Chevron 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

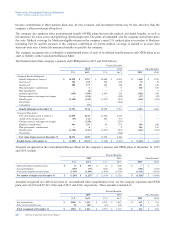

Notes to the Consolidated Financial Statements

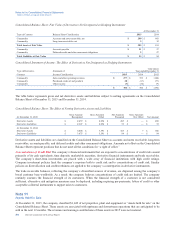

Millions of dollars, except per-share amounts

In 2015, before-tax loss for U.S. operations, including related corporate and other charges, was $(2,877), compared with

before-tax income of $6,296 and $4,672 in 2014 and 2013, respectively. For international operations, before-tax income was

$7,719, $24,906 and $31,233 in 2015, 2014 and 2013, respectively. U.S. federal income tax expense was reduced by $35,

$68 and $175 in 2015, 2014 and 2013, respectively, for business tax credits.

The reconciliation between the U.S. statutory federal income tax rate and the company’s effective income tax rate is detailed

in the following table:

Year ended December 31

2015 2014 2013

U.S. statutory federal income tax rate 35.0 % 35.0 % 35.0 %

Effect of income taxes from international operations1(25.1) 2.1 4.4

State and local taxes on income, net of U.S. federal income tax benefit (1.5) 0.7 0.6

Tax credits (0.7) (0.2) (0.5)

Other1,2 (5.0) 0.5 0.4

Effective tax rate 2.7 % 38.1 % 39.9 %

12013 and 2014 conformed to 2015 presentation.

22015 includes one-time tax benefits associated with changes in uncertain tax positions and provision-to-return adjustments.

The company’s effective tax rate decreased from 38.1 percent in 2014 to 2.7 percent in 2015. The decrease primarily resulted

from the impacts of jurisdictional mix, one-time tax benefits, foreign currency remeasurement, equity earnings and a

reduction in statutory tax rates in the United Kingdom, partially offset by the effects of valuation allowances recognized on

deferred tax assets and the sale of the company’s interest in Caltex Australia Limited.

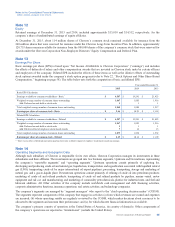

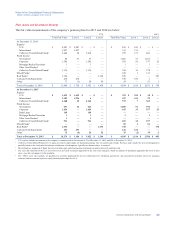

The company records its deferred taxes on a tax-jurisdiction basis and classifies those net amounts as current or noncurrent

based on the balance sheet classification of the related assets or liabilities. The reported deferred tax balances are composed

of the following:

At December 31

2015 2014

Deferred tax liabilities

Properties, plant and equipment $ 27,044 $ 28,452

Investments and other 3,743 3,059

Total deferred tax liabilities 30,787 31,511

Deferred tax assets

Foreign tax credits (10,534) (11,867)

Abandonment/environmental reserves (6,880) (6,686)

Employee benefits (4,801) (4,831)

Deferred credits (1,810) (1,828)

Tax loss carryforwards (2,748) (1,747)

Other accrued liabilities (525) (498)

Inventory (120) (153)

Miscellaneous (2,525) (2,128)

Total deferred tax assets (29,943) (29,738)

Deferred tax assets valuation allowance 15,412 16,292

Total deferred taxes, net $ 16,256 $ 18,065

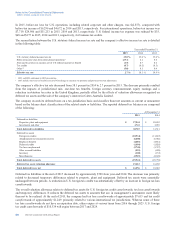

Deferred tax liabilities at the end of 2015 decreased by approximately $700 from year-end 2014. The decrease was primarily

related to decreased temporary differences related to property, plant and equipment. Deferred tax assets were essentially

unchanged between periods. A reduction in U.S. foreign tax credits was substantially offset by an increase in foreign tax loss

carryforwards.

The overall valuation allowance relates to deferred tax assets for U.S. foreign tax credit carryforwards, tax loss carryforwards

and temporary differences. It reduces the deferred tax assets to amounts that are, in management’s assessment, more likely

than not to be realized. At the end of 2015, the company had tax loss carryforwards of approximately $7,615 and tax credit

carryforwards of approximately $1,249, primarily related to various international tax jurisdictions. Whereas some of these

tax loss carryforwards do not have an expiration date, others expire at various times from 2016 through 2025. U.S. foreign

tax credit carryforwards of $10,534 will expire between 2017 and 2024.

54 Chevron Corporation 2015 Annual Report