eBay 2003 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

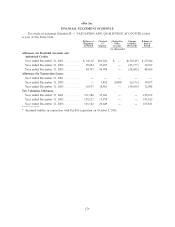

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

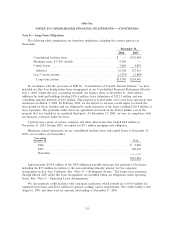

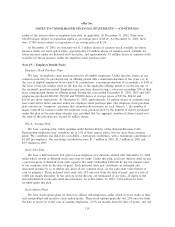

The following is a reconciliation of the diÅerence between the actual provision for income taxes and

the provision computed by applying the federal statutory rate of 35% for 2001, 2002, and 2003 to income

before income taxes (in thousands):

Year Ended December 31,

2001 2002 2003

Provision at statutory rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $59,660 $138,543 $228,873

Permanent diÅerences:

Foreign income taxed at diÅerent rates ÏÏÏÏÏÏÏÏÏÏ (4,212) (5,406) (45,190)

Acquisition related expenses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11,834 Ì Ì

Change in valuation allowance ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 5,756

Subsidiary loss not beneÑted ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,807 1,052 Ì

Tax-exempt interest incomeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (3,737) (2,378) (1,272)

State taxes, net of federal beneÑt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,468 15,722 23,297

Tax credits ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì (2,021) (7,943)

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 189 434 3,217

$80,009 $145,946 $206,738

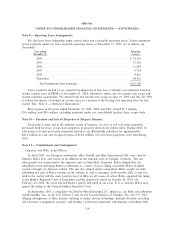

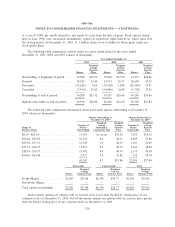

Deferred tax assets and liabilities are recognized for the future tax consequences of diÅerences

between the carrying amounts of assets and liabilities and their respective tax bases using enacted tax rates

in eÅect for the year in which the diÅerences are expected to reverse. SigniÑcant deferred tax assets and

liabilities consist of the following (in thousands):

December 31,

2002 2003

Deferred tax assets:

Net operating loss and credits ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 207,276 $ 186,142

Accruals and allowances ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 40,941 38,344

Depreciation and amortization ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (5,708) (16,164)

Net unrealized lossesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,921 9,469

Net deferred tax assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 245,430 217,791

Valuation allowanceÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (145,182) (165,831)

100,248 51,960

Deferred tax liabilities:

Acquisition-related intangibles ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (111,843) (107,064)

$ (11,595) $ (55,104)

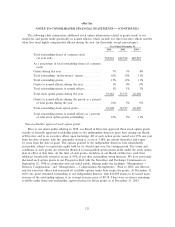

As of December 31, 2003, our federal and state net operating loss carryforwards for income tax

purposes were approximately $502.6 million and $238.8 million, respectively. If not utilized, the federal net

operating loss carryforwards will begin to expire in 2019, and the state net operating loss carryforwards will

begin to expire in 2006. The Company's federal and state research tax credit carryforwards for income tax

purposes are approximately $20.2 million and $17.4 million, respectively. If not utilized, the federal tax

credit carryforwards will begin to expire in 2021. Deferred tax assets of approximately $151.6 million at

December 31, 2003 pertain primarily to certain net operating loss carryforwards resulting from the exercise

123