Chevron 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

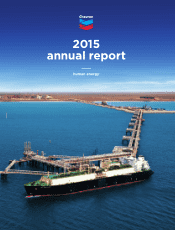

2015

annual report

Table of contents

-

Page 1

2015 annual report -

Page 2

... of energy and financial terms 9 financial review 68 five-year financial summary 69 five-year operating summary 8 1 chevron history 82 board of directors 83 corporate officers 84 stockholder and investor information On the cover: The Chevron-operated Asia Excellence liqueï¬ed natural gas tanker... -

Page 3

... optimizing our portfolio by divesting assets that no longer have a strategic fit or cannot compete for capital with other investment alternatives. And we are capturing the benefits of being a fully integrated energy company with Downstream and Chemicals delivering strong results. We are optimistic... -

Page 4

...entire oil and natural gas industry, reducing earnings across the sector. Our full-year 2015 net income was $4.6 billion, down from $19.2 billion in 2014. Our sales and other operating revenue were $129.9 billion, down from $200.5 billion in 2014. We achieved a 2.5 percent return on capital employed... -

Page 5

... ratio was a comfortable 20.2 percent. energy company most admired for its people, partnership and performance. Thank you for your confidence and your investment in Chevron. John S. Watson Chairman of the Board and Chief Executive Officer February 25, 2016 Chevron Corporation 2015 Annual Report... -

Page 6

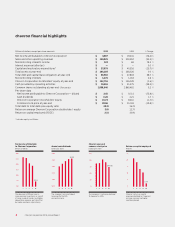

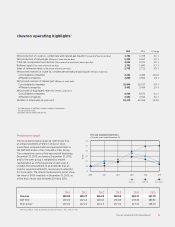

... ï¬nancial highlights Millions of dollars, except per-share amounts 2015 2014 % Change Net income attributable to Chevron Corporation Sales and other operating revenues Noncontrolling interests income Interest expense (after tax) Capital and exploratory expenditures* Total assets at year... -

Page 7

... for stock splits. The interim measurement points show the value of $100 invested on December 31, 2010, as of the end of each year between 2011 and 2015. 200 180 160 Dollars Five-year cumulative total returns (Calendar years ended December 31) 140 120 100 80 2010 2011 2012 2013 2014 2015 Chevron... -

Page 8

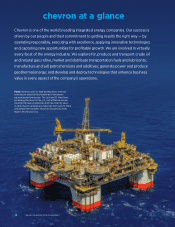

... generate power and produce geothermal energy; and develop and deploy technologies that enhance business value in every aspect of the company's operations. Photo: With the Jack/St. Malo development, Chevron continues to advance the boundaries of deepwater exploration and production. The Jack and St... -

Page 9

...centers in Houston; London; Singapore; and San Ramon, California. Technology Strategy: Differentiate performance through technology. Our three technology companies - Chevron Energy Technology, Chevron Technology Ventures and Chevron Information Technology - are focused on enhancing business value... -

Page 10

... with the U.S. Securities and Exchange Commission. Investors should refer to proved reserves disclosures in Chevron's Annual Report on Form 10-K for the year ended December 31, 2015. Resources Estimated quantities of oil and gas resources are recorded under Chevron's 6P system, which is modeled... -

Page 11

... REFORM ACT OF 1995 This Annual Report of Chevron Corporation contains forward-looking statements relating to Chevron's operations that are based on management's current expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words or phrases such... -

Page 12

... markets, the level of worldwide economic activity, and the implications for the company of movements in prices for crude oil and natural gas. Management takes these developments into account in the conduct of daily operations and for business planning. 10 Chevron Corporation 2015 Annual Report -

Page 13

... operates and holds investments, and seeks to manage risks in operating its facilities and businesses. The longer-term trend in earnings for the upstream segment is also a function of other factors, including the company's ability to find or acquire and efficiently produce crude oil and natural gas... -

Page 14

...to other markets. The company's long-term contract prices for liquefied natural gas (LNG) are typically linked to crude oil prices. Approximately 85 percent of the equity LNG offtake from the operated Australian LNG projects is targeted to be sold into binding long-term contracts, with the remainder... -

Page 15

..., insurance operations, real estate activities and technology companies. Operating Developments Key operating developments and other events during 2015 and early 2016 included the following: Upstream Angola-Republic of Congo Joint Development Area Achieved first production from the Lianzi Project... -

Page 16

...interest in Caltex Australia Limited. New Zealand Completed the sale of the company's interest in The New Zealand Refining Company Limited and reached agreement to sell the company's marketing operations. Other Common Stock Dividends The 2015 annual dividend was $4.28 per share, making 2015 the 28th... -

Page 17

.... International net natural gas production of 4.0 billion cubic feet per day in 2015 was up 1 percent from 2014 and unchanged from 2013. Refer to the "Selected Operating Data" table, on page 19, for a three-year comparison of international production volumes. Chevron Corporation 2015 Annual Report... -

Page 18

... cash management and debt financing activities, corporate administrative functions, insurance operations, real estate activities, and technology companies. Net charges in 2015 decreased $935 million from 2014, mainly due to lower corporate tax items and the absence of 2014 charges related to... -

Page 19

... GS Caltex in South Korea, higher earnings from CPChem and the absence of 2013 impairments of power-related affiliates. Refer to Note 15, beginning on page 48, for a discussion of Chevron's investments in affiliated companies. Millions of dollars Other income $ 2015 3,868 $ 2014 4,378 $ 2013 1,165... -

Page 20

... decreased between 2014 and 2013 primarily due to the impact of changes in jurisdictional mix and equity earnings, and the tax effects related to the 2014 sale of interests in Chad and Cameroon, partially offset by other one-time and ongoing tax charges. 18 Chevron Corporation 2015 Annual Report -

Page 21

... branded and unbranded gasoline. Includes sales of affiliates (MBPD): 420 475 471 In 2015, the company sold its interests in affiliates in Australia and New Zealand, which included operable capacities of 55,000 and 12,000 barrels per day, respectively. Chevron Corporation 2015 Annual Report 19 -

Page 22

...of contributions to employee pension plans of approximately $0.9 billion, $0.4 billion and $1.2 billion in 2015, 2014 and 2013, respectively. Cash provided by investing activities included proceeds and deposits related to asset sales of $5.7 billion in 2015, $5.7 billion in 2014, and $1.1 billion in... -

Page 23

... and $47 million in 2015 and 2014, respectively. Pension Obligations Information related to pension plan contributions is included on page 64 in Note 23 to the Consolidated Financial Statements under the heading "Cash Contributions and Benefit Payments." Chevron Corporation 2015 Annual Report 21 -

Page 24

... be shared with project partners. Total payments under the agreements were approximately $1.9 billion in 2015, $3.7 billion in 2014 and $3.6 billion in 2013. The following table summarizes the company's significant contractual obligations: Millions of dollars On Balance Sheet:2 Short-Term Debt3 Long... -

Page 25

... interest rate swaps. Transactions With Related Parties Chevron enters into a number of business arrangements with related parties, principally its equity affiliates. These arrangements include long-term supply or offtake agreements and long-term purchase agreements. Refer to "Other Information" in... -

Page 26

...21 through 23 of the company's Annual Report on Form 10-K for a discussion of some of the inherent risks of increasingly restrictive environmental and other regulation that could materially impact the company's results of operations or financial condition. 24 Chevron Corporation 2015 Annual Report -

Page 27

... oil and gas reserves on Chevron's Consolidated Financial Statements, using the successful efforts method of accounting, include the following: 1. Amortization - Capitalized exploratory drilling and development costs are depreciated on a unit-of-production (UOP) basis using proved developed reserves... -

Page 28

... 1 to the Consolidated Financial Statements, beginning on page 36, which includes a description of the "successful efforts" method of accounting for oil and gas exploration and production activities. Impairment of Properties, Plant and Equipment and Investments in Affiliates The company assesses its... -

Page 29

... obligations for OPEB plans, which provide for certain health care and life insurance benefits for qualifying retired employees and which are not funded, are the discount rate and the assumed health care cost-trend rates. Information related to the Company's processes to develop these assumptions is... -

Page 30

...taxes: Intraday price. The company's common stock is listed on the New York Stock Exchange (trading symbol: CVX). As of February 15, 2016, stockholders of record numbered approximately 145,000. There are no restrictions on the company's ability to pay dividends. 28 Chevron Corporation 2015 Annual... -

Page 31

... company's internal control over financial reporting as of December 31, 2015, has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in its report included herein. John S. Watson Chairman of the Board and Chief Executive Officer February 25, 2016... -

Page 32

... assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (i) pertain to... -

Page 33

... of dollars, except per-share amounts Year ended December 31 2015 Revenues and Other Income Sales and other operating revenues* Income from equity affiliates Other income Total Revenues and Other Income Costs and Other Deductions Purchased crude oil and products Operating expenses Selling, general... -

Page 34

... equity affiliates Income taxes on defined benefit plans Total Other Comprehensive Gain (Loss), Net of Tax Comprehensive Income Comprehensive income attributable to noncontrolling interests Comprehensive Income Attributable to Chevron Corporation See accompanying Notes to the Consolidated Financial... -

Page 35

... income Other taxes payable Total Current Liabilities Long-term debt Capital lease obligations Deferred credits and other noncurrent obligations Noncurrent deferred income taxes Noncurrent employee benefit plans Total Liabilities Preferred stock (authorized 100,000,000 shares; $1.00 par value; none... -

Page 36

...long-term receivables Decrease (increase) in other deferred charges Cash contributions to employee pension plans Other Net Cash Provided by Operating Activities Investing Activities Capital expenditures Proceeds and deposits related to asset sales Net maturities of time deposits Net sales (purchases... -

Page 37

...1 Purchases Issuances - mainly employee benefit plans Balance at December 31 Total Chevron Corporation Stockholders' Equity at December 31 Noncontrolling Interests Total Equity See accompanying Notes to the Consolidated Financial Statements. 2014 Shares - $ 2,442,677 $ $ $ Amount - Shares - $ 2013... -

Page 38

... the equity method. As part of that accounting, the company recognizes gains and losses that arise from the issuance of stock by an affiliate that results in changes in the company's proportionate share of the dollar amount of the affiliate's equity currently in income. Investments in affiliates are... -

Page 39

... costs using currently available technology and applying current regulations and the company's own internal environmental policies. Future amounts are not discounted. Recoveries or reimbursements are recorded as assets when receipt is reasonably assured. Chevron Corporation 2015 Annual Report 37 -

Page 40

... over the service period required to earn the award, which is the shorter of the vesting period or the time period an employee becomes eligible to retain the award at retirement. Stock options and stock appreciation rights granted under the company's Long-Term Incentive Plan have graded vesting... -

Page 41

...$5,000 under its share repurchase program, respectively. In 2015, 2014 and 2013, "Net sales (purchases) of other short-term investments" generally consisted of restricted cash associated with upstream abandonment activities, tax payments, and funds held in escrow for tax-deferred exchanges and asset... -

Page 42

... as part of "Properties, plant and equipment, at cost" on the Consolidated Balance Sheet. Such leasing arrangements involve crude oil production and processing equipment, service stations, bareboat charters, office buildings, and other facilities. Other leases are classified as operating leases... -

Page 43

.... CUSA also holds the company's investment in the Chevron Phillips Chemical Company LLC joint venture, which is accounted for using the equity method. The summarized financial information for CUSA and its consolidated subsidiaries is as follows: 2015 Sales and other operating revenues Total costs... -

Page 44

... LLP Chevron has a 50 percent equity ownership interest in Tengizchevroil LLP (TCO). Refer to Note 15, beginning on page 48, for a discussion of TCO operations. Summarized financial information for 100 percent of TCO is presented in the table below: 2015 Sales and other operating revenues Costs... -

Page 45

... may also be required. Derivative instruments measured at fair value at December 31, 2015, December 31, 2014, and December 31, 2013, and their classification on the Consolidated Balance Sheet and Consolidated Statement of Income are on the next page: Chevron Corporation 2015 Annual Report 43 -

Page 46

... held for sale" on the Consolidated Balance Sheet. These assets are associated with upstream and downstream operations that are anticipated to be sold in the next 12 months. The revenues and earnings contributions of these assets in 2015 were not material. 44 Chevron Corporation 2015 Annual Report -

Page 47

... shares that were reserved for issuance under the Chevron Long-Term Incentive Plan. In addition, approximately 120,753 shares remain available for issuance from the 800,000 shares of the company's common stock that were reserved for awards under the Chevron Corporation Non-Employee Directors' Equity... -

Page 48

...years 2015, 2014 and 2013, are presented in the table on the next page. Products are transferred between operating segments at internal product values that approximate market prices. Revenues for the upstream segment are derived primarily from the production and sale of crude oil and natural gas, as... -

Page 49

...753 (1,248) 14,308 Other Segment Information Additional information for the segmentation of major equity affiliates is contained in Note 15, on page 48. Information related to properties, plant and equipment by segment is contained in Note 16, on page 49. Chevron Corporation 2015 Annual Report 47 -

Page 50

... for using the equity method and other investments accounted for at or below cost, is shown in the following table. For certain equity affiliates, Chevron pays its share of some income taxes directly. For such affiliates, the equity in earnings does not include these taxes, which are reported on the... -

Page 51

... Ltd. Chevron sold its 50 percent equity ownership interest in Caltex Australia Ltd. (CAL) in second quarter 2015. Other Information "Sales and other operating revenues" on the Consolidated Statement of Income includes $4,850, $10,404 and $14,635 with affiliated companies for 2015, 2014 and 2013... -

Page 52

...from the oil exploration and production operations and seeks unspecified damages to fund environmental remediation and restoration of the alleged environmental harm, plus a health monitoring program. Until 1992, Texaco Petroleum Company (Texpet), a subsidiary of Texaco Inc., was a minority member of... -

Page 53

...'s operations. On May 30, 2012, the Lago Agrio plaintiffs filed an action against Chevron Corporation, Chevron Canada Limited, and Chevron Canada Finance Limited in the Ontario Superior Court of Justice in Ontario, Canada, seeking to recognize and enforce the Ecuadorian judgment. On May 1, 2013... -

Page 54

... Norberto Priu, requiring shares of both companies to be "embargoed," requiring third parties to withhold 40 percent of any payments due to Chevron Argentina S.R.L. and ordering banks to withhold 40 percent of the funds in Chevron Argentina S.R.L. bank accounts. On December 14, 2012, the Argentinean... -

Page 55

... International Total income tax expense (benefit) $ Year ended December 31 2014 2013 $ (817) (580) (187) (109) (1,693) 2,997 (1,172) 1,825 132 $ 748 1,330 336 36 2,450 9,235 207 9,442 $ 15 1,128 120 74 1,337 12,296 675 12,971 $ 11,892 $ 14,308 53 Chevron Corporation 2015 Annual Report -

Page 56

...Financial Statements Millions of dollars, except per-share amounts In 2015, before-tax loss for U.S. operations, including related corporate and other charges, was $(2,877), compared with before-tax income of $6,296 and $4,672 in 2014 and 2013, respectively. For international operations, before-tax... -

Page 57

... ended December 31, 2015, 2014 and 2013. The term "unrecognized tax benefits" in the accounting standards for income taxes refers to the differences between a tax position taken or expected to be taken in a tax return and the benefit measured and recognized in the financial statements. Interest and... -

Page 58

... 2020. These facilities support commercial paper borrowing and can also be used for general corporate purposes. The company's practice has been to continually replace expiring commitments with new commitments on substantially the same terms, maintaining levels management believes appropriate. Any... -

Page 59

... Financial Statements Millions of dollars, except per-share amounts Note 20 Long-Term Debt Total long-term debt, excluding capital leases, at December 31, 2015, was $33,584. The company's long-term debt outstanding at year-end 2015 and 2014 was as follows: 2015 3.191% notes due 2023 Floating rate... -

Page 60

... units and restricted stock units was $32 ($21 after tax), $71 ($46 after tax) and $223 ($145 after tax) for 2015, 2014 and 2013, respectively. No significant stock-based compensation cost was capitalized at December 31, 2015, or December 31, 2014. 58 Chevron Corporation 2015 Annual Report -

Page 61

... benefits realized for the tax deductions from option exercises were $17, $54 and $73 for 2015, 2014 and 2013, respectively. Cash paid to settle performance units and stock appreciation rights was $104, $204 and $186 for 2015, 2014 and 2013, respectively. Awards under the Chevron Long-Term Incentive... -

Page 62

... investment alternatives. The company also sponsors other postretirement benefit (OPEB) plans that provide medical and dental benefits, as well as life insurance for some active and qualifying retired employees. The plans are unfunded, and the company and retirees share the costs. Medical coverage... -

Page 63

..., and 7 years for OPEB plans. During 2016, the company estimates prior service (credits) costs of $(9), $15 and $14 will be amortized from "Accumulated other comprehensive loss" for U.S. pension, international pension and OPEB plans, respectively. Chevron Corporation 2015 Annual Report 61 -

Page 64

...For 2015, the company used an expected long-term rate of return of 7.5 percent for U.S. pension plan assets, which account for 71 percent of the company's pension plan assets. In both 2014 and 2013, the company used a long-term rate of return of 7.5 percent for this plan. The market-related value of... -

Page 65

... Financial Statements Millions of dollars, except per-share amounts Plan Assets and Investment Strategy The fair value measurements of the company's pension plans for 2015 and 2014 are below: Total Fair Value At December 31, 2014 Equities U.S.1 International Collective Trusts/Mutual Funds2 Fixed... -

Page 66

...31, 2014 Actual Return on Plan Assets: Assets held at the reporting date Assets sold during the period Purchases, Sales and Settlements Transfers in and/or out of Level 3 Total at December 31, 2015 $ $ 23 - - (1) - $ 22 (3) - 6 - 25 $ $ Fixed Income Mortgage-Backed Securities $ 2 - - (2 Real Estate... -

Page 67

... retirement plans. At December 31, 2015 and 2014, trust assets of $36 and $38, respectively, were invested primarily in interest-earning accounts. Employee Incentive Plans The Chevron Incentive Plan is an annual cash bonus plan for eligible employees that links awards to corporate, business... -

Page 68

...year-end 2015 environmental reserves balance of $1,230, $845 is related to the company's U.S. downstream operations, $58 to its international downstream operations, $323 to upstream operations and $4 to other businesses. Liabilities at all sites were primarily associated with the company's plans and... -

Page 69

..., covering severance benefits, is classified as current on the Consolidated Balance Sheet. Approximately $134 ($87 after-tax) is associated with employee reductions in All Other, $113 ($73 after-tax) in U.S. Upstream and $106 ($63 after-tax) in International Upstream. During 2015, the company made... -

Page 70

...of dollars, except per-share amounts 2015 2014 2013 2012 2011 Statement of Income Data Revenues and Other Income Total sales and other operating revenues* Income from equity affiliates and other income Total Revenues and Other Income Total Costs and Other Deductions Income Before Income Tax Expense... -

Page 71

... Sales of natural gas Worldwide - Excludes Equity in Affiliates Number of completed wells (net)5, 6 Oil and gas Dry Productive oil and gas wells (net)5, 6 Includes natural gas consumed in operations: United States International 2 Includes net production of synthetic oil: Canada Venezuela affiliate... -

Page 72

... Total cost incurred Non-oil and gas activities ARO Upstream C&E $ 28.6 3.5 (1.0) 31.1 $ 2014 33.7 4.6 (1.2) 37.1 $ 2013 33.5 5.8 (1.4) 37.9 (Primarily includes LNG, gas-to-liquids and transportation activities) Reference page 21 Upstream total $ $ $ 70 Chevron Corporation 2015 Annual Report -

Page 73

... in Venezuela and Angola. Refer to Note 15, beginning on page 48, for a discussion of the company's major equity affiliates. Table II - Capitalized Costs Related to Oil and Gas Producing Activities Consolidated Companies Millions of dollars At December 31, 2015 Unproved properties Proved properties... -

Page 74

... are excluded from the results reported in Table III and from the net income amounts on page 46. Consolidated Companies Millions of dollars Year Ended December 31, 2015 Revenues from net production Sales Transfers Total Production expenses excluding taxes Taxes other than on income Proved producing... -

Page 75

Supplemental Information on Oil and Gas Producing Activities - Unaudited Table III - Results of Operations for Oil and Gas Producing Activities1, continued Consolidated Companies Millions of dollars Year Ended December 31, 2013 Revenues from net production Sales Transfers Total Production expenses ... -

Page 76

...Information on Oil and Gas Producing Activities - Unaudited Table V Reserve Quantity Information Summary of Net Oil and Gas Reserves 2015 Crude Oil Condensate Synthetic Natural NGLs Oil Gas 2014 Crude Oil Condensate Synthetic Natural NGLs Oil Gas 2013 Crude Oil Condensate Synthetic Natural NGLs Oil... -

Page 77

...of the internal control process related to reserves estimation, the company maintains a Reserves Advisory Committee (RAC) that is chaired by the Manager of Corporate Reserves, a corporate department that is separate from the Upstream operating organization. The Manager of Corporate Reserves has more... -

Page 78

... increase. Improved field performance and drilling associated with Gulf of Mexico projects and drilling in the Midland and Delaware basins accounted for the majority of the 55 million barrel increase in the United States. Synthetic oil reserves in Canada increased by 40 million barrels, primarily... -

Page 79

...-end reserve quantities related to production-sharing contracts (PSC) (refer to page 8 for the definition of a PSC). PSC-related reserve quantities are 20 percent, 19 percent and 20 percent for consolidated companies for 2015, 2014 and 2013, respectively. Chevron Corporation 2015 Annual Report 77 -

Page 80

...179, 189, 177 in 2015, 2014 and 2013, respectively. Total "as sold" volumes are 1,742 BCF, 1,695 BCF and 1,702 BCF for 2015, 2014 and 2013, respectively; 2013 conformed to 2014 presentation. Includes reserve quantities related to production-sharing contracts (PSC) (refer to page 8 for the definition... -

Page 81

... of future development and production costs. The calculations are made as of December 31 each year and do not represent management's estimate of the company's future cash flows or value of its oil and gas reserves. In the following table, the caption "Standardized Measure Net Cash Flows" refers to... -

Page 82

... of discount Net change in income tax Net change for 2014 Present Value at December 31, 2014 Sales and transfers of oil and gas produced net of production costs Development costs incurred Purchases of reserves Sales of reserves Extensions, discoveries and improved recovery less related costs... -

Page 83

... marketed. 2001 Merged with Texaco Inc. and changed name to ChevronTexaco Corporation. Became the second-largest U.S.-based energy company. 1900 Acquired by the West Coast operations of John D. Rockefeller's original Standard Oil Company. 2002 Relocated corporate headquarters from San Francisco... -

Page 84

... Vice President, Strategy and Development; Corporate Vice President and President, Chevron International Exploration and Production Company; Vice President and Chief Financial Officer; and Corporate Vice President, Strategic Planning. He serves on the Board of Directors and the Executive Committee... -

Page 85

..., aviation, diversity, ombuds, and business and real estate services. Previously Group Vice President, Corporate Human Resources and Labor Affairs, Ford Motor Company. Joined the company in 2008. James W. Johnson, 57 Executive Vice President, Upstream, since 2015. Responsible for Chevron's global... -

Page 86

... All of these terms are used for convenience only and are not intended as a precise description of any of the separate companies, each of which manages its own affairs. Corporate headquarters 6001 Bollinger Canyon Road San Ramon, CA 94583-2324 925 842 1000 84 Chevron Corporation 2015 Annual Report -

Page 87

... 2015 are available on the company's website, Chevron.com, or by writing to: Policy, Government and Public Affairs Chevron Corporation 6001 Bollinger Canyon Road Building G San Ramon, CA 94583-2324 For additional information about the company and the energy industry, visit Chevron's website, Chevron... -

Page 88

Chevron Corporation 6001 Bollinger Canyon Road, San Ramon, CA 94583-2324 USA www.chevron.com © 2016 Chevron Corporation. All Rights Reserved. 10% Recycled 100% Recyclable 912-0975