eBay 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

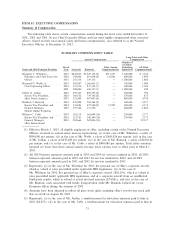

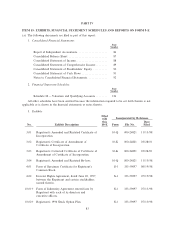

table above are rounded to the nearest cent. The exercise per share has been adjusted to reÖect the

two-for-one stock split eÅective on August 28, 2003.

(4) ReÖects the value of the stock option on the date of grant assuming (i) for the 5% column, a 5%

annual rate of appreciation in our common stock over the ten-year term of the option and (ii) for the

10% column, a 10% annual rate of appreciation in our common stock over the ten-year term of the

option, in each case without discounting to net present value and before income taxes associated with

the exercise. The 5% and 10% assumed rates of appreciation are based on the rules of the SEC and

do not represent our estimate or projection of the future common stock price. The amounts in this

table may not necessarily be achieved.

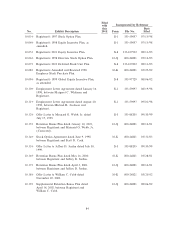

The following table sets forth the number of shares acquired and the value realized upon exercise of

stock options during 2003 and the number of shares of our common stock subject to exercisable and

unexercisable stock options held as of December 31, 2003, by each of the Named Executive OÇcers. The

value at Ñscal year end is measured as the diÅerence between the exercise price and the fair market value

at close of market on December 31, 2003, which was $64.61.

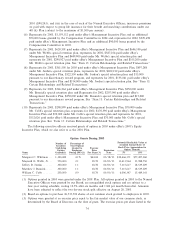

Aggregate Option Exercises in 2003 and Values at December 31, 2003

Number of Securities

Underlying Unexercised Value of Unexercised

Options at December 31, In-the-Money Options at

Number of 2003(1) December 31, 2003(3)

Shares

Acquired on Value Exercisable Unexercisable Exercisable Unexercisable

Name Exercise(1) Realized(2) (#) (#) ($) ($)

Margaret C. Whitman ÏÏÏÏÏ Ì Ì 1,168,750 2,031,250 $44,676,294 $66,169,756

Maynard G. Webb, Jr. ÏÏÏÏÏ 800,000 $21,395,255 992,848 637,152 40,320,571 18,565,841

JeÅrey D. JordanÏÏÏÏÏÏÏÏÏÏ 440,664 10,729,467 824,045 416,389 27,107,751 12,613,256

Matthew J. Bannick ÏÏÏÏÏÏÏ 482,494 10,561,316 342,081 412,083 10,007,700 12,437,300

William C. CobbÏÏÏÏÏÏÏÏÏÏ 155,000 4,080,193 268,124 466,876 10,143,483 15,907,824

(1) Amounts have been adjusted to reÖect the two-for-one stock split eÅective on August 28, 2003.

(2) Value realized is based on the fair market value of our common stock on date of exercise minus the

exercise price and does not necessarily reÖect proceeds actually received by the oÇcer.

(3) Calculated using the fair market value of our common stock on December 31, 2003 ($64.61) less the

exercise price of the option.

Employment Agreements, Change-in-Control Arrangements, and Retention Bonus Plans

We do not have long-term employment agreements or change-in-control arrangements with any of our

executive oÇcers, nor are any of our executive oÇcers covered by any pension plan or deferred

compensation plan. ""Item 13: Certain Relationships and Related Transactions'' contains descriptions of the

special retention bonus plans that we have entered into with certain of our executive oÇcers.

Compensation of Directors

New directors who are not employees of eBay, or any parent, subsidiary or aÇliate of eBay, receive

deferred stock units, or DSUs, with an initial value of $150,000 under our 2003 Deferred Stock Unit Plan.

DSUs represent an unfunded, unsecured right to receive shares of eBay common stock (or the equivalent

value thereof in cash or property), and the value of DSUs varies directly with the price of eBay's common

stock. Each DSU award granted to a non-employee director upon election to the Board will vest as to 25%

of the DSUs on the Ñrst anniversary of the date of grant and as to 1/48 of the DSUs each month

thereafter, provided the director continues as a director or consultant of eBay.

75