eBay 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7: MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

FORWARD LOOKING STATEMENTS

This report contains statements that involve expectations, plans or intentions (such as those relating to

future business or Ñnancial results, new features or services, or management strategies). These statements

are forward-looking and are subject to risks and uncertainties, so actual results may vary materially. You

can identify these forward-looking statements by words such as ""may,'' ""will,'' ""should,'' ""expect,''

""anticipate,'' ""believe,'' ""estimate,'' ""intend,'' ""plan'' and other similar expressions. You should consider

our forward-looking statements in light of the risks discussed under the heading ""Risk Factors That May

AÅect Results of Operations and Financial Condition" below, as well as our consolidated Ñnancial

statements, related notes, and the other Ñnancial information appearing elsewhere in this report and our

other Ñlings with the Securities and Exchange Commission. We assume no obligation to update any

forward-looking statements.

You should read the following Management's Discussion and Analysis of Financial Condition and

Results of Operations in conjunction with the Consolidated Financial Statements and the related notes that

appear elsewhere in this document.

Overview

About eBay

We pioneered online trading by developing an Internet-based marketplace in which a community of

buyers and sellers are brought together in an entertaining, intuitive, easy-to-use environment to browse,

buy and sell an enormous variety of items. Through our PayPal service, we enable any business or

consumer with email to send and receive online payments securely, conveniently and cost-eÅectively.

Executive Operating and Financial Summary

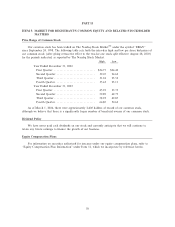

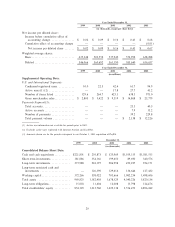

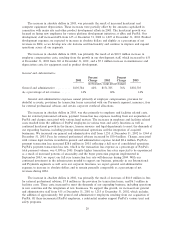

Members of our senior management team regularly review key operating metrics such as new users,

active users, listings and gross merchandise sales transacted on our global marketplace as well as new user

accounts, total payment volume and oÅ-eBay transactions processed by our wholly-owned PayPal

subsidiary. This information allows us to monitor marketplace trends and anticipate new features and

functionality that may be required to serve the needs of our users. We believe that an understanding of the

key operating metrics and how they change over time is important to investors, analysts and other parties

analyzing our market opportunities and business results.

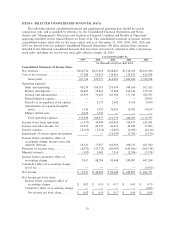

Members of our senior management also regularly review key Ñnancial information including net

revenues, operating income margins, earnings per share, cash Öows from operations and free cash Öows,

which we deÑne as operating cash Öows less purchases of property and equipment. This information allows

us to monitor the proÑtability of our business and evaluate the eÅectiveness of investments that we have

made and continue to make in the areas of international expansion, customer support, product

development, marketing and site operations. We believe that an understanding of key Ñnancial information

and how it changes over time is important to investors, analysts and other parties analyzing our business

results and future market opportunities.

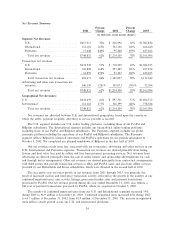

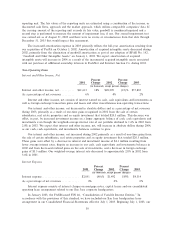

We expect that our growth in net revenues during 2004 will result primarily from transaction net

revenues across our U.S., International, and Payments segments, with a potentially more signiÑcant eÅect

of seasonality during the second and third quarters. The expected future growth in our Payments segment

net revenues will also cause downward pressure on our gross margin and operating proÑt margin. We

continue to make investments in our business and infrastructure to help us achieve our long-term growth

objectives. We expect to continue our investments in the areas of international expansion, product

development, site operations and various corporate infrastructure areas. We believe these investments are

necessary to support the long-term demands of our growing business. In addition, to the extent that the

21