eBay 2003 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ConÑnity Plan was assumed by PayPal in connection with its merger with ConÑnity in 2000. Prior to

our acquisition of PayPal and PayPal's merger with ConÑnity, the stockholders of ConÑnity approved

the ConÑnity Plan. Our stockholders, however, did not approve the ConÑnity Plan in connection with

our acquisition of PayPal.

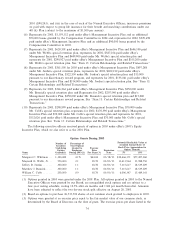

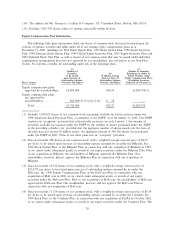

(5) Does not include 219,395 shares of our common stock, with a weighted average exercise price of

$1.53 per share, to be issued upon exercise of outstanding options assumed by us under the X.com

Corporation 1999 Stock Plan, or the X.com Plan, in connection with our acquisition of PayPal in

October 2002, as we cannot make subsequent grants or awards of our equity securities under the

X.com Plan. Prior to our acquisition of PayPal, the stockholders of PayPal approved the X.com Plan.

Our stockholders, however, did not approve the X.com Plan in connection with our acquisition of

PayPal.

(6) Does not include 1,207,404 shares of our common stock, with a weighted average exercise price of

$17.46 per share, to be issued upon exercise of outstanding options assumed by us under the PayPal,

Inc. 2001 Equity Incentive Plan, or the PayPal Plan, in connection with our acquisition of PayPal in

October 2002, as we cannot make subsequent grants or awards of our equity securities under the

PayPal Plan. Prior to our acquisition of PayPal, the stockholders of PayPal approved the PayPal Plan.

Our stockholders, however, did not approve the PayPal Plan in connection with our acquisition of

PayPal.

The only outstanding Non-Plan Grant as of December 31, 2003 relates to an individual compensation

arrangement that was made prior to the initial public oÅering of our Common Stock in 1998. At the time

of this Non-Plan Grant, members of our Board and their aÇliates beneÑcially owned in excess of 90% of

our then outstanding equity and voting interests. This Non-Plan Grant has been previously disclosed in our

initial public oÅering Prospectus Ñled with the SEC on September 25, 1998 under the headings

""Management Ì Director Compensation'' and ""Ì Compensation Arrangements.'' Except as set forth

below, the terms and conditions of this Non-Plan Grant are identical to the terms of our 1997 Stock

Option Plan, a copy of which was Ñled as an exhibit to our S-1 Registration Statement (No. 33-59097)

Ñled in connection with our initial public oÅering.

The outstanding Non-Plan Grant involved the Board's grant of an option to purchase 1,800,000 shares

of our Common Stock at an exercise price of $0.78 to Mr. Cook upon his joining our Board in June 1998

as an independent director. These options granted to Mr. Cook were non-qualiÑed options and were

immediately exercisable, with a term of 10 years. These options vested as to 25% of the underlying shares

in June 1999 and as to 2.08% of the shares each month thereafter until they fully vested in June 2002.

Mr. Cook exercised options to purchase 240,000 shares in 2002 and exercised options to purchase an

additional 715,000 shares during 2003. As of December 31, 2003, options to purchase 845,000 shares

remain outstanding under the Non-Plan Grant.

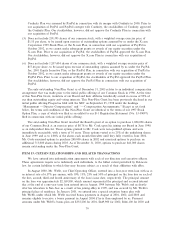

ITEM 13: CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

We have entered into indemniÑcation agreements with each of our directors and executive oÇcers.

These agreements require us to indemnify such individuals, to the fullest extent permitted by Delaware

law, for certain liabilities to which they may become subject as a result of their aÇliation with eBay.

In August 2000, Mr. Webb, our Chief Operating OÇcer, entered into a four-year term loan with us at

an interest rate of 6.37% per annum, with 10%, 15%, 25% and 50% of principal on the loan due on each of

the Ñrst, second, third and fourth anniversary of the loan's issue date, respectively. The principal amount

on the loan was approximately $2,169,800, which amount represented the principal and accrued interest

due at the end of a one-year term loan entered into in August 1999 between Mr. Webb and us shortly

after his relocation to San Jose as a result of his joining eBay in 1999, and was secured by Mr. Webb's

principal place of residence. In January 2001, we entered into a special retention bonus plan with

Mr. Webb, under which Mr. Webb received bonus payments in August of 2001, 2002, and 2003 and

remains eligible to receive a bonus payment in August 2004 if he is then employed by us. Payment

amounts under Mr. Webb's bonus plan are $355,200 for 2001, $449,900 for 2002, $646,100 for 2003 and

79