eBay 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Direct contribution consists of net revenues less direct segment costs. Direct segment costs include

speciÑc costs of net revenues, sales and marketing expenses, and general and administrative expenses over

which segment managers have direct discretionary control or inÖuence, such as advertising and marketing

programs, customer support expenses, bank charges, provisions for doubtful accounts, authorized credits

and transaction losses. Expenses over which segment managers do not currently have discretionary control

or inÖuence Ì such as site operations costs, product development expenses, and general and administrative

costs Ì are monitored by management through shared cost centers and are not evaluated in the

measurement of segment performance.

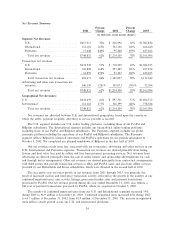

For an analysis of Ñnancial information about geographic areas as well as our segments, see

""Note 4 Ì Segments'' of the notes to our Consolidated Financial Statements, which we incorporate by

reference herein.

Available Information

Our Internet address is www.ebay.com. Our investor relations website is located at

http://investor.ebay.com. We make available free of charge on our investors relations website under ""SEC

Filings'' our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on

Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically Ñle or

furnish such materials to the U.S. Securities and Exchange Commission.

ITEM 2: PROPERTIES

We own and lease various properties in the United States and in 16 other countries around the world.

We use the properties for corporate, administrative, customer support and other general business needs.

Our corporate headquarters are located in San Jose, California. Our owned and leased properties provide

us with 525,000 and 957,000 aggregate square feet, respectively. The total square feet occupied by our

U.S., International and Payments segments are 663,000, 375,000 and 444,000, respectively.

We are currently considering various alternatives related to our long-term facilities needs. While we

believe our existing facilities are adequate to meet our immediate needs, it may become necessary to lease

or acquire additional or alternative space to accommodate any future growth.

For a discussion of the accounting treatment of our leased corporate headquarters, see ""Note 8 Ì

Long-Term Obligations'' of the notes to our Consolidated Financial Statements, which we incorporate by

reference herein.

ITEM 3: LEGAL PROCEEDINGS

In April 2001, our European subsidiaries, eBay GmbH and eBay International AG, were sued by

Montres Rolex S.A. and certain of its aÇliates in the regional court of Cologne, Germany. The suit

subsequently was transferred to the regional court in Dusseldorf, Germany. Rolex alleged that our

subsidiaries were infringing Rolex's trademarks as a result of users selling counterfeit Rolex watches

through our German website. The suit also alleged unfair competition. Rolex sought an order forbidding

the sale of Rolex-branded watches on the website as well as damages. In December 2002, a trial was held

in the matter and the court ruled in favor of eBay on all causes of action. Rolex appealed the ruling to the

Higher Regional Court of Dusseldorf, and the appeal was heard on October 30, 2003. On February 26,

2004, the court rejected Rolex's appeal and ruled in our favor. If it so chooses, Rolex may appeal the

ruling to the German Federal Supreme Court.

In September 2001, a complaint was Ñled by MercExchange LLC against us, our Half.com subsidiary

and ReturnBuy, Inc. in the U.S. District Court for the Eastern District of Virginia (No. 2:01-CV-736)

alleging infringement of three patents (relating to online auction technology, multiple database searching

and electronic consignment systems) and seeking a permanent injunction and damages (including treble

damages for willful infringement). In October 2002, the court granted in part our summary judgment

motion, eÅectively invalidating the patent related to online auction technology and rendering it

15