eBay 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

translation rate changes for the Euro, combined with translation rate changes in other foreign currencies,

resulted in increased net revenues of approximately $82.0 million in 2003 when compared to the weighted-

average foreign currency exchange rates used in the preparation of our consolidated Ñnancial statements in

2002. In addition, the weighted-average translation rate changes in foreign currencies increased operating

expenses by approximately $37.9 million in 2003 when compared to the weighted average translation rates

used in 2002.

We expect our international operations will continue to grow in signiÑcance as we develop and deploy

our global marketplace. As a result, foreign currency Öuctuations in future periods could become more

signiÑcant and may have a negative impact on our net revenues and net income. See the information in

Item 7A under ""Foreign Currency Risk'' for additional discussion of the impact of foreign currency

translation and related hedging activities.

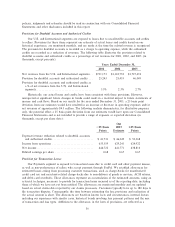

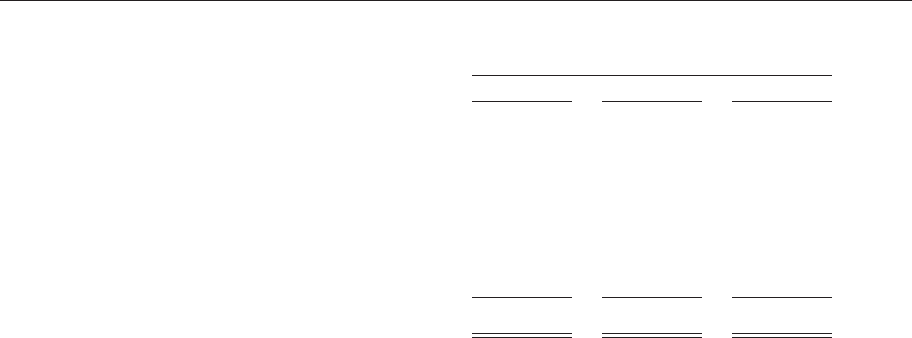

Liquidity and Capital Resources

Cash Flows

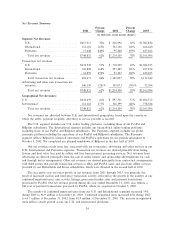

Year Ended December 31,

2001 2002 2003

(in thousands)

Net cash provided by (used in):

Operating activities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 252,112 $ 479,903 $ 874,119

Investing activities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (29,819) (157,759) (1,319,542)

Financing activities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 101,505 252,067 688,866

EÅect of exchange rates on cash and cash

equivalents ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (1,702) 11,133 28,757

Net increase in cash and cash equivalents ÏÏÏÏÏ $ 322,096 $ 585,344 $ 272,200

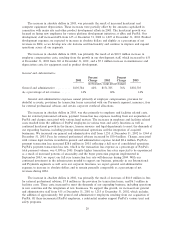

We have generated annual cash provided by operating activities in amounts greater than net income

in 2001, 2002 and 2003, driven mainly by non cash charges to earnings. Non-cash charges to earnings

included depreciation and amortization on our long-term assets, tax beneÑts on the exercise of employee

stock options resulting from our increasing stock price and the related increases in the personal gains

recognized by our employees, provision for doubtful accounts and authorized credits resulting from

increasing revenues, provision for transaction losses resulting from increased total payment volumes

processed by our PayPal subsidiary and other costs. In 2001, operating cash Öows were partially oÅset by

cash used to support working capital needs. In 2002 and 2003, operating cash Öows were positively

impacted by the net cash amounts provided by year-over-year changes in working capital assets and

liabilities. During 2003, we used net cash provided by operating and Ñnancing activities to fund purchases

of property and equipment, acquisitions and repayments of borrowings. Net cash provided by operating

activities also contributed to an increase in our aggregate cash, cash equivalents and investments balance

by $979.8 million in 2003 to approximately $2.8 billion. We currently expect that Ñscal 2004 cash Öows

from operations will continue to exceed net income. We believe that existing cash, cash equivalents and

investments, together with any cash generated from operations, will be suÇcient to fund our operating

activities, capital expenditures and other obligations for the foreseeable future. However, if during that

period or thereafter we are not successful in generating suÇcient cash Öows from operations or in raising

additional capital when required in suÇcient amounts and on terms acceptable to us, our business could

suÅer.

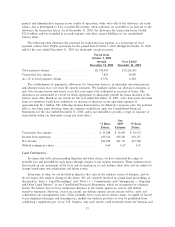

The net cash Öows used in investing activities in 2001, 2002 and 2003 were due primarily to the

movement of cash between cash and investments, the purchase of property and equipment, and

acquisitions. Purchases of property and equipment totaled $57.4 million in 2001, $138.7 million in 2002

and $365.4 million in 2003. Purchases of property and equipment in 2001 and 2002 related mainly to

purchases of computer equipment and software to support our site operations, customer support and

33