Chevron 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

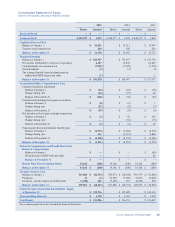

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

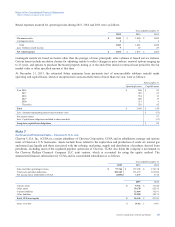

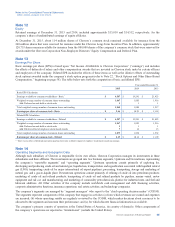

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

At December 31 At December 31

Total Level 1 Level 2 Level 3

Before-Tax Loss

Year 2015 Total Level 1 Level 2 Level 3

Before-Tax Loss

Year 2014

Properties, plant and equipment, net (held

and used) $ 3,051 $ — $ 239 $ 2,812 $ 3,222 $ 947 $ — $ 213 $ 734 $ 1,249

Properties, plant and equipment, net (held

for sale) 937 — 937 — 844 ———— 25

Investments and advances 75—75— 28 11——11 41

Total Nonrecurring Assets at Fair

Value $ 4,063 $ — $ 1,251 $ 2,812 $ 4,094 $ 958 $ — $ 213 $ 745 $ 1,315

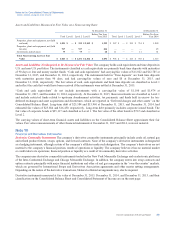

Assets and Liabilities Not Required to Be Measured at Fair Value The company holds cash equivalents and time deposits in

U.S. and non-U.S. portfolios. The instruments classified as cash equivalents are primarily bank time deposits with maturities

of 90 days or less and money market funds. “Cash and cash equivalents” had carrying/fair values of $11,022 and $12,785 at

December 31, 2015, and December 31, 2014, respectively. The instruments held in “Time deposits” are bank time deposits

with maturities greater than 90 days, and had carrying/fair values of zero and $8 at December 31, 2015, and

December 31, 2014, respectively. The fair values of cash, cash equivalents and bank time deposits are classified as Level 1

and reflect the cash that would have been received if the instruments were settled at December 31, 2015.

“Cash and cash equivalents” do not include investments with a carrying/fair value of $1,100 and $1,474 at

December 31, 2015, and December 31, 2014, respectively. At December 31, 2015, these investments are classified as Level 1

and include restricted funds related to upstream abandonment activities, tax payments, and funds held in escrow for tax-

deferred exchanges and asset acquisitions and divestitures, which are reported in “Deferred charges and other assets” on the

Consolidated Balance Sheet. Long-term debt of $25,584 and $15,960 at December 31, 2015, and December 31, 2014, had

estimated fair values of $25,884 and $16,450, respectively. Long-term debt primarily includes corporate issued bonds. The

fair value of corporate bonds is $25,117 and classified as Level 1. The fair value of the other bonds is $767 and classified as

Level 2.

The carrying values of short-term financial assets and liabilities on the Consolidated Balance Sheet approximate their fair

values. Fair value remeasurements of other financial instruments at December 31, 2015 and 2014, were not material.

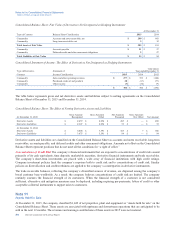

Note 10

Financial and Derivative Instruments

Derivative Commodity Instruments The company’s derivative commodity instruments principally include crude oil, natural gas

and refined product futures, swaps, options, and forward contracts. None of the company’s derivative instruments is designated

as a hedging instrument, although certain of the company’s affiliates make such designation. The company’s derivatives are not

material to the company’s financial position, results of operations or liquidity. The company believes it has no material market

or credit risks to its operations, financial position or liquidity as a result of its commodity derivative activities.

The company uses derivative commodity instruments traded on the New York Mercantile Exchange and on electronic platforms

of the Inter-Continental Exchange and Chicago Mercantile Exchange. In addition, the company enters into swap contracts and

option contracts principally with major financial institutions and other oil and gas companies in the “over-the-counter” markets,

which are governed by International Swaps and Derivatives Association agreements and other master netting arrangements.

Depending on the nature of the derivative transactions, bilateral collateral arrangements may also be required.

Derivative instruments measured at fair value at December 31, 2015, December 31, 2014, and December 31, 2013, and their

classification on the Consolidated Balance Sheet and Consolidated Statement of Income are on the next page:

Chevron Corporation 2015 Annual Report 43