eBay 2003 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

until the obligation is satisÑed or the uncertainty is resolved. These amounts are included in deferred

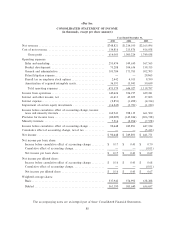

revenue in our balance sheet. Revenue from barter arrangements totaled $10.4 million, $10.1 million and

$10.1 million for the years ended December 31, 2001, 2002 and 2003, respectively.

Our end-to-end services revenues are derived principally from contractual arrangements with third

parties that provide transaction services to eBay users. To date, the duration of our end-to-end services

contracts has ranged from one to three years. End-to-end services revenues are recognized as the

contracted services are delivered to end users. To the extent that signiÑcant obligations remain at the end

of a period or collection of the resulting receivable is not considered probable, revenues are deferred until

the obligation is satisÑed or the uncertainty is resolved.

OÉine revenues represents seller commissions, buyer premiums, bidder registration fees, and auction-

related services including appraisal and authentication derived from the traditional auction services

provided by ButterÑelds and Kruse International. ButterÑelds auction revenues were derived primarily from

auction commissions and fees from the sale of property through the auction process. Revenues from seller

commissions and buyer premiums were recognized at the date the related auction was concluded. Service

revenues were derived from Ñnancial, appraisal and other related services and were recognized as such

services were rendered. During 2002, we sold our ButterÑelds and Kruse subsidiaries and accordingly, no

oÉine revenues were recognized in 2003.

Website development costs

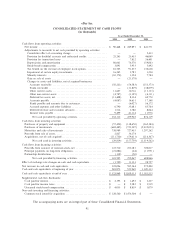

We expense costs related to the planning and post implementation phases of our website development

eÅorts. Direct costs incurred in the development phase are capitalized and amortized over the product's

estimated useful life of one to three years as charges to cost of net revenues. Costs associated with minor

enhancements and maintenance for the website are included in cost of net revenues in the accompanying

consolidated statement of income.

Advertising expense

We expense the costs of producing advertisements at the time production occurs, and expense the cost

of communicating advertising in the period during which the advertising space or airtime is used. Internet

advertising expenses are recognized based on the terms of the individual agreements, which is generally

over the greater of the ratio of the number of impressions delivered over the total number of contracted

impressions, or on a straight-line basis over the term of the contract. Advertising expenses totaled

$127.1 million, $181.8 million and $321.4 million during the years ended December 31, 2001, 2002, and

2003, respectively.

Stock-based compensation

Consistent with predominant industry practice, we account for stock-based employee compensation

issued under compensatory plans using the intrinsic value method, which calculates compensation expense

based on the diÅerence, if any, on the date of the grant, between the fair value of our stock and the option

exercise price. Generally accepted accounting principles require companies who choose to account for

stock option grants using the intrinsic value method to also determine the fair value of option grants using

an option pricing model, such as the Black-Scholes model, and to disclose the impact of fair value

accounting in a note to the Ñnancial statements. In December 2002, the Financial Accounting Standards

Board, or FASB, issued Statement of Financial Accounting Standards No. 148, ""Accounting for Stock-

Based Compensation Transition and Disclosure, an Amendment of FASB Statement No. 123.'' We did

not elect to voluntarily change to the fair value based method of accounting for stock based employee

compensation and record such amounts as charges to operating expense. The impact of recognizing the fair

97