Chevron 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

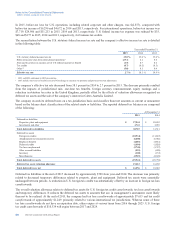

Note 20

Long-Term Debt

Total long-term debt, excluding capital leases, at December 31, 2015, was $33,584. The company’s long-term debt

outstanding at year-end 2015 and 2014 was as follows:

At December 31

2015 2014

3.191% notes due 2023 $ 2,250 $ 2,250

Floating rate notes due 2017 (0.555%)12,050 650

1.104% notes due 2017 2,000 2,000

1.718% notes due 2018 2,000 2,000

2.355% notes due 2022 2,000 2,000

1.365% notes due 2018 1,750 —

1.961% notes due 2020 1,750 —

4.95% notes due 2019 1,500 1,500

1.790% notes due 2018 1,250 —

2.419% notes due 2020 1,250 —

1.345% notes due 2017 1,100 1,100

1.344% notes due 2017 1,000 —

2.427% notes due 2020 1,000 1,000

Floating rate notes due 2018 (0.676%)1800 —

0.889% notes due 2016 750 750

2.193% notes due 2019 750 750

3.326% notes due 2025 750 —

2.411% notes due 2022 700 —

Floating rate notes due 2016 (0.444%)2700 700

Floating rate notes due 2019 (0.772%)2400 400

Floating rate notes due 2021 (0.892%)2400 400

Floating rate notes due 2022 (0.952%)2350 —

8.625% debentures due 2032 147 147

Amortizing Bank Loan due 2018 (1.172%)2110 —

8.625% debentures due 2031 108 107

8.0% debentures due 2032 74 74

9.75% debentures due 2020 54 54

8.875% debentures due 2021 40 40

Medium-term notes, maturing from 2021 to 2038 (5.975%)138 38

Total including debt due within one year 27,071 15,960

Debt due within one year (1,487) —

Reclassified from short-term debt 8,000 8,000

Total long-term debt $ 33,584 $ 23,960

1Weighted-average interest rate at December 31, 2015.

2Interest rate at December 31, 2015.

Chevron has an automatic shelf registration statement that expires in August 2018. This registration statement is for an

unspecified amount of nonconvertible debt securities issued or guaranteed by the company.

Long-term debt of $27,071 matures as follows: 2016 – $1,487; 2017 – $6,187; 2018 – $5,836; 2019 – $2,650; 2020 – $4,054;

and after 2020 – $6,857.

The company completed bond issuances of $6,000 and $5,000 in March and November 2015, respectively.

See Note 9, beginning on page 42, for information concerning the fair value of the company’s long-term debt.

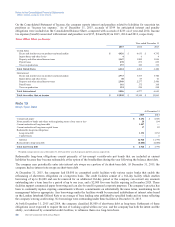

Note 21

Accounting for Suspended Exploratory Wells

The company continues to capitalize exploratory well costs after the completion of drilling when (a) the well has found a

sufficient quantity of reserves to justify completion as a producing well, and (b) the business unit is making sufficient

progress assessing the reserves and the economic and operating viability of the project. If either condition is not met or if the

company obtains information that raises substantial doubt about the economic or operational viability of the project, the

exploratory well would be assumed to be impaired, and its costs, net of any salvage value, would be charged to expense.

Chevron Corporation 2015 Annual Report 57