Chevron 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Supplemental Information on Oil and Gas Producing Activities - Unaudited

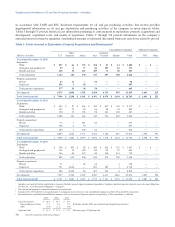

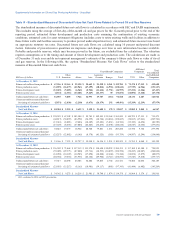

In 2014, extensions and discoveries in the Midland and Delaware basins and the Gulf of Mexico were primarily responsible

for the 164 million barrel increase in the United States.

In 2015, extensions and discoveries in the Midland and Delaware basins were primarily responsible for the 137 million barrel

increase in the United States.

Purchases In 2014, the purchase of additional reserves in Canada was responsible for the 26 million barrel increase in

synthetic oil.

Sales In 2014, the sale of the company’s interests in Chad was responsible for the 20 million barrel decrease in Africa.

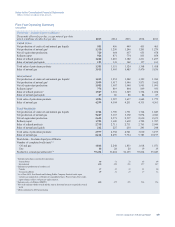

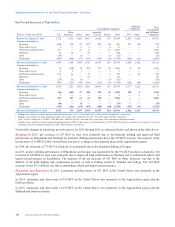

Net Proved Reserves of Crude Oil, Condensate, Natural Gas Liquids and Synthetic Oil

Consolidated Companies Affiliated Companies

Total

Consolidated

Millions of barrels U.S.

Other

Americas1Africa Asia

Australia/

Oceania Europe

Synthetic

Oil2Total TCO

Synthetic

Oil Other3

and Affiliated

Companies

Reserves at January 1, 2013 1,359 223 1,130 837 134 157 513 4,353 1,732 232 164 6,481

Changes attributable to:

Revisions 55 25 94 84 7 17 40 322 32 (3) 3 354

Improved recovery 26 — 10 10 — 11 — 57 — — — 57

Extensions and discoveries 55 4 13 2 — 4 — 78 — — — 78

Purchases 2 9 —— — — —11 — — — 11

Sales (3) — (1)— — — — (4) — — — (4)

Production (164) (18) (142) (141) (10) (23) (16) (514) (96) (9) (13) (632)

Reserves at December 31, 201341,330 243 1,104 792 131 166 537 4,303 1,668 220 154 6,345

Changes attributable to:

Revisions 90 — 74 80 19 9 (32) 240 41 (4) — 277

Improved recovery 19 1 1 8 — 5 — 34 — — — 34

Extensions and discoveries 164 18 2 7 — 8 19 218 — — 1 219

Purchases 1 — —— — — 26 27 — — — 27

Sales (6) — (20) — — (3) — (29) — — — (29)

Production (166) (24) (140) (135) (8) (19) (16) (508) (94) (12) (10) (624)

Reserves at December 31, 201441,432 238 1,021 752 142 166 534 4,285 1,615 204 145 6,249

Changes attributable to:

Revisions (1) (9) 60 164 14 (3) 80 305 163 — (4) 464

Improved recovery 7 — 11 2 — — — 20 — — — 20

Extensions and discoveries 137 28 4 5 5 — — 179 — — — 179

Purchases — ——— — — —— — —— —

Sales (6) — (7) — — — — (13) — — (13)

Production (183) (21) (132) (133) (8) (20) (17) (514) (102) (11) (10) (637)

Reserves at December 31, 201541,386 236 957 790 153 143 597 4,262 1,676 193 131 6,262

1Ending reserve balances in North America were 155, 142 and 141 and in South America were 81, 96 and 102 in 2015, 2014 and 2013, respectively.

2Reserves associated with Canada.

3Ending reserve balances in Africa were 34, 37 and 37 and in South America were 97, 108 and 117 in 2015, 2014 and 2013, respectively.

4Included are year-end reserve quantities related to production-sharing contracts (PSC) (refer to page 8 for the definition of a PSC). PSC-related reserve quantities are

20 percent, 19 percent and 20 percent for consolidated companies for 2015, 2014 and 2013, respectively.

Chevron Corporation 2015 Annual Report 77