eBay 2003 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

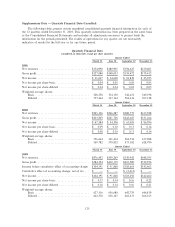

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

earlier of the issuance date or employee hire date, as applicable. At December 31, 2002, there were

184,000 shares subject to repurchase rights at an average price of $0.45. At December 31, 2003, there

were 17,000 shares subject to repurchase at an average price of $1.54.

At December 31, 2003, we had reserved 51.3 million shares of common stock available for future

issuance under our stock option plans, approximately 2.0 million shares of common stock available for

future issuance under our deferred stock unit plan, and approximately 3.0 million shares of common stock

available for future issuance under the employee stock purchase plan.

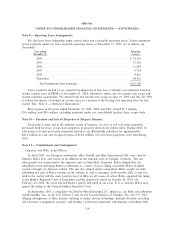

Note 15 Ì Employee BeneÑt Plans:

Employee Stock Purchase Plan

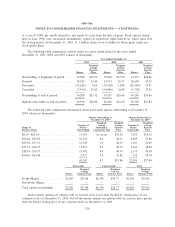

We have an employee stock purchase plan for all eligible employees. Under the plan, shares of our

common stock may be purchased over an oÅering period with a maximum duration of two years (or, in

the case of eligible employees in two non-U.S. jurisdictions, a maximum duration of six months) at 85% of

the lower of the fair market value on the Ñrst day of the applicable oÅering period or on the last day of

the six-month purchase period. Employees may purchase shares having a value not exceeding 10% of their

gross compensation during an oÅering period. During the years ended December 31, 2001, 2002 and 2003,

employees purchased 248,000, 352,000 and 580,000 shares at average prices of $21.86, $26.63 and

$52.06 per share, respectively. At December 31, 2003, approximately 3.0 million shares of common stock

were reserved for future issuance under our employee stock purchase plan. Our employee stock purchase

plan contains an ""evergreen'' provision that automatically increases, on each January 1, the number of

shares reserved for issuance under the employee stock purchase plan by the number of shares purchased

under this plan in the preceding calendar year, provided that the aggregate number of shares issued over

the term of the plan does not exceed 18 million shares.

401(k) Savings Plan

We have a savings plan, which qualiÑes under Section 401(k) of the Internal Revenue Code.

Participating employees may contribute up to 25% of their annual salary, but not more than statutory

limits. We contribute one dollar for each dollar a participant contributes, with a maximum contribution of

$1,500 per employee. Our matching contributions were $1.7 million in 2001, $2.3 million in 2002 and

$3.9 million in 2003.

Stock Unit Plan

We have a deferred stock unit plan for non-employee new directors elected after December 31, 2002

under which awards of deferred stock units may be made. Under this plan, each new director shall receive

a one-time grant of deferred stock units equal to the result of dividing $150,000 by the fair market value

of our common stock on the date of grant. Each deferred stock unit constitutes an unfunded and

unsecured promise by us to deliver one share of our common stock (or the equivalent value thereof in

cash or property). These deferred stock units vest 25% one year from the date of grant, and at a rate of

2.08% per month thereafter. If the services of the director are terminated at any time, all rights to the

unvested deferred stock units shall also terminate. As at December 31, 2003, 5,630 units have been

awarded under this plan.

Stock Option Plans

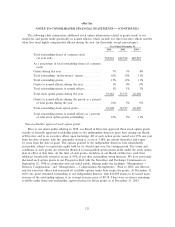

We have stock option plans for directors, oÇcers and employees, under which we have made to date

only nonqualiÑed and incentive stock option grants. These stock options generally vest 25% one year from

the date of grant (or in the case of existing employees, 12.5% six months from the date of grant) and vest

119