Chevron 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

Note 25

Asset Retirement Obligations

The company records the fair value of a liability for an asset retirement obligation (ARO) as an asset and liability when there

is a legal obligation associated with the retirement of a tangible long-lived asset and the liability can be reasonably estimated.

The legal obligation to perform the asset retirement activity is unconditional, even though uncertainty may exist about the

timing and/or method of settlement that may be beyond the company’s control. This uncertainty about the timing and/or

method of settlement is factored into the measurement of the liability when sufficient information exists to reasonably

estimate fair value. Recognition of the ARO includes: (1) the present value of a liability and offsetting asset, (2) the

subsequent accretion of that liability and depreciation of the asset, and (3) the periodic review of the ARO liability estimates

and discount rates.

AROs are primarily recorded for the company’s crude oil and natural gas producing assets. No significant AROs associated

with any legal obligations to retire downstream long-lived assets have been recognized, as indeterminate settlement dates for

the asset retirements prevent estimation of the fair value of the associated ARO. The company performs periodic reviews of

its downstream long-lived assets for any changes in facts and circumstances that might require recognition of a retirement

obligation.

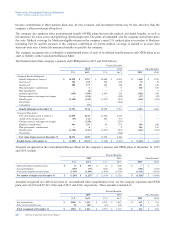

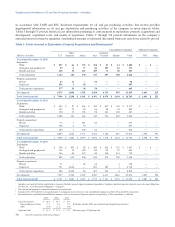

The following table indicates the changes to the company’s before-tax asset retirement obligations in 2015, 2014 and 2013:

2015 2014 2013

Balance at January 1 $ 15,053 $ 14,298 $ 13,271

Liabilities incurred 51 133 59

Liabilities settled (981) (1,291) (907)

Accretion expense 715 882 627

Revisions in estimated cash flows 804 1,031 1,248

Balance at December 31 $ 15,642 $ 15,053 $ 14,298

In the table above, the amounts associated with “Revisions in estimated cash flows” generally reflect increased cost estimates

to abandon wells, equipment and facilities and accelerated timing of abandonment. The long-term portion of the $15,642

balance at the end of 2015 was $14,892.

Note 26

Restructuring and Reorganization Costs

In 2015, the company recorded accruals and adjustments for employee reduction programs related to the restructuring and

reorganization of its corporate staffs and certain upstream operations. The employee reductions are expected to be

substantially completed by the end of 2016.

A before-tax charge of $353 ($223 after-tax) was recorded in 2015, with $219 reported as “Operating Expenses” and $134

reported as “Selling, general and administrative expense” on the Consolidated Statement of Income. The accrued liability,

covering severance benefits, is classified as current on the Consolidated Balance Sheet. Approximately $134 ($87 after-tax)

is associated with employee reductions in All Other, $113 ($73 after-tax) in U.S. Upstream and $106 ($63 after-tax) in

International Upstream.

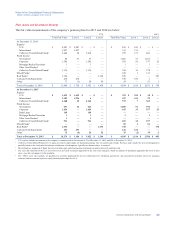

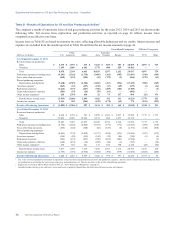

During 2015, the company made payments of $60 associated with these liabilities. The following table summarizes the

accrued severance liability, which is classified as current on the Consolidated Balance Sheet:

Amounts Before Tax

Balance at January 1, 2015 $—

Accruals/Adjustments 353

Payments (60)

Balance at December 31, 2015 $ 293

Note 27

Other Financial Information

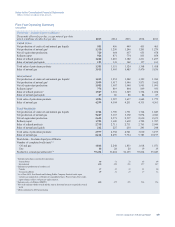

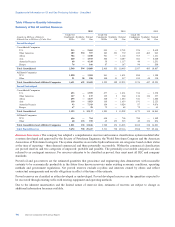

Earnings in 2015 included after-tax gains of approximately $2,300 relating to the sale of nonstrategic properties. Of this

amount, approximately $1,800 and $500 related to downstream and upstream, respectively. Earnings in 2014 included after-

tax gains of approximately $3,000 relating to the sale of nonstrategic properties, of which approximately $1,800 and $1,000

related to upstream and downstream assets, respectively. Earnings in 2015 included after-tax charges of approximately

$3,000 for impairments and other asset write-offs related to upstream. Earnings in 2014 included after-tax charges of

approximately $1,000 for impairments and other asset write-offs, of which $800 was related to upstream and $200 to a

mining asset.

Chevron Corporation 2015 Annual Report 67