Chevron 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Litigation and Other Contingencies

MTBE Information related to methyl tertiary butyl ether (MTBE) matters is included on page 50 in Note 17 to the

Consolidated Financial Statements under the heading “MTBE.”

Ecuador Information related to Ecuador matters is included in Note 17 to the Consolidated Financial Statements under the

heading “Ecuador,” beginning on page 50.

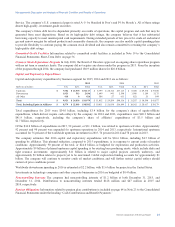

Environmental The following table displays the annual changes to the company’s before-tax environmental remediation

reserves, including those for federal Superfund sites and analogous sites under state laws.

Millions of dollars 2015 2014 2013

Balance at January 1 $ 1,683 $ 1,456 $ 1,403

Net Additions 365 636 488

Expenditures (470) (409) (435)

Balance at December 31 $ 1,578 $ 1,683 $ 1,456

The company records asset retirement obligations when there is a legal obligation associated with the retirement of

long-lived assets and the liability can be reasonably estimated. These asset retirement obligations include costs related to

environmental issues. The liability balance of approximately $15.6 billion for asset retirement obligations at year-end 2015

related primarily to upstream properties.

For the company’s other ongoing operating assets, such as refineries and chemicals facilities, no provisions are made for exit

or cleanup costs that may be required when such assets reach the end of their useful lives unless a decision to sell or

otherwise abandon the facility has been made, as the indeterminate settlement dates for the asset retirements prevent

estimation of the fair value of the asset retirement obligation.

Refer to the discussion below for additional information on environmental matters and their impact on Chevron, and on the

company’s 2015 environmental expenditures. Refer to Note 24 on page 66 for additional discussion of environmental

remediation provisions and year-end reserves. Refer also to Note 25 on page 67 for additional discussion of the company’s

asset retirement obligations.

Suspended Wells Information related to suspended wells is included in Note 21 to the Consolidated Financial Statements,

Accounting for Suspended Exploratory Wells, beginning on page 57.

Income Taxes Information related to income tax contingencies is included on pages 53 through 56 in Note 18 and page 65 in

Note 24 to the Consolidated Financial Statements under the heading “Income Taxes.”

Other Contingencies Information related to other contingencies is included on page 66 in Note 24 to the Consolidated

Financial Statements under the heading “Other Contingencies.”

Environmental Matters

The company is subject to various international, federal, state and local environmental, health and safety laws, regulations

and market-based programs. These laws, regulations and programs continue to evolve and are expected to increase in both

number and complexity over time and govern not only the manner in which the company conducts its operations, but also the

products it sells. For example, international agreements (e.g., the Paris Accord and the Kyoto Protocol) and national (e.g.,

carbon tax, cap-and-trade, or efficiency standards), regional, and state legislation (e.g., California’s AB32 or other low

carbon fuel standards) and regulatory measures (e.g., the U.S. Environmental Protection Agency’s methane performance

standards) to limit or reduce greenhouse gas (GHG) emissions are currently in various stages of discussion or

implementation. Consideration of GHG issues and the responses to those issues through international agreements and

national, regional or state legislation or regulation are integrated into the company’s strategy, planning and capital investment

reviews, where applicable. They are also factored into the company’s long-range supply, demand and energy price forecasts.

These forecasts reflect long-range effects from renewable fuel penetration, energy efficiency standards, climate-related

policy actions, and demand response to oil and natural gas prices. In addition, legislation and regulations intended to address

hydraulic fracturing also continue to evolve at the international, national and state levels. Refer to “Risk Factors” in Part I,

Item 1A, on pages 21 through 23 of the company’s Annual Report on Form 10-K for a discussion of some of the inherent

risks of increasingly restrictive environmental and other regulation that could materially impact the company’s results of

operations or financial condition.

24 Chevron Corporation 2015 Annual Report