Chevron 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

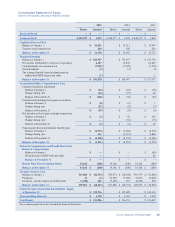

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

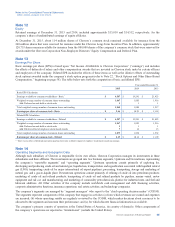

Rental expenses incurred for operating leases during 2015, 2014 and 2013 were as follows:

Year ended December 31

2015 2014 2013

Minimum rentals $ 1,041 $ 1,080 $ 1,049

Contingent rentals 211

Total 1,043 1,081 1,050

Less: Sublease rental income 91425

Net rental expense $ 1,034 $ 1,067 $ 1,025

Contingent rentals are based on factors other than the passage of time, principally sales volumes at leased service stations.

Certain leases include escalation clauses for adjusting rentals to reflect changes in price indices, renewal options ranging up

to 25 years, and options to purchase the leased property during or at the end of the initial or renewal lease period for the fair

market value or other specified amount at that time.

At December 31, 2015, the estimated future minimum lease payments (net of noncancelable sublease rentals) under

operating and capital leases, which at inception had a noncancelable term of more than one year, were as follows:

At December 31

Operating Leases Capital Leases

Year 2016 $ 846$ 23

2017 689 21

2018 554 19

2019 420 19

2020 311 6

Thereafter 528 62

Total $ 3,348 $ 150

Less: Amounts representing interest and executory costs $ (53)

Net present values 97

Less: Capital lease obligations included in short-term debt (17)

Long-term capital lease obligations $80

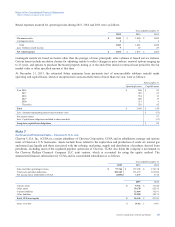

Note 7

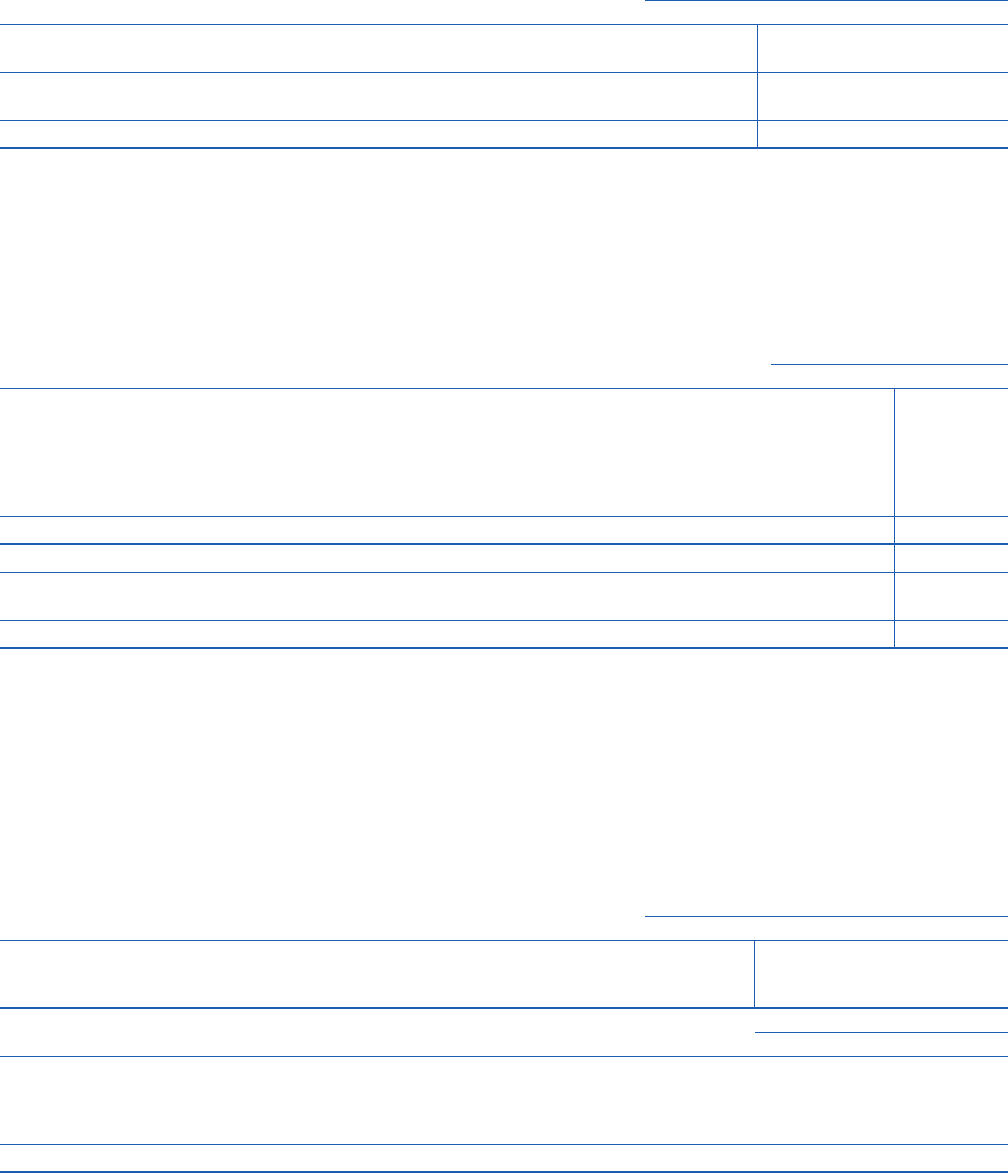

Summarized Financial Data – Chevron U.S.A. Inc.

Chevron U.S.A. Inc. (CUSA) is a major subsidiary of Chevron Corporation. CUSA and its subsidiaries manage and operate

most of Chevron’s U.S. businesses. Assets include those related to the exploration and production of crude oil, natural gas

and natural gas liquids and those associated with the refining, marketing, supply and distribution of products derived from

petroleum, excluding most of the regulated pipeline operations of Chevron. CUSA also holds the company’s investment in

the Chevron Phillips Chemical Company LLC joint venture, which is accounted for using the equity method. The

summarized financial information for CUSA and its consolidated subsidiaries is as follows:

Year ended December 31

2015 2014 2013

Sales and other operating revenues $ 97,766 $ 157,198 $ 174,318

Total costs and other deductions 101,565 153,139 169,984

Net income (loss) attributable to CUSA (1,054) 3,849 3,714

2015 2014

Current assets $ 9,732 $ 13,724

Other assets 59,170 62,195

Current liabilities 13,664 16,191

Other liabilities 29,100 30,175

Total CUSA net equity $ 26,138 $ 29,553

Memo: Total debt $ 14,462 $ 14,473

Chevron Corporation 2015 Annual Report 41