Chevron 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

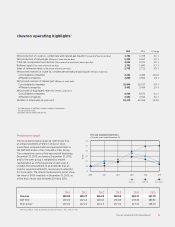

Low commodity prices made 2015 a challenging year for Chevron and the entire

oil and natural gas industry, reducing earnings across the sector.

to our stockholders

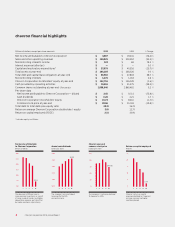

Our full-year

2015

net income was $4.6 billion,

down from $19.2 billion in 2014. Our sales

and other operating revenue were

$129.9 billion, down from $200.5 billion

in 2014. We achieved a 2.5 percent return

on capital employed versus the 10.9 percent

achieved in 2014.

In light of dicult market conditions, we

took significant actions to reduce costs and

improve net cash flow. We reduced capital

and operating expenses by $9 billion through

renegotiating contracts with vendors and

suppliers, streamlining organizations to

reduce our employee and contractor work-

force, deferring and canceling projects not

economic at low prices, and selling $6 billion

in nonstrategic and other assets.

We had a number of notable accomplish-

ments during

2015

. Our Upstream business,

which is responsible for exploration and

production, increased worldwide net

oil-equivalent production by 2 percent, to

2.6 million barrels per day. We started up the

Lianzi Field, located in a unitized oshore

zone between the Republic of Congo and

Angola; Moho Nord, our deepwater devel-

opment oshore the Republic of Congo;

Agbami 3, o the coast of the central

Niger Delta region; and Chuandongbei,

our natural gas field in southwest China,

which initiated production in early 2016.

In addition we ramped up Jack/St. Malo

and Tubular Bells in the U.S. Gulf of Mexico.

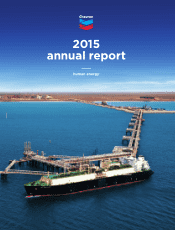

Also significant progress was achieved on

our major capital projects, including Gorgon,

our largest Australian liquefied natural gas

(LNG) project, and Wheatstone LNG as they

move toward start-up in 2016 and mid-2017,

respectively.