Chevron 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

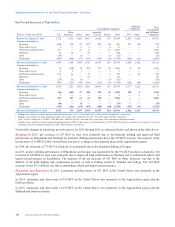

Supplemental information on Oil and Gas Producing Activities - Unaudited

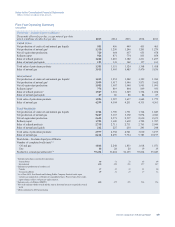

Table VI - Standardized Measure of Discounted Future Net Cash Flows Related to Proved Oil and Gas Reserves

The standardized measure of discounted future net cash flows is calculated in accordance with SEC and FASB requirements.

This includes using the average of first-day-of-the-month oil and gas prices for the 12-month period prior to the end of the

reporting period, estimated future development and production costs assuming the continuation of existing economic

conditions, estimated costs for asset retirement obligations (includes costs to retire existing wells and facilities in addition to

those future wells and facilities necessary to produce proved undeveloped reserves), and estimated future income taxes based

on appropriate statutory tax rates. Discounted future net cash flows are calculated using 10 percent mid-period discount

factors. Estimates of proved-reserve quantities are imprecise and change over time as new information becomes available.

Probable and possible reserves, which may become proved in the future, are excluded from the calculations. The valuation

requires assumptions as to the timing and amount of future development and production costs. The calculations are made as

of December 31 each year and do not represent management’s estimate of the company’s future cash flows or value of its oil

and gas reserves. In the following table, the caption “Standardized Measure Net Cash Flows” refers to the standardized

measure of discounted future net cash flows.

Consolidated Companies

Affiliated

Companies Total

Consolidated

and Affiliated

CompaniesMillions of dollars U.S.

Other

Americas Africa Asia

Australia/

Oceania Europe Total TCO Other

At December 31, 2015

Future cash inflows from production $ 67,536 $ 39,363 $ 52,128 $ 58,645 $ 93,550 $ 8,561 $ 319,783 $ 75,378 $ 17,519 $ 412,680

Future production costs (33,895) (26,477) (22,963) (27,499) (10,814) (6,994) (128,642) (17,959) (6,546) (153,147)

Future development costs (12,625) (5,485) (6,562) (8,924) (11,612) (1,751) (46,959) (17,232) (3,226) (67,417)

Future income taxes (4,161) (2,316) (14,681) (9,229) (21,337) 70 (51,654) (12,056) (3,460) (67,170)

Undiscounted future net cash flows 16,855 5,085 7,922 12,993 49,787 (114) 92,528 28,131 4,287 124,946

10 percent midyear annual discount

for timing of estimated cash flows (5,871) (2,830) (2,230) (3,673) (26,179) 292 (40,491) (15,249) (2,239) (57,979)

Standardized Measure

Net Cash Flows $ 10,984 $ 2,255 $ 5,692 $ 9,320 $ 23,608 $ 178 $ 52,037 $ 12,882 $ 2,048 $ 66,967

At December 31, 2014

Future cash inflows from production $ 138,385 $ 67,102 $ 103,304 $ 99,741 $ 142,541 $ 18,168 $ 569,241 $ 144,721 $ 37,511 $ 751,473

Future production costs (42,817) (30,899) (26,992) (34,359) (12,744) (10,814) (158,625) (30,015) (17,061) (205,701)

Future development costs (13,616) (8,283) (9,486) (12,629) (15,681) (3,031) (62,726) (19,349) (4,454) (86,529)

Future income taxes (27,129) (8,445) (47,884) (24,225) (34,235) (2,692) (144,610) (28,607) (6,634) (179,851)

Undiscounted future net cash flows 54,823 19,475 18,942 28,528 79,881 1,631 203,280 66,750 9,362 279,392

10 percent midyear annual discount

for timing of estimated cash flows (23,257) (12,082) (6,145) (8,570) (43,325) (380) (93,759) (34,987) (5,294) (134,040)

Standardized Measure

Net Cash Flows $ 31,566 $ 7,393 $ 12,797 $ 19,958 $ 36,556 $ 1,251 $ 109,521 $ 31,763 $ 4,068 $ 145,352

At December 31, 20131

Future cash inflows from production $ 136,942 $ 73,468 $ 117,119 $ 111,970 $ 130,620 $ 20,232 $ 590,351 $ 157,108 $ 43,380 $ 790,839

Future production costs (39,009) (29,373) (27,800) (35,716) (12,593) (10,099) (154,590) (32,245) (18,027) (204,862)

Future development costs (12,058) (10,149) (10,983) (17,290) (18,220) (2,644) (71,344) (12,852) (3,879) (88,075)

Future income taxes (28,458) (9,454) (53,953) (26,162) (29,942) (4,727) (152,696) (33,603) (9,418) (195,717)

Undiscounted future net cash flows 57,417 24,492 24,383 32,802 69,865 2,762 211,721 78,408 12,056 302,185

10 percent midyear annual discount

for timing of estimated cash flows (23,055) (15,217) (8,165) (10,901) (39,117) (888) (97,343) (41,444) (6,482) (145,269)

Standardized Measure

Net Cash Flows $ 34,362 $ 9,275 $ 16,218 $ 21,901 $ 30,748 $ 1,874 $ 114,378 $ 36,964 $ 5,574 $ 156,916

12013 conformed to 2014 and 2015 presentation.

Chevron Corporation 2015 Annual Report 79