eBay 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

U.S. dollar strengthens or weakens against foreign currencies, and, in particular, the Euro, the translation

of these foreign currency denominated transactions into U.S. dollars will impact our net revenues,

operating expenses and net income.

The detailed discussion of our Ñnancial condition and results of operations contained herein is

intended to provide information to assist investors, analysts and other parties reading this report understand

the key operating metrics and Ñnancial information summarized above as well as the changes in our results

of operations from year to year, the primary factors that accounted for those changes and how certain

accounting principles, policies, judgments, and estimates aÅect our Consolidated Financial Statements.

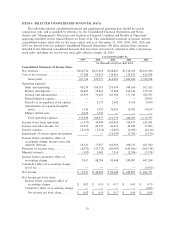

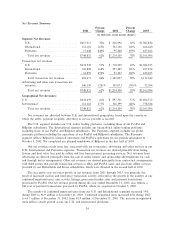

Business Combinations

Our historical Ñnancial statements reÖect the impact of various business combinations that have been

accounted for as pooling-of-interests and purchase transactions. Our Consolidated Financial Statements

have been retroactively restated to include the historical Ñnancial statements of all entities acquired in

pooling-of-interests transactions. The Ñnancial statements of entities acquired in purchase transactions are

reÖected in our consolidated results from the eÅective dates of each acquisition. The aggregate purchase

price for all acquisitions using the purchase method of accounting during the three years ended

December 31, 2003 totaled approximately $2.1 billion and was been allocated in our Consolidated

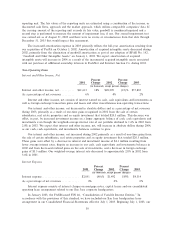

Financial Statements as follows (in thousands):

Net tangible assetsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 207,717

IdentiÑable intangible assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 326,353

Deferred tax liabilities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (51,000)

Minority interests ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (21,690)

Unearned compensation ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,943

Goodwill ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,665,257

$2,136,580

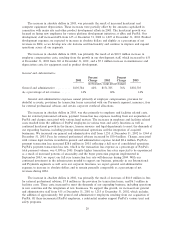

Tangible net assets were valued at their respective carrying amounts as we believe that these amounts

approximated their current fair values at the respective acquisition dates. The valuation of identiÑable

intangible assets acquired was based on management's estimates using valuation reports prepared by an

independent third-party valuation consultant. Such assets consist of customer lists, trademarks and

tradenames, developed technologies and other acquired intangible assets including contractual agreements.

IdentiÑable intangible assets are amortized using the straight-line method over the estimated useful lives of

one to seven years. We believe the straight-line method of amortization best represents the distribution of

the economic value of the identiÑable intangible assets. Goodwill represents the excess of the purchase

price over the fair value of the net tangible and identiÑable intangible assets acquired in each business

combination. In accordance with SFAS No. 142, goodwill is no longer subject to amortization. Rather,

goodwill is subject to at least an annual assessment for impairment, applying a fair-value based test. See

""Note 1 Ì The Company and Summary of SigniÑcant Accounting Policies'' and ""Note 3 Ì Business

Combinations, Goodwill and Intangible Assets'' to our Consolidated Financial Statements, which we

incorporate by reference herein.

22