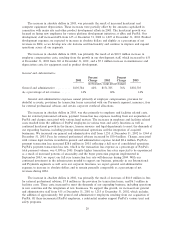

eBay 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

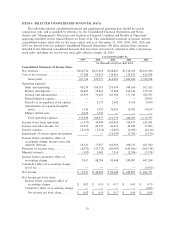

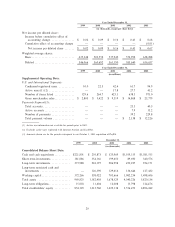

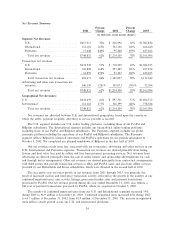

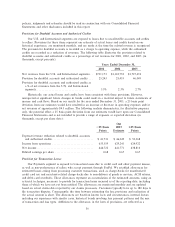

Patent Litigation Expense

Percent Percent

2001 Change 2002 Change 2003

(in thousands, except percent changes)

Patent litigation expenseÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì N/A Ì N/A $29,965

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 1%

Patent litigation expense during 2003 relates to the accrual of an August 6, 2003 court judgment

resulting from the MercExchange patent infringement lawsuit. See ""Note 11 Ì Commitments and

Contingencies'' to our Consolidated Financial Statements.

Payroll Tax on Employee Stock Options

Percent Percent

2001 Change 2002 Change 2003

(in thousands, except percent changes)

Payroll tax on employee stock options ÏÏÏÏÏÏÏ $2,442 64% $4,015 139% $9,590

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏÏÏÏ 0% 0% 0%

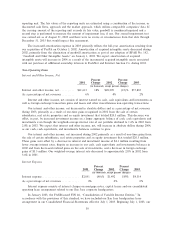

We are subject to employer payroll taxes on employee gains resulting from exercises of non-qualiÑed

stock options. These employer payroll taxes are recorded as a charge to operations in the period in which

such options are exercised and sold based on actual gains realized by employees. The increases in 2003

and 2002 were primarily a result of larger individual gains recognized on stock option exercises by our

employees during periods in which our stock price was high relative to historic levels. Our results of

operations and cash Öows could vary signiÑcantly depending on the actual period that stock options are

exercised by employees and, consequently, the amount of employer payroll taxes assessed. In general, we

expect payroll taxes on employee stock option gains to increase during periods in which our stock price is

high relative to historic levels.

Amortization of Acquired Intangible Assets

Percent Percent

2001 Change 2002 Change 2003

(in thousands, except percent changes)

Amortization of acquired intangible assets $36,591 (56)% $15,941 218% $50,659

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏ 5% 1% 2%

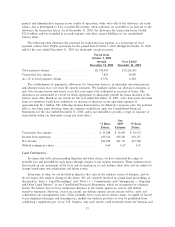

From time to time we have purchased, and we expect to continue purchasing, assets or businesses to

accelerate category and geographic expansion, increase the features and functions available to our users

and maintain a leading role in online trading. These purchase transactions may result in the creation of

acquired intangible assets and lead to a corresponding increase in the amortization expense in future

periods.

Intangible assets include purchased customer lists, trademarks and tradenames, developed technolo-

gies, and other intangible assets. We amortize intangible assets, excluding goodwill, using the straight-line

method over estimated useful lives ranging from one to eight years. We believe the straight-line method of

amortization best represents the distribution of economic value of the identiÑed intangible assets.

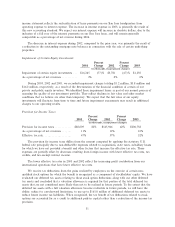

Goodwill represents the excess of the purchase price over the fair value of the net tangible and

identiÑable intangible assets acquired in a business combination. In accordance with SFAS No. 142,

goodwill is subject to assessment for impairment and is no longer subject to amortization. Rather, goodwill

is subject to at least an annual assessment for impairment, applying a fair-value based test. We evaluate

goodwill, at a minimum, on an annual basis and whenever events and changes in circumstances suggest

that the carrying amount may not be recoverable. Impairment of goodwill is tested at the reporting unit

level by comparing the reporting unit's carrying amount, including goodwill, to the fair value of the

29