eBay 2003 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

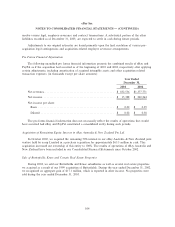

swaps as of December 31, 2003 was an unrealized loss of $4.0 million, net of tax beneÑt, and is recorded

in accumulated other comprehensive loss on the balance sheet.

On January 1, 2001, we adopted Statement of Financial Accounting Standards No. 133, as amended,

and the cumulative eÅect of this change in accounting method relating to the interest rate swaps was an

immaterial gain on net income and an unrealized loss, net of tax, of approximately $2.6 million on other

comprehensive income. At December 31, 2003, we expect to reclassify approximately $3.4 million of

losses, net of tax, on the interest rate swaps from accumulated other comprehensive income to interest

expense during the next twelve months.

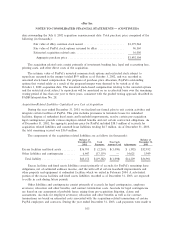

As of December 31, 2003, we had outstanding forward foreign exchange contracts with notional values

equivalent to approximately $222.4 million with maturity dates within 92 days. The forward contracts are

used to oÅset changes in the value of assets and liabilities denominated in foreign currencies as a result of

currency Öuctuations. Transaction gains and losses on the contracts and the assets and liabilities are

recognized each period in our statement of income and generally are oÅsetting.

We convert the Ñnancial statements of our foreign subsidiaries into U.S. dollars. When there is a

change in foreign currency exchange rates, the conversion of the foreign subsidiaries' Ñnancial statements

into the U.S. dollars will lead to a translation gain or loss. Translation exposure is the change in the book

value of assets, liabilities, revenues, and expenses that results from changes in foreign currency exchange

rates. From time to time we enter into transactions to hedge portions of our foreign currency denominated

earnings translation exposure using both options and forward contracts. The notional amount of the options

hedges entered into in 2003 was 57 million Euro. The premium cost was approximately $869,000 and the

net loss on the options totaled approximately $486,000, which was recorded in other income and expense

in 2003. The notional amount of forward contracts entered into in 2003 was 20 million Euro. The net loss

on these forward contracts totaled approximately $635,000 and was recorded in other income and expense

in 2003. All contracts hedging translation exposure mature ratably over the quarter in which they are

executed.

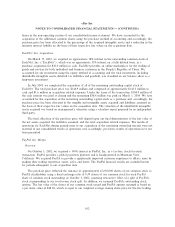

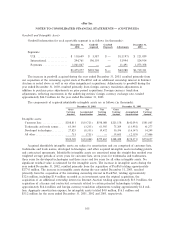

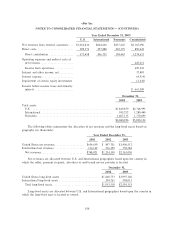

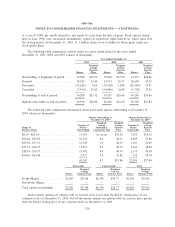

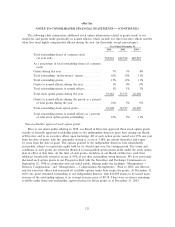

Note 7 Ì Balance Sheet Components:

December 31,

2002 2003

(in thousands)

Accounts receivable, net:

Accounts receivable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $162,155 $273,940

Allowance for doubtful accounts ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (27,731) (43,194)

Allowance for authorized credits ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (2,971) (4,875)

$131,453 $225,871

Write-oÅs against the allowance for doubtful accounts and authorized credits were $10.3 million,

$23.8 million and $28.8 million in the years ended December 31, 2001, 2002 and 2003, respectively.

111