPSC. The filing included

an earnings review filing for the 2001 test year that resulted in a

rate decrease of $11.5 million, which was implemented effective

June 2002. The filing also contained a prospective revenue

requirement study based on the 2001 test year that shows that a

prospective rate increase of approximately $21.7 million would

be appropriate. Both components of the filing are subject to

review by the LPSC and may result in changes in rates other

than those sought in the filing. A procedural schedule has been

adopted and hearings are scheduled for October 2003.

FORMULA RATE PLAN FILINGS (ENTERGY LOUISIANA) – In July

2002, the LPSC approved a settlement between Entergy

Louisiana and the LPSC Staff in Entergy Louisiana’s 2000 and

2001 formula rate plan proceedings. Entergy Louisiana agreed

to a $5 million rate reduction effective August 2001. The

prospective rate reduction was implemented beginning in

August 2002 and the refund for the retroactive period occurred

in September 2002. As part of the settlement, Entergy

Louisiana’s current rates, including its previously authorized

ROE midpoint of 10.5%, remain in effect until changed

pursuant to a new formula rate plan filing or a revenue

requirement analysis to be filed by June 30, 2003.

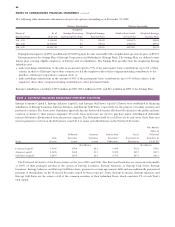

In May 1997, Entergy Louisiana made its second annual

performance-based formula rate plan filing with the LPSC for

the 1996 test year. This filing resulted in a rate reduction of

approximately $54.5 million, which was implemented in July 1997.

At the same time, rates were reduced by an additional $0.7 million

and by an additional $2.9 million effective March 1998. Upon

completion of the hearing process in December 1998, the LPSC

issued an order requiring an additional rate reduction and

refund based upon the LPSC’s contention that it could inter-

pret and enforce a FERC rate schedule. The resulting amounts

were not quantified, although they are expected to be immaterial.

Entergy Louisiana appealed this order and obtained a prelim-

inary injunction pending a final decision on appeal. The

Louisiana Supreme Court rendered a non-unanimous decision in

April 2002 affirming the LPSC’s order. Entergy Louisiana filed

58

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued