eBay 2003 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

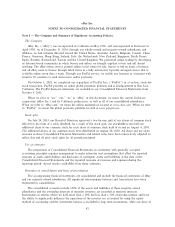

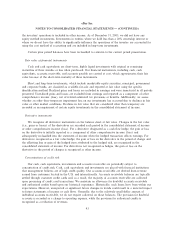

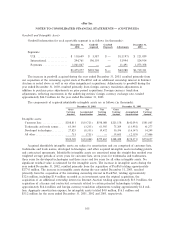

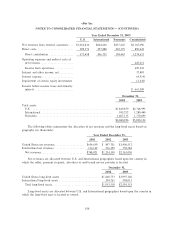

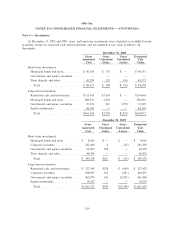

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

deferred tax assets is reduced by the amount of any tax beneÑts that are not expected to be realized based

on available evidence.

Consolidation of Variable Interest Entities

In accordance with the provisions of FIN 46, ""Consolidation of Variable Interest Entities,'' we have

included our San Jose corporate headquarters lease arrangement in our Consolidated Financial Statements

eÅective July 1, 2003. Under this new accounting standard, our balance sheet at December 31, 2003

reÖects additions for land and buildings totaling $126.4 million, lease obligations of $122.5 million and

non-controlling minority interests of $3.9 million. Our consolidated income statement for year ended

December 31, 2003, reÖects the reclassiÑcation of lease payments on our San Jose corporate headquarters

from operating expense to interest expense, beginning with quarters following our adoption of FIN 46 on

July 1, 2003, a $5.4 million after-tax charge for cumulative depreciation for periods from lease inception

through June 30, 2003, and incremental depreciation expense of approximately $400,000, net of tax, per

quarter for the third and fourth quarters of 2003. We have adopted the provisions of FIN 46 prospectively

from July 1, 2003, and as a result, prior periods have not been restated. The cumulative eÅect of the

change in accounting principle arising from the adoption of FIN 46 has been reÖected in net income in

2003.

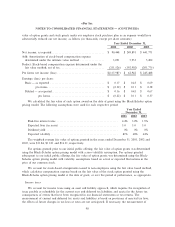

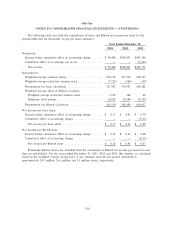

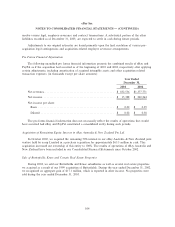

Note 2 Ì Net Income Per Share:

Basic net income per share is computed by dividing the net income for the period by the weighted

average number of common shares outstanding during the period. Diluted net income per share is

computed by dividing the net income for the period by the weighted average number of common and

common equivalent shares outstanding during the period. Potentially dilutive securities, composed of

unvested, restricted common stock and incremental common shares issuable upon the exercise of stock

options and warrants, are included in diluted net income per share to the extent such shares are dilutive.

99