Chevron 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

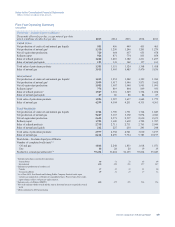

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

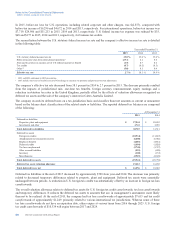

The accumulated benefit obligations for all U.S. and international pension plans were $12,032 and $4,684, respectively, at

December 31, 2015, and $12,833 and $4,995, respectively, at December 31, 2014.

Information for U.S. and international pension plans with an accumulated benefit obligation in excess of plan assets at

December 31, 2015 and 2014, was:

Pension Benefits

2015 2014

U.S. Int’l. U.S. Int’l.

Projected benefit obligations $ 13,500 $ 1,623 $ 14,182 $ 1,938

Accumulated benefit obligations 11,969 1,357 12,765 1,525

Fair value of plan assets 10,198 207 11,009 262

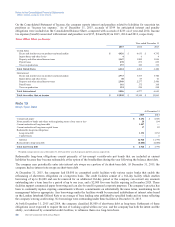

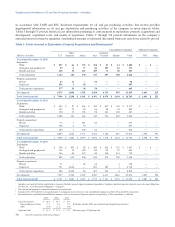

The components of net periodic benefit cost and amounts recognized in the Consolidated Statement of Comprehensive

Income for 2015, 2014 and 2013 are shown in the table below:

Pension Benefits

2015 2014 2013 Other Benefits

U.S. Int’l. U.S. Int’l. U.S. Int’l. 2015 2014 2013

Net Periodic Benefit Cost

Service cost $ 538 $ 185 $ 450 $ 190 $ 495 $ 197 $72 $50$66

Interest cost 502 277 494 340 471 314 151 148 149

Expected return on plan assets (783) (262) (788) (298) (701) (274) ———

Amortization of prior service costs (credits) (8) 22 (9) 21 2 21 14 14 (50)

Recognized actuarial losses 356 78 209 96 485 143 34 753

Settlement losses 320 6 237 208 173 12 ———

Curtailment losses (gains) — (14) ———— ———

Total net periodic benefit cost 925 292 593 557 925 413 271 219 218

Changes Recognized in Comprehensive Income

Net actuarial (gain) loss during period 513 (260) 2,233 (17) (2,244) (476) (362) 514 (659)

Amortization of actuarial loss (676) (84) (446) (304) (658) (155) (34) (7) (53)

Prior service (credits) costs during period —(6) — 4 (78) 18 —2—

Amortization of prior service (costs) credits 8 (24) 9 (21) (2) (21) (14) (14) 50

Total changes recognized in other

comprehensive income (155) (374) 1,796 (338) (2,982) (634) (410) 495 (662)

Recognized in Net Periodic Benefit Cost and Other

Comprehensive Income $ 770 $ (82) $2,389 $ 219 $(2,057) $ (221) $ (139) $ 714 $ (444)

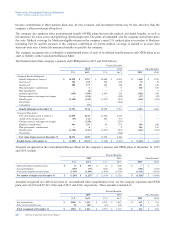

Net actuarial losses recorded in “Accumulated other comprehensive loss” at December 31, 2015, for the company’s U.S.

pension, international pension and OPEB plans are being amortized on a straight-line basis over approximately 10, 10 and 16

years, respectively. These amortization periods represent the estimated average remaining service of employees expected to

receive benefits under the plans. These losses are amortized to the extent they exceed 10 percent of the higher of the

projected benefit obligation or market-related value of plan assets. The amount subject to amortization is determined on a

plan-by-plan basis. During 2016, the company estimates actuarial losses of $335, $56 and $19 will be amortized from

“Accumulated other comprehensive loss” for U.S. pension, international pension and OPEB plans, respectively. In addition,

the company estimates an additional $324 will be recognized from “Accumulated other comprehensive loss” during 2016

related to lump-sum settlement costs from the main U.S. pension plan.

The weighted average amortization period for recognizing prior service costs (credits) recorded in “Accumulated other

comprehensive loss” at December 31, 2015, was approximately 4 and 11 years for U.S. and international pension plans,

respectively, and 7 years for OPEB plans. During 2016, the company estimates prior service (credits) costs of $(9), $15 and

$14 will be amortized from “Accumulated other comprehensive loss” for U.S. pension, international pension and OPEB

plans, respectively.

Chevron Corporation 2015 Annual Report 61