Chevron 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

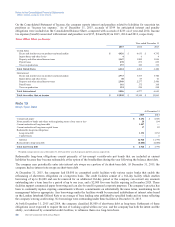

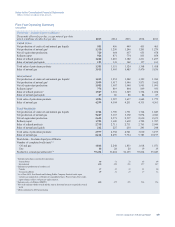

Millions of dollars, except per-share amounts

Employee Savings Investment Plan Eligible employees of Chevron and certain of its subsidiaries participate in the Chevron

Employee Savings Investment Plan (ESIP). Compensation expense for the ESIP totaled $316, $316 and $163 in 2015, 2014

and 2013, respectively. The amount for ESIP expense in 2013 is net of $140, which reflects the value of common stock

released from the former leveraged employee stock ownership plan (LESOP). LESOP debt was retired in 2013, and all

remaining shares were released.

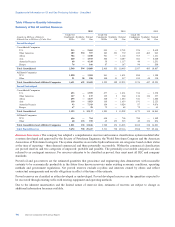

Benefit Plan Trusts Prior to its acquisition by Chevron, Texaco established a benefit plan trust for funding obligations under

some of its benefit plans. At year-end 2015, the trust contained 14.2 million shares of Chevron treasury stock. The trust will

sell the shares or use the dividends from the shares to pay benefits only to the extent that the company does not pay such

benefits. The company intends to continue to pay its obligations under the benefit plans. The trustee will vote the shares held

in the trust as instructed by the trust’s beneficiaries. The shares held in the trust are not considered outstanding for earnings-

per-share purposes until distributed or sold by the trust in payment of benefit obligations.

Prior to its acquisition by Chevron, Unocal established various grantor trusts to fund obligations under some of its benefit

plans, including the deferred compensation and supplemental retirement plans. At December 31, 2015 and 2014, trust assets

of $36 and $38, respectively, were invested primarily in interest-earning accounts.

Employee Incentive Plans The Chevron Incentive Plan is an annual cash bonus plan for eligible employees that links awards

to corporate, business unit and individual performance in the prior year. Charges to expense for cash bonuses were $690,

$965 and $871 in 2015, 2014 and 2013, respectively. Chevron also has the LTIP for officers and other regular salaried

employees of the company and its subsidiaries who hold positions of significant responsibility. Awards under the LTIP

consist of stock options and other share-based compensation that are described in Note 22, beginning on page 58.

Note 24

Other Contingencies and Commitments

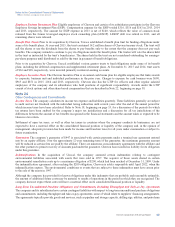

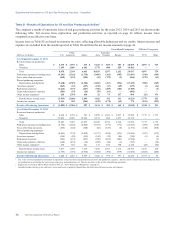

Income Taxes The company calculates its income tax expense and liabilities quarterly. These liabilities generally are subject

to audit and are not finalized with the individual taxing authorities until several years after the end of the annual period for

which income taxes have been calculated. Refer to Note 18, beginning on page 53, for a discussion of the periods for which

tax returns have been audited for the company’s major tax jurisdictions and a discussion for all tax jurisdictions of the

differences between the amount of tax benefits recognized in the financial statements and the amount taken or expected to be

taken in a tax return.

Settlement of open tax years, as well as other tax issues in countries where the company conducts its businesses, are not

expected to have a material effect on the consolidated financial position or liquidity of the company and, in the opinion of

management, adequate provision has been made for income and franchise taxes for all years under examination or subject to

future examination.

Guarantees The company’s guarantee of $447 is associated with certain payments under a terminal use agreement entered

into by an equity affiliate. Over the approximate 12-year remaining term of the guarantee, the maximum guarantee amount

will be reduced as certain fees are paid by the affiliate. There are numerous cross-indemnity agreements with the affiliate and

the other partners to permit recovery of amounts paid under the guarantee. Chevron has recorded no liability for its obligation

under this guarantee.

Indemnifications In the acquisition of Unocal, the company assumed certain indemnities relating to contingent

environmental liabilities associated with assets that were sold in 1997. The acquirer of those assets shared in certain

environmental remediation costs up to a maximum obligation of $200, which had been reached at December 31, 2009. Under

the indemnification agreement, after reaching the $200 obligation, Chevron is solely responsible until April 2022, when the

indemnification expires. The environmental conditions or events that are subject to these indemnities must have arisen prior

to the sale of the assets in 1997.

Although the company has provided for known obligations under this indemnity that are probable and reasonably estimable,

the amount of additional future costs may be material to results of operations in the period in which they are recognized. The

company does not expect these costs will have a material effect on its consolidated financial position or liquidity.

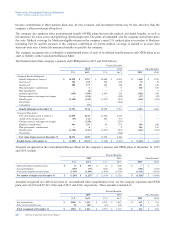

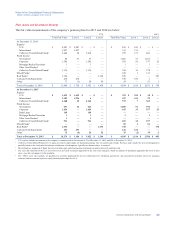

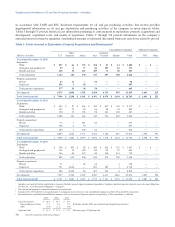

Long-Term Unconditional Purchase Obligations and Commitments, Including Throughput and Take-or-Pay Agreements

The company and its subsidiaries have certain contingent liabilities with respect to long-term unconditional purchase obligations

and commitments, including throughput and take-or-pay agreements, some of which relate to suppliers’ financing arrangements.

The agreements typically provide goods and services, such as pipeline and storage capacity, drilling rigs, utilities, and petroleum

Chevron Corporation 2015 Annual Report 65