Chevron 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

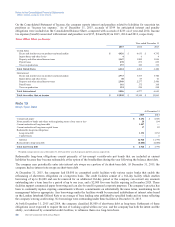

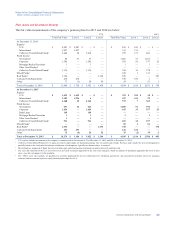

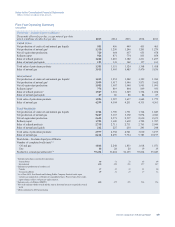

Millions of dollars, except per-share amounts

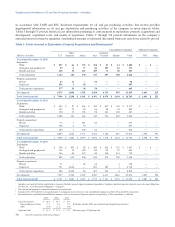

products, to be used or sold in the ordinary course of the company’s business. The aggregate approximate amounts of

required payments under these various commitments are: 2016 – $2,100; 2017 – $1,900; 2018 – $1,700; 2019 – $1,500;

2020 – $1,100; 2020 and after – $3,100. A portion of these commitments may ultimately be shared with project partners.

Total payments under the agreements were approximately $1,900 in 2015, $3,700 in 2014 and $3,600 in 2013.

Environmental The company is subject to loss contingencies pursuant to laws, regulations, private claims and legal

proceedings related to environmental matters that are subject to legal settlements or that in the future may require the

company to take action to correct or ameliorate the effects on the environment of prior release of chemicals or petroleum

substances, including MTBE, by the company or other parties. Such contingencies may exist for various operating, closed

and divested sites, including, but not limited to, federal Superfund sites and analogous sites under state laws, refineries,

chemical plants, marketing facilities, crude oil fields, and mining sites.

Although the company has provided for known environmental obligations that are probable and reasonably estimable, it is

likely that the company will continue to incur additional liabilities. The amount of additional future costs are not fully

determinable due to such factors as the unknown magnitude of possible contamination, the unknown timing and extent of the

corrective actions that may be required, the determination of the company’s liability in proportion to other responsible

parties, and the extent to which such costs are recoverable from third parties. These future costs may be material to results of

operations in the period in which they are recognized, but the company does not expect these costs will have a material effect

on its consolidated financial position or liquidity.

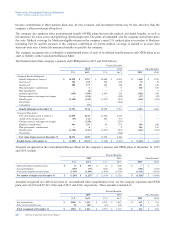

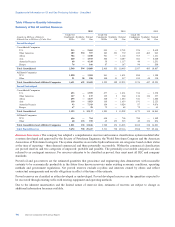

Chevron’s environmental reserve as of December 31, 2015, was $1,578. Included in this balance were $348 related to

remediation activities at approximately 163 sites for which the company had been identified as a potentially responsible party

under the provisions of the federal Superfund law or analogous state laws which provide for joint and several liability for all

responsible parties. Any future actions by regulatory agencies to require Chevron to assume other potentially responsible

parties’ costs at designated hazardous waste sites are not expected to have a material effect on the company’s results of

operations, consolidated financial position or liquidity.

Of the remaining year-end 2015 environmental reserves balance of $1,230, $845 is related to the company’s U.S.

downstream operations, $58 to its international downstream operations, $323 to upstream operations and $4 to other

businesses. Liabilities at all sites were primarily associated with the company’s plans and activities to remediate soil or

groundwater contamination or both.

The company manages environmental liabilities under specific sets of regulatory requirements, which in the United States

include the Resource Conservation and Recovery Act and various state and local regulations. No single remediation site at

year-end 2015 had a recorded liability that was material to the company’s results of operations, consolidated financial

position or liquidity.

Refer to Note 25 on page 67 for a discussion of the company’s asset retirement obligations.

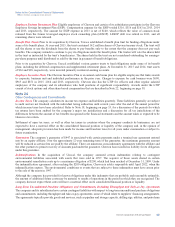

Other Contingencies On November 7, 2011, while drilling a development well in the deepwater Frade Field about 75 miles

offshore Brazil, an unanticipated pressure spike caused oil to migrate from the well bore through a series of fissures to the

sea floor, emitting approximately 2,400 barrels of oil. The source of the seep was substantially contained within four days

and the well was plugged and abandoned. On March 14, 2012, the company identified a small, second seep in a different part

of the field. No evidence of any coastal or wildlife impacts related to either of these seeps emerged. As reported in the

company’s previously filed periodic reports, it has resolved civil claims relating to these incidents brought by a Brazilian

federal district prosecutor. As also reported previously, the federal district prosecutor also filed criminal charges against

Chevron and 11 Chevron employees. These charges were dismissed by the trial court on February 19, 2013, reinstated by an

appellate court on October 9, 2013, and then, upon Chevron’s motion for reconsideration, dismissed by the appellate court on

August 27, 2015. The federal district prosecutor has appealed the appellate court’s decision.

Chevron receives claims from and submits claims to customers; trading partners; U.S. federal, state and local regulatory

bodies; governments; contractors; insurers; suppliers; and individuals. The amounts of these claims, individually and in the

aggregate, may be significant and take lengthy periods to resolve, and may result in gains or losses in future periods.

The company and its affiliates also continue to review and analyze their operations and may close, abandon, sell, exchange,

acquire or restructure assets to achieve operational or strategic benefits and to improve competitiveness and profitability.

These activities, individually or together, may result in significant gains or losses in future periods.

66 Chevron Corporation 2015 Annual Report