Chevron 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

that are available to Chevron and Texpet as a result of that breach. Phase Two issues were addressed at a hearing held in

April and May 2015. The Tribunal has not set a date for Phase Three, the damages phase of the arbitration.

Company’s RICO Action Through a series of U.S. court proceedings initiated by Chevron to obtain discovery relating to the

Lago Agrio litigation and the BIT arbitration, Chevron obtained evidence that it believes shows a pattern of fraud, collusion,

corruption, and other misconduct on the part of several lawyers, consultants and others acting for the Lago Agrio plaintiffs.

In February 2011, Chevron filed a civil lawsuit in the Federal District Court for the Southern District of New York against

the Lago Agrio plaintiffs and several of their lawyers, consultants and supporters, alleging violations of the Racketeer

Influenced and Corrupt Organizations Act and other state laws. Through the civil lawsuit, Chevron is seeking relief that

includes a declaration that any judgment against Chevron in the Lago Agrio litigation is the result of fraud and other

unlawful conduct and is therefore unenforceable. On March 7, 2011, the Federal District Court issued a preliminary

injunction prohibiting the Lago Agrio plaintiffs and persons acting in concert with them from taking any action in

furtherance of recognition or enforcement of any judgment against Chevron in the Lago Agrio case pending resolution of

Chevron’s civil lawsuit by the Federal District Court. On May 31, 2011, the Federal District Court severed claims one

through eight of Chevron’s complaint from the ninth claim for declaratory relief and imposed a discovery stay on claims one

through eight pending a trial on the ninth claim for declaratory relief. On September 19, 2011, the U.S. Court of Appeals for

the Second Circuit vacated the preliminary injunction, stayed the trial on Chevron’s ninth claim, a claim for declaratory

relief, that had been set for November 14, 2011, and denied the defendants’ mandamus petition to recuse the judge hearing

the lawsuit. The Second Circuit issued its opinion on January 26, 2012 ordering the dismissal of Chevron’s ninth claim for

declaratory relief. On February 16, 2012, the Federal District Court lifted the stay on claims one through eight, and on

October 18, 2012, the Federal District Court set a trial date of October 15, 2013. On March 22, 2013, Chevron settled its

claims against Stratus Consulting, and on April 12, 2013 sworn declarations by representatives of Stratus Consulting were

filed with the Court admitting their role and that of the plaintiffs’ attorneys in drafting the environmental report of the mining

engineer appointed by the provincial court in Lago Agrio. On September 26, 2013, the Second Circuit denied the defendants’

Petition for Writ of Mandamus to recuse the judge hearing the case and to collaterally estop Chevron from seeking a

declaration that the Lago Agrio judgment was obtained through fraud and other unlawful conduct.

The trial commenced on October 15, 2013 and concluded on November 22, 2013. On March 4, 2014, the Federal District Court

entered a judgment in favor of Chevron, prohibiting the defendants from seeking to enforce the Lago Agrio judgment in the

United States and further prohibiting them from profiting from their illegal acts. The defendants appealed the Federal District

Court’s decision, and, on April 20, 2015, a panel of the U.S. Court of Appeals for the Second Circuit heard oral arguments.

Management’s Assessment The ultimate outcome of the foregoing matters, including any financial effect on Chevron,

remains uncertain. Management does not believe an estimate of a reasonably possible loss (or a range of loss) can be made in

this case. Due to the defects associated with the Ecuadorian judgment, the 2008 engineer’s report on alleged damages and the

September 2010 plaintiffs’ submission on alleged damages, management does not believe these documents have any utility

in calculating a reasonably possible loss (or a range of loss). Moreover, the highly uncertain legal environment surrounding

the case provides no basis for management to estimate a reasonably possible loss (or a range of loss).

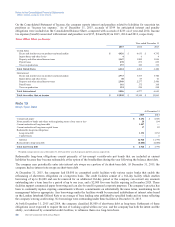

Note 18

Taxes

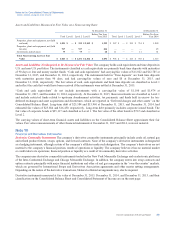

Income Taxes Year ended December 31

2015 2014 2013

Income tax expense (benefit)

U.S. federal

Current $ (817) $ 748 $ 15

Deferred (580) 1,330 1,128

State and local

Current (187) 336 120

Deferred (109) 36 74

Total United States (1,693) 2,450 1,337

International

Current 2,997 9,235 12,296

Deferred (1,172) 207 675

Total International 1,825 9,442 12,971

Total income tax expense (benefit) $ 132 $ 11,892 $ 14,308

Chevron Corporation 2015 Annual Report 53